Creator-led commerce in Asia-Pacific could reach $1.2 trillion by 2030, according to a TikTok-backed study, reflecting how social platforms are transforming digital retail across the region.

What began as brand sponsorships and affiliate links is rapidly evolving into a full-fledged retail channel. Creator commerce across Asia-Pacific is projected to reach $1.2 trillion by 2030, according to a study referenced by TikTok, highlighting the scale at which creators are reshaping how goods are discovered and sold.

The projection reflects more than audience growth. It signals a structural shift in digital commerce, where entertainment, community, and transactions are increasingly bundled into the same experience.

Why Asia-Pacific is leading the shift

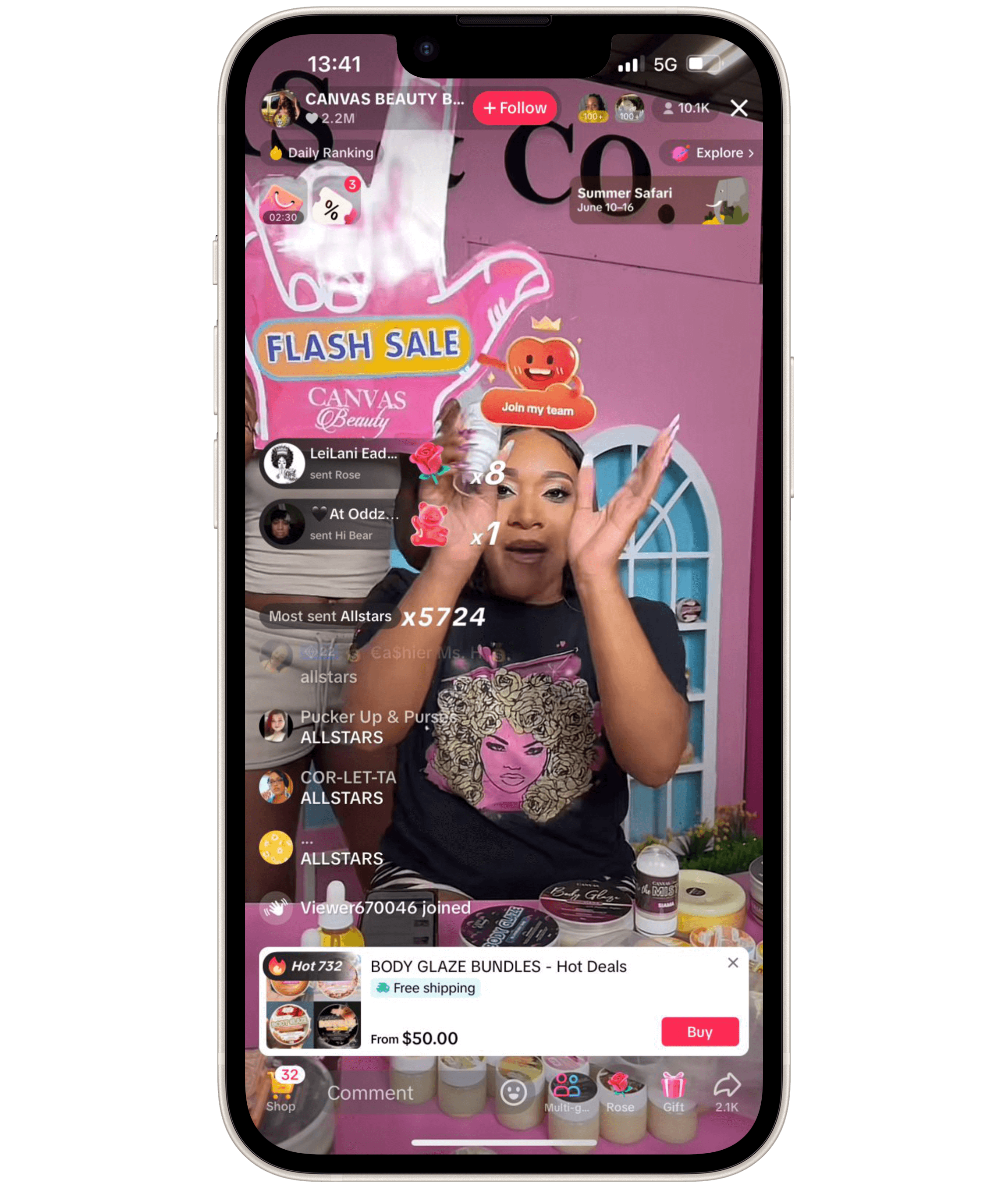

Asia-Pacific has emerged as the global center of gravity for creator-driven retail. Livestream shopping, short-form video, and in-app checkout have been adopted more quickly in markets such as Southeast Asia, China, and parts of South Asia than in the West.

Several factors are at play: mobile-first consumers, high social media engagement, and a willingness among small merchants to experiment with new sales channels. Platforms have also invested heavily in logistics and payments, lowering the friction between content and conversion.

As a result, creators in the region are not just marketers—they are increasingly storefronts, sales agents, and brand builders.

Platforms move closer to commerce

The projected $1.2 trillion figure also reflects a strategic pivot by platforms. Social networks are no longer content-only ecosystems; they are becoming end-to-end commerce infrastructure providers.

For TikTok and its peers, creator commerce offers diversification beyond advertising at a time when ad markets are volatile and regulators are scrutinizing data practices. Transaction-based revenue and merchant services provide a more durable business model if consumer trust holds.

This convergence, however, raises new questions around platform power, data access, and the dependence of creators on algorithmic distribution.

What it means for brands and startups

For brands, especially emerging ones, creator commerce lowers barriers to entry. Instead of competing for shelf space or expensive ads, companies can scale through partnerships with creators who already command trust and attention.

For startups building tools around payments, logistics, analytics, and creator management, the growth projection points to a rapidly expanding ecosystem—one that extends beyond influencers to include software and infrastructure providers.

Still, competition is intensifying. As more creators turn to commerce, differentiation and compliance will matter as much as reach.

A new phase for digital retail

The projected growth of creator commerce suggests that Asia-Pacific is not just adopting global e-commerce trends—it is defining them. The region’s models of livestream selling and integrated checkout are increasingly being studied, and in some cases replicated, elsewhere.

By 2030, if current trajectories hold, creator commerce may no longer be viewed as an alternative channel, but as a core pillar of digital retail across Asia-Pacific.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)