Teradyne has forecast stronger-than-expected quarterly revenue, suggesting demand for semiconductor test equipment is stabilising after a prolonged slowdown.

US-based semiconductor equipment maker Teradyne has forecast upbeat quarterly revenue, adding to signs that parts of the semiconductor cycle may be turning a corner.

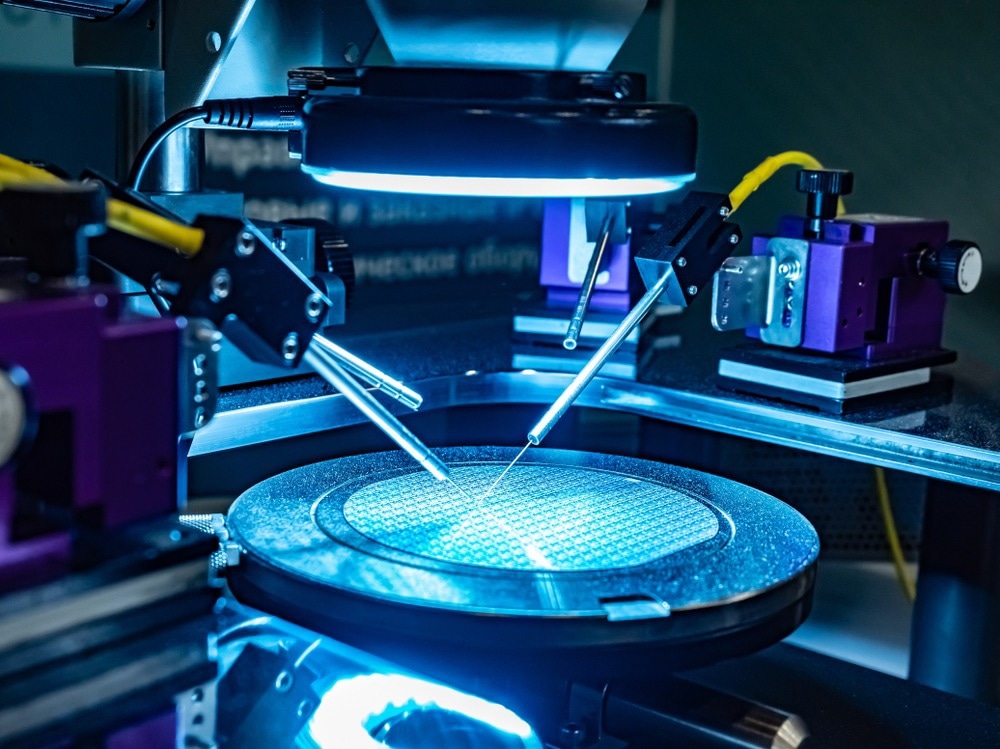

Teradyne supplies automated test equipment used to verify the performance and reliability of chips before they are shipped to customers, making its outlook a key signal for downstream semiconductor activity.

Why Teradyne matters in the chip cycle

Test equipment sits late in the semiconductor production process. When chipmakers begin increasing orders for testing tools, it often indicates improving confidence in near-term demand.

Teradyne’s forecast suggests:

- Customer order visibility is improving

- Inventory corrections are easing

- Capital spending may be stabilising

The company’s results contrast with more cautious outlooks seen earlier in the downturn.

Industrial and automotive demand

The company has benefited from exposure to industrial and automotive semiconductor segments, which tend to be less volatile than consumer electronics.

These markets are driven by:

- Electrification

- Factory automation

- Longer product lifecycles

As a result, demand has proven more resilient even as smartphone and PC markets slowed.

AI and advanced chips

Growth in AI-related chips has also supported testing demand. Advanced processors require more complex and time-intensive testing, increasing the value of high-end equipment.

While AI is not yet the dominant driver of Teradyne’s revenue, it provides incremental upside as chip complexity rises.

Cautious optimism remains

Despite the upbeat forecast, the company has not signaled a full industry recovery. Semiconductor customers remain cautious with capital expenditure, and visibility beyond the next few quarters remains limited.

The company’s outlook points to stabilisation rather than a sharp rebound.

What this means for the sector

If Teradyne’s forecast proves accurate, it could reinforce expectations that the semiconductor equipment market is emerging from its trough.

However, recovery is likely to be uneven, with growth concentrated in specific end markets rather than broad-based.

For now, Teradyne’s guidance offers a measured but positive signal in an industry still finding its footing.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)