Terradot has acquired a rival carbon removal startup, consolidating technology and talent in a sector backed by major tech companies. The deal highlights growing pressure for scale in climate infrastructure.

The carbon removal sector is moving from experimentation toward consolidation.

Terradot, a climate technology company backed by Google and Microsoft, has acquired a competing startup focused on carbon removal. The deal brings additional intellectual property and operational capacity under one roof as the industry faces increasing demands for scale and credibility.

While financial terms were not disclosed, the acquisition reflects a broader shift in climate tech: early-stage rivalry is giving way to aggregation.

Why scale matters in carbon removal

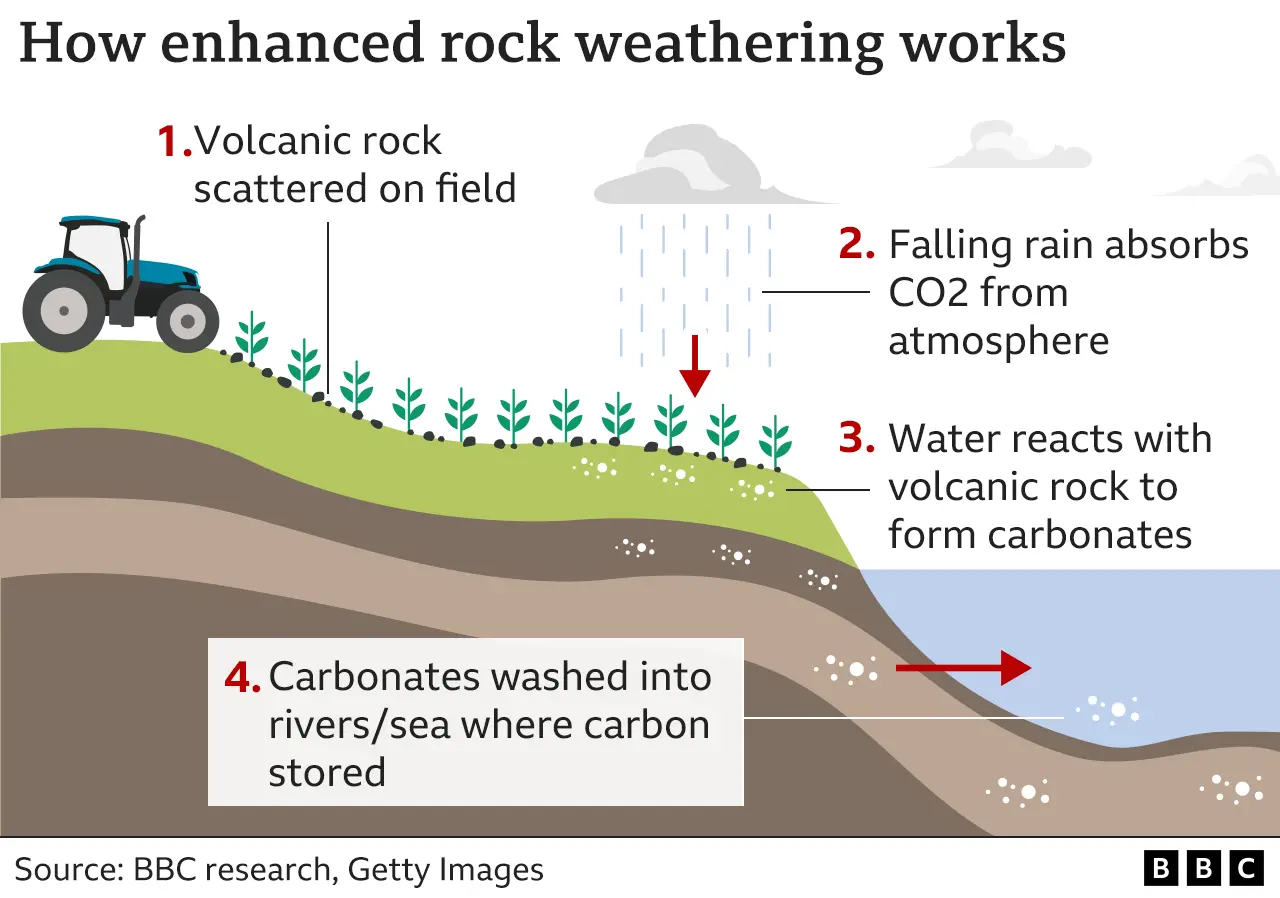

Carbon removal technologies, particularly approaches like enhanced rock weathering, require significant infrastructure, logistics, and long-term monitoring. These are not software-first businesses that can scale cheaply.

As buyers—including corporations seeking carbon credits—become more selective, startups face pressure to demonstrate reliability, durability, and measurable impact. Smaller players often struggle to meet those expectations alone.

By acquiring a competitor, Terradot is effectively buying time and capability—reducing duplication while expanding technical reach.

Big Tech’s influence looms large

Backing from companies like Google and Microsoft has helped legitimize carbon removal as a serious category rather than a speculative offset market. But that backing also raises expectations.

Large corporate buyers want standardization, verifiable measurement, and long-term contracts. Startups that cannot meet those thresholds risk being sidelined, regardless of technical promise.

Consolidation can make the sector easier to navigate for buyers, even if it reduces diversity among providers.

A maturing climate tech market

The acquisition is part of a familiar pattern seen in other infrastructure-heavy sectors. Early innovation attracts many entrants; operational reality favors fewer, larger players.

For policymakers and regulators, fewer but more robust companies may simplify oversight. For investors, consolidation can clarify which approaches are viable at scale.

The risk, however, is that concentration slows experimentation—a tension the sector will need to manage carefully.

What comes next

Carbon removal remains a young industry, but the tone is changing. The focus is shifting from proof-of-concept to delivery.

Terradot’s move suggests that survival in this market will depend less on novel ideas and more on execution, scale, and trust.

As climate commitments collide with physical constraints, consolidation may be the price of turning ambition into infrastructure.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)