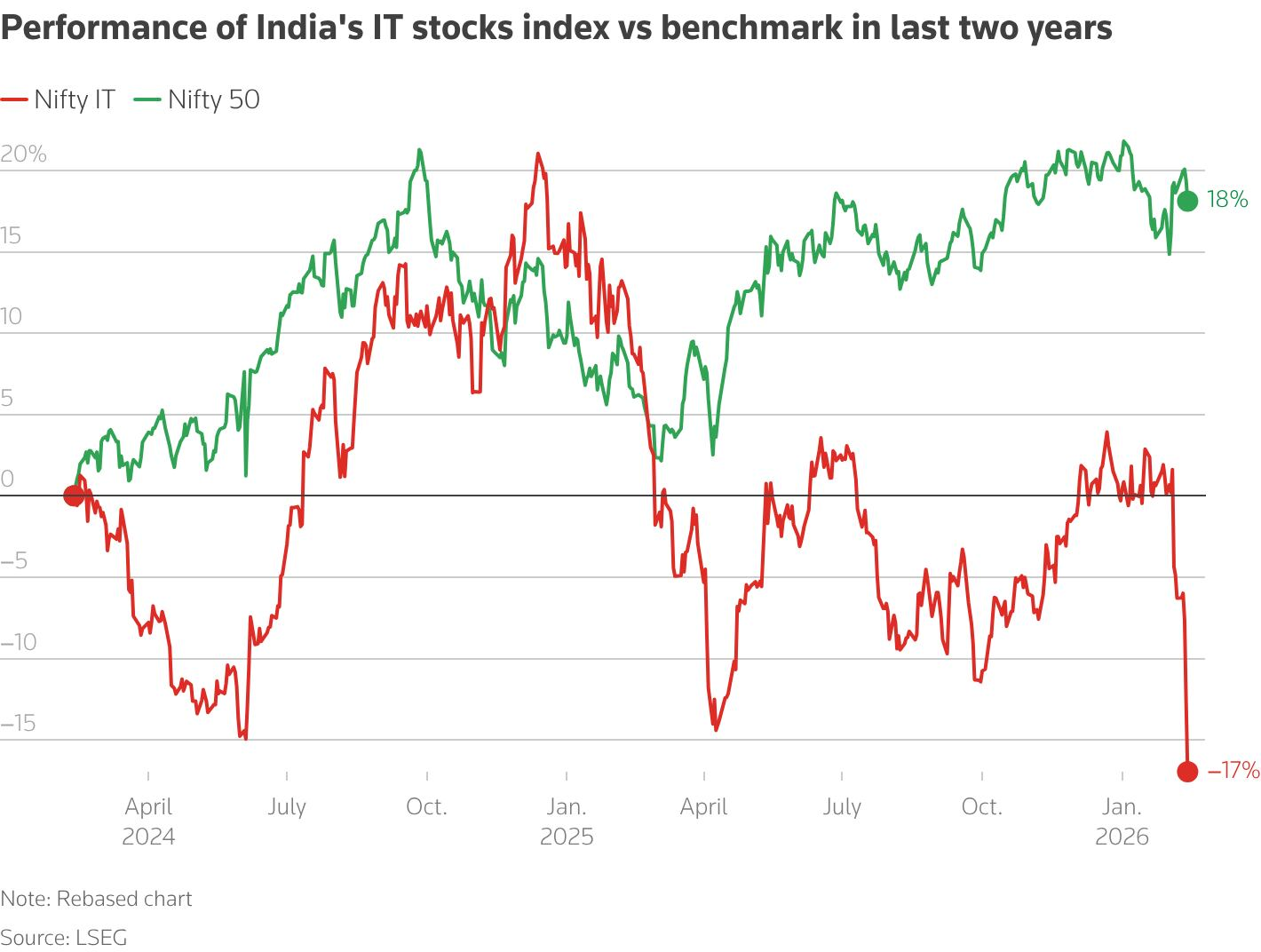

Indian IT stocks have reportedly lost around $50 billion in market value in their worst weekly decline since the pandemic, as investors reassess the impact of AI automation on outsourcing demand.

One of India’s most reliable export engines is facing a structural reckoning.

Shares of major IT services firms fell sharply during the week, wiping out an estimated $50 billion in market capitalization. The decline reflects growing concern that generative AI and automation tools could compress margins across the traditional outsourcing model.

AI changes the cost equation

Indian IT firms have historically thrived on labor arbitrage