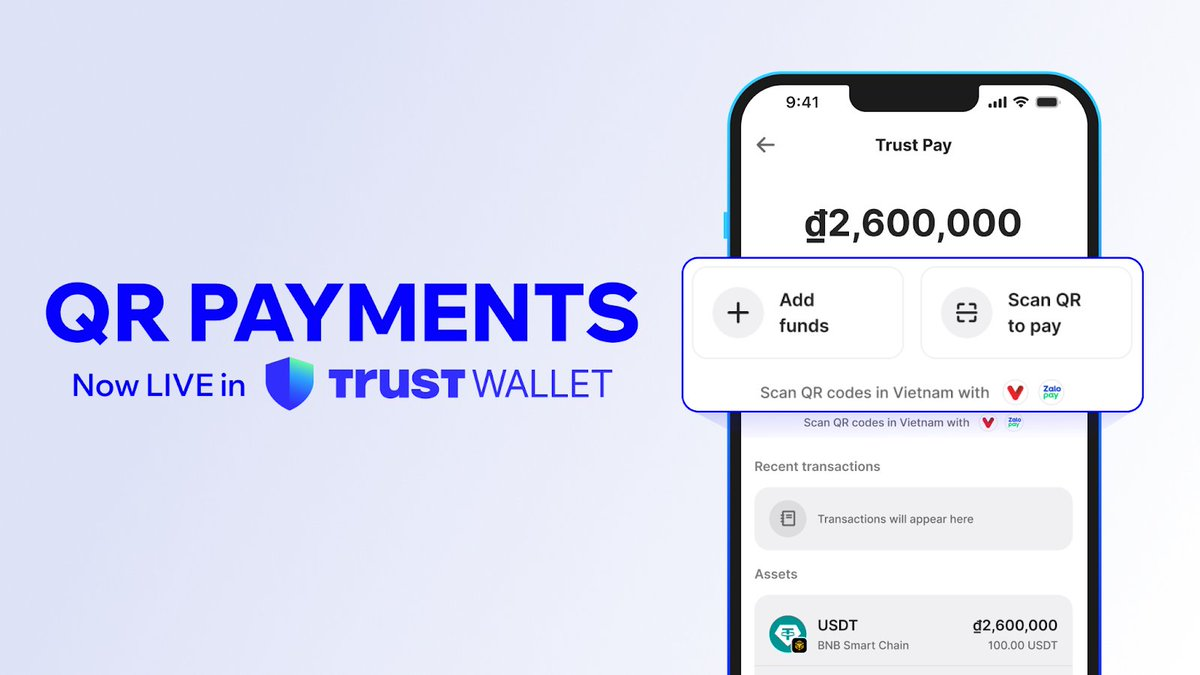

Trust Wallet has launched QR code-based stablecoin payments in Vietnam, allowing users to pay merchants directly with digital assets via a mobile wallet interface.

Crypto wallets are steadily moving from speculative trading tools to payment instruments.

Trust Wallet has unveiled stablecoin-based QR code payments in Vietnam, enabling users to transact directly with merchants using supported digital assets. The rollout places Vietnam among a growing group of markets experimenting with retail crypto payments anchored to price-stable tokens.

The move reflects broader efforts to bridge Web3 infrastructure with real-world commerce.

Why Vietnam matters

Vietnam has emerged as one of Southeast Asia’s most active crypto markets by user adoption. High smartphone penetration and familiarity with QR-based mobile payments create favorable conditions for wallet-based transactions.

At the same time, regulatory clarity around digital assets remains evolving.

By introducing stablecoin payments—rather than volatile cryptocurrencies—Trust Wallet is targeting practical everyday use cases such as retail purchases and peer-to-peer transfers.

Stablecoins as transactional rails

Stablecoins, typically pegged to fiat currencies like the US dollar, aim to reduce price volatility that deters mainstream spending.

For merchants, acceptance hinges on ease of conversion and minimal transaction friction.

QR payments offer a familiar interface, aligning crypto usage with existing digital payment habits across Asia.

Regulatory balancing act

Vietnam does not yet have a comprehensive legal framework governing cryptocurrency payments.

While wallet-based transfers are widely used, formal recognition of digital assets as legal tender remains limited.

The expansion could therefore test how regulators respond to retail-scale crypto payment systems.

Competitive landscape in digital payments

Southeast Asia is home to intense competition among fintech platforms, super apps, and traditional banks offering QR payment systems.

Crypto wallets entering the space must compete not only on functionality but also on trust, compliance, and user experience.

Trust Wallet’s strategy appears to focus on integration rather than disruption—embedding stablecoin usage within existing payment behaviors.

A gradual shift from trading to spending

Globally, crypto adoption has been dominated by trading and speculative activity.

Retail payment rollouts like this suggest a pivot toward everyday utility.

Whether consumers choose stablecoins over established mobile payment apps will depend on fees, incentives, and perceived security.

For now, Vietnam is becoming a testing ground for whether crypto can operate as payment infrastructure—not just an investment vehicle.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)