Cerebras Systems has reached a $23 billion valuation after raising $1 billion in a Tiger Global-led funding round, underscoring investor appetite for alternatives to Nvidia in AI computer.

US-based AI chipmaker Cerebras Systems has surged to a $23 billion valuation following a $1 billion funding round led by Tiger Global, marking one of the largest private investments yet in next-generation AI hardware.

The deal positions Cerebras as one of the most valuable privately held semiconductor companies globally and sharpens competitive pressure on Nvidia, whose GPUs currently dominate the market for training and running large AI models.

A rare mega-round in a cautious market

The scale of Cerebras’ raise stands out at a time when venture capital remains selective and capital-intensive hardware plays face heightened scrutiny.

Investors backing the round appear to be making a concentrated bet that AI infrastructure demand will continue to grow faster than cloud providers can supply, creating space for alternative architectures beyond Nvidia’s GPU-centric model.

The valuation leap reflects confidence not just in Cerebras’ technology, but in the structural dynamics of the AI compute market.

What makes Cerebras different

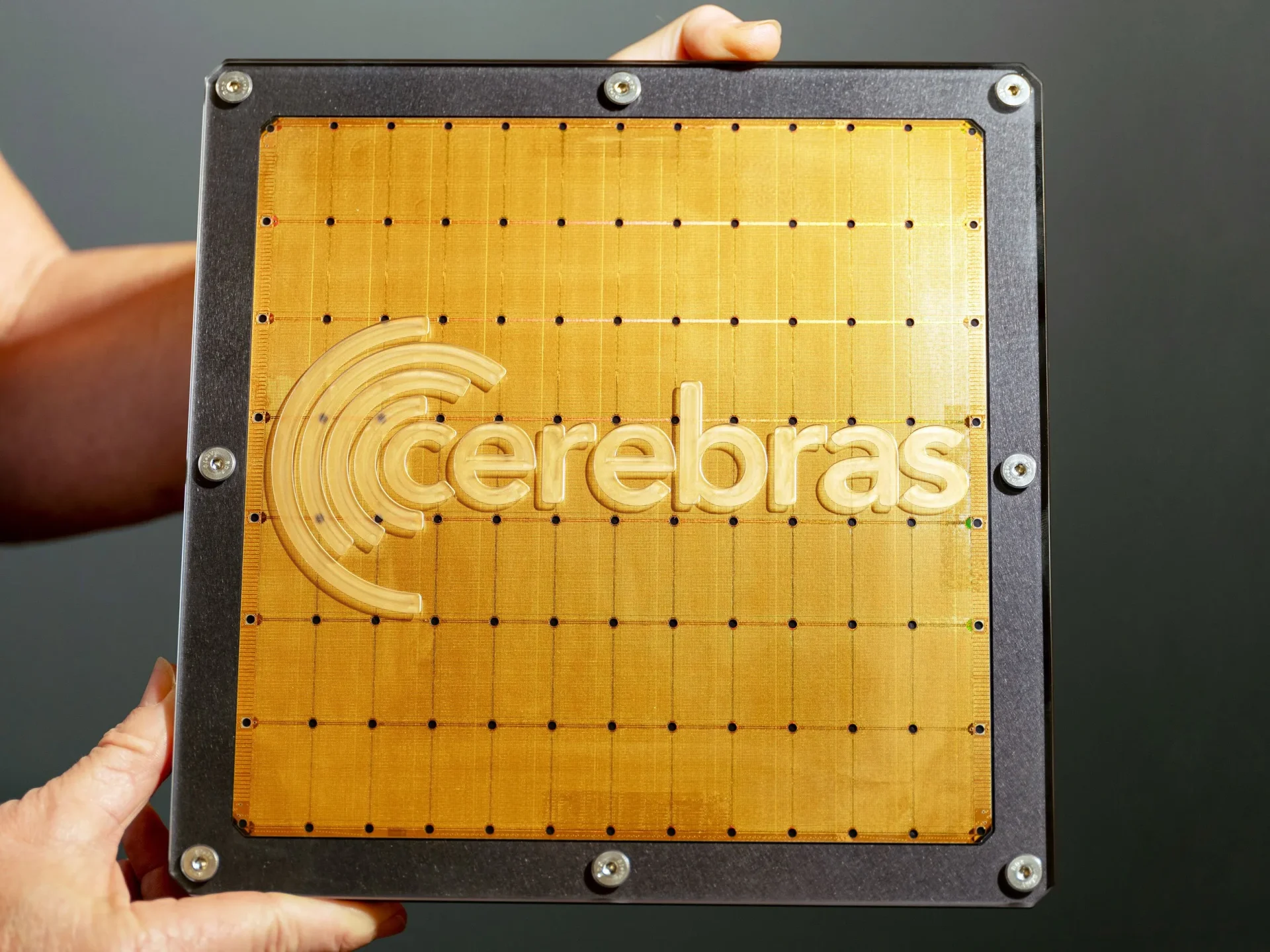

Cerebras is best known for its wafer-scale engine, a processor built on an entire silicon wafer rather than being sliced into individual chips.

This design enables:

- Massive parallelism

- Faster training times for large models

- Reduced complexity in scaling AI workloads

By eliminating many of the interconnect bottlenecks that plague multi-GPU clusters, Cerebras argues it can deliver performance gains for specific classes of AI workloads.

A direct challenge to Nvidia’s dominance

Nvidia has become the default supplier for AI training and inference, with demand for its GPUs far outstripping supply.

Cerebras’ rise reflects growing frustration among AI developers and cloud providers with:

- Long procurement lead times

- High costs

- Vendor concentration risk

While Nvidia’s ecosystem remains unmatched, customers are increasingly open to alternative architectures if they can deliver predictable performance and availability.

Who is backing the bet

Tiger Global’s lead role is notable. The firm, known for aggressive technology investing, has been more restrained in recent years after market corrections.

Its renewed willingness to deploy $1 billion into a single AI hardware company signals conviction that AI compute is not a cyclical trend but foundational infrastructure akin to cloud or mobile.

