NXP Semiconductors forecast a stronger upcoming quarter, suggesting demand in the industrial semiconductor market may be stabilising after a prolonged slowdown.

Dutch chipmaker NXP Semiconductors has issued an upbeat forecast for the coming quarter, offering fresh evidence that the industrial semiconductor market may be emerging from its downturn.

The guidance stands out in an industry where many suppliers have been cautious about near-term recovery.

Why NXP’s outlook matters

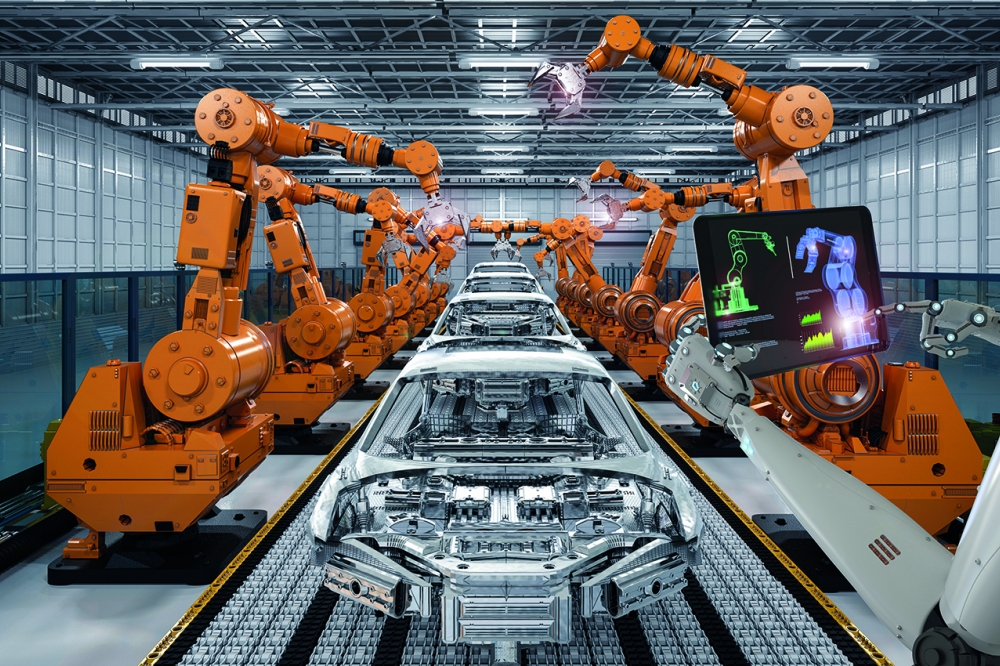

NXP is heavily exposed to industrial and automotive markets, supplying chips used in:

- Factory automation

- Power management

- Vehicle electronics

- Industrial networking

These segments tend to lag consumer electronics in both downturns and recoveries, making them useful indicators of broader economic health.

Signs of stabilisation

NXP’s forecast suggests:

- Customer inventories are normalising

- Order cancellations are easing

- Demand visibility is improving

While volumes remain below peak levels, the company indicated conditions are no longer deteriorating.

Automotive resilience

Automotive demand has been a relative bright spot, supported by electrification, advanced driver assistance systems, and software-defined vehicles.

These trends require:

- Higher chip content per vehicle

- Longer-term supply agreements

- Greater design complexity

NXP’s positioning in automotive electronics has helped offset weakness elsewhere.

What this means for the sector

If NXP’s outlook proves accurate, it could mark a turning point for industrial semiconductor suppliers that have endured several weak quarters.

However, recovery is expected to be uneven, with:

- Gradual order growth

- Continued pricing pressure

- Cautious customer behaviour

A cautious signal, not a boom

Its forecast does not suggest a rapid rebound. Instead, it points to a floor forming under demand.

For investors and industry players, that distinction matters. Stability is the first step toward recovery — but sustained growth will depend on broader industrial investment cycles.

For now, its outlook provides a rare note of optimism in an otherwise measured semiconductor landscape.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)