Amazon Pharmacy is expanding same-day prescription delivery to nearly 4,500 US cities, significantly broadening its healthcare logistics footprint.

Speed is becoming central to healthcare commerce.

Amazon is expanding same-day prescription delivery through Amazon Pharmacy to nearly 4,500 US cities, according to TechCrunch, marking one of the company’s most significant pushes into time-sensitive healthcare logistics.

The move positions Amazon more directly against traditional pharmacy chains and digital-first competitors in the prescription market.

Logistics as competitive advantage

Amazon Pharmacy‘s healthcare strategy has consistently leaned on its fulfillment network.

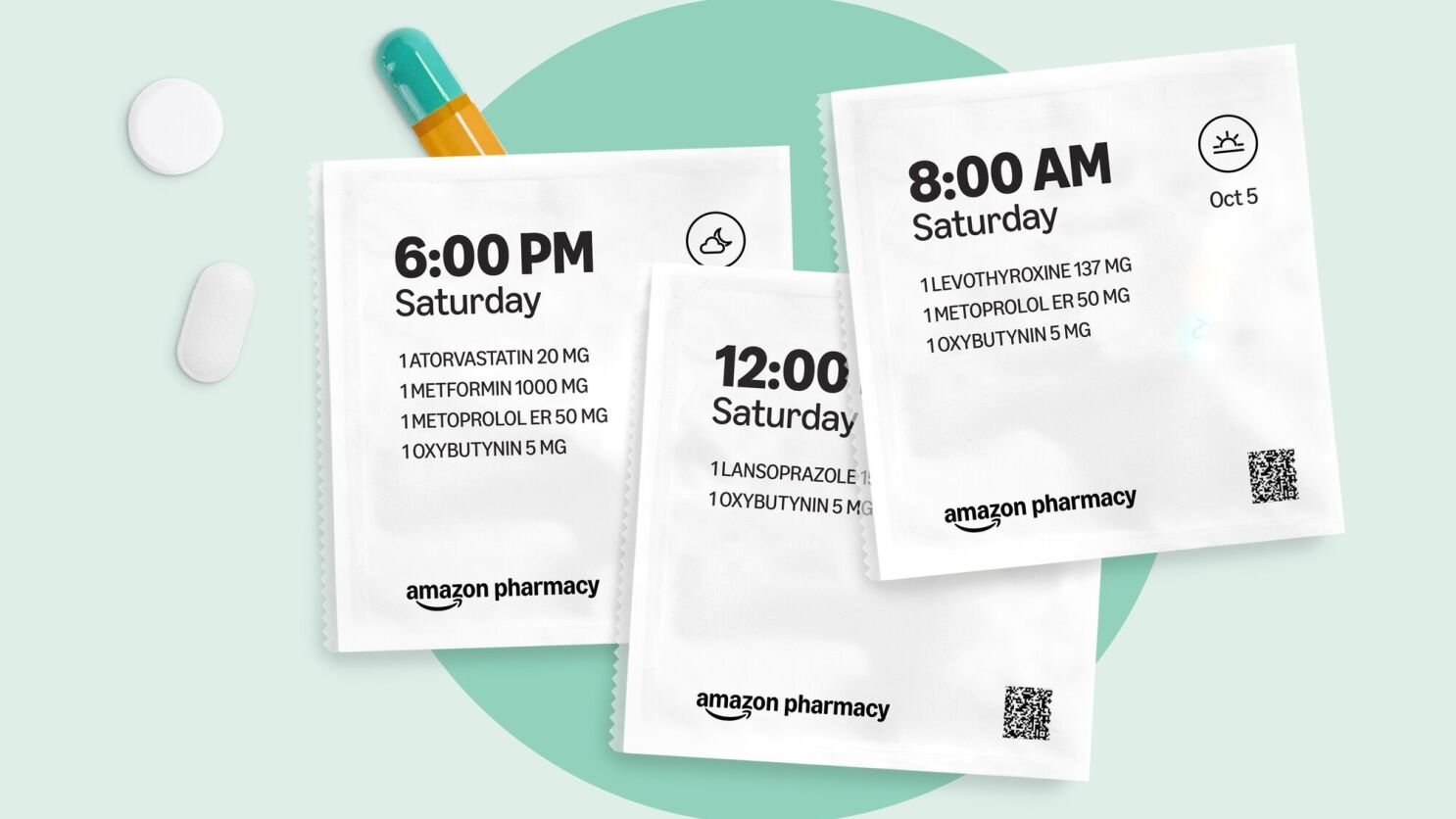

By leveraging existing warehousing and last-mile infrastructure, the company aims to reduce friction in prescription access — particularly for maintenance medications and recurring orders.

Same-day delivery increases convenience, a key differentiator in a market where patients often prioritize speed and reliability.

Intensifying pharmacy competition

The US pharmacy landscape includes established retail chains, pharmacy benefit managers (PBMs), and newer digital entrants.

Amazon Pharmacy‘s expansion raises competitive pressure on brick-and-mortar pharmacies that rely on in-store pickup.

Digital pharmacy adoption has grown steadily, particularly among younger and tech-native consumers.

Healthcare as long-term growth pillar

Amazon has made multiple healthcare bets over the past decade, ranging from pharmacy services to telehealth and employer-focused offerings.

While some initiatives have been restructured, pharmacy remains a strategic vertical aligned with recurring consumer demand.

Prescription fulfillment offers predictable volume and integration potential with broader health services.

Regulatory and operational complexity

Pharmaceutical distribution is heavily regulated.

Expanding same-day delivery requires coordination with state-level pharmacy rules, cold-chain requirements for certain drugs, and insurance reimbursement systems.

Maintaining compliance while scaling speed presents logistical challenges.

Patient convenience versus cost control

Faster delivery does not automatically equate to lower healthcare costs.

However, reducing missed doses and improving medication adherence can contribute to better long-term outcomes.

Amazon’s model may prioritize user experience, potentially influencing how insurers and employers structure pharmacy partnerships.

The broader retail health shift

The expansion reflects a larger transformation of healthcare into a logistics-driven industry.

Retail giants increasingly view health services as extensions of ecommerce infrastructure.

For Amazon, same-day pharmacy delivery is not merely about prescriptions — it is about embedding healthcare into the company’s broader ecosystem.

If execution meets consumer expectations, the pharmacy business could evolve into a durable revenue engine within Amazon’s diversified portfolio.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)