The round reportedly also includes participation from existing strategic and institutional investors, reinforcing long-term support.

Demand driven by model scale

The funding comes as AI models continue to grow in size, complexity, and compute intensity.

Training frontier models now requires:

- Massive memory bandwidth

- Efficient interconnects

- Energy-efficient architectures

Cerebras positions itself as particularly well-suited for training very large models without the overhead of coordinating thousands of discrete GPUs.

Commercial traction remains key

Despite the valuation, Cerebras still faces execution challenges. Hardware innovation alone does not guarantee market dominance.

Key questions include:

- Can Cerebras scale manufacturing efficiently?

- Will customers commit to its software ecosystem?

- Can it compete on total cost of ownership against Nvidia-based clusters?

Large cloud providers and AI labs tend to favour platforms with deep tooling, broad compatibility, and long-term support guarantees.

Software and ecosystem matter

Nvidia’s strength lies not just in hardware but in its CUDA software stack and developer ecosystem.

Cerebras has invested heavily in its own software tools to abstract complexity and ease adoption, but changing developer habits is difficult.

The company’s success will depend on how seamlessly customers can integrate its systems into existing workflows.

Geopolitical and supply chain factors

AI hardware has become strategically important, drawing attention from governments and regulators.

Cerebras, as a US-based company, may benefit from:

- Domestic manufacturing incentives

- National security-driven demand

- Policy support for AI infrastructure

At the same time, supply chain constraints and export controls remain potential risks.

What the $23B valuation signals

Cerebras’ valuation is less a verdict on near-term revenue and more a statement about the future shape of AI infrastructure.

Investors appear to believe:

- GPU monopolies will be challenged

- AI workloads will diversify across architectures

- Specialised hardware will coexist with general-purpose accelerators

In that future, Cerebras does not need to replace Nvidia—only to capture a meaningful slice of a rapidly expanding market.

Looking ahead

With fresh capital, Cerebras is expected to:

- Expand manufacturing capacity

- Deepen software capabilities

- Pursue large enterprise and cloud partnerships

Whether it can convert technological promise into durable market share remains to be seen.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)