South Korean game publisher Krafton reported a $15.5 million net loss in the fourth quarter, highlighting rising costs and a tougher global gaming environment.

Krafton’s latest earnings underline how quickly conditions have shifted for even the most established names in gaming.

The South Korean publisher reported a net loss of $15.5 million for the fourth quarter, reversing profitability from earlier periods as operating expenses rose and parts of its portfolio faced slower momentum. The result reflects broader pressures across the global games industry, where growth has cooled after years of pandemic-driven expansion.

For Krafton, the quarter marks a reminder that scale alone no longer guarantees resilience.

Costs rise as growth normalizes

Krafton has continued to invest heavily in new titles, live-service operations, and global expansion—particularly across mobile and emerging markets. Those investments carry upfront costs that are harder to absorb when revenue growth moderates.

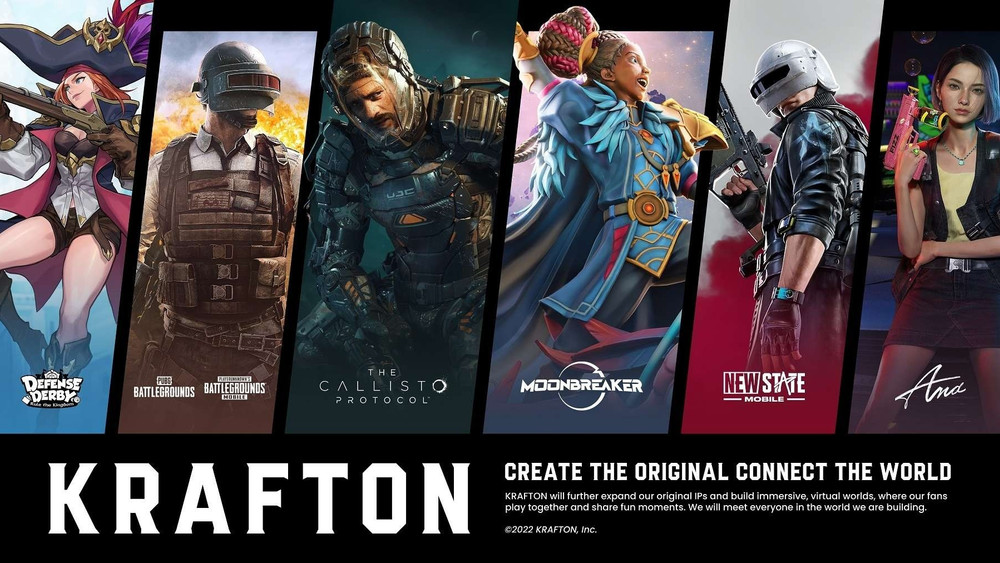

The company remains heavily associated with the PUBG franchise, which continues to generate significant revenue but faces natural maturity challenges in a competitive market increasingly crowded with live-service alternatives.

As player acquisition becomes more expensive, margins come under pressure.

PUBG still anchors the business

Despite the quarterly loss, Krafton’s core franchises remain commercially important. PUBG—across PC, console, and mobile—continues to deliver cash flow that funds experimentation and long-term bets.

However, dependence on a small number of blockbuster titles has become a structural risk across the gaming industry. Publishers are being pushed to diversify portfolios while managing the cost of doing so.

That balance is proving difficult to strike.

A wider industry pattern

Krafton’s Q4 loss mirrors a trend seen across global gaming companies. Player spending has softened, marketing costs remain elevated, and new releases face higher expectations in a saturated market.

At the same time, live-service games require continuous content investment to maintain engagement, limiting opportunities to cut costs quickly.

The result is a sector adjusting to a more disciplined, less forgiving environment.

What investors will watch next

Investors are likely to focus less on a single quarter and more on Krafton’s ability to stabilize margins while delivering new growth drivers beyond its flagship titles.

Execution matters: controlling costs without slowing innovation, and expanding internationally without overextending.

The company’s long-term strategy remains intact, but the Q4 loss underscores that the gaming industry’s reset is real—and ongoing.

For Krafton, the next phase will be defined not by scale, but by efficiency and portfolio depth.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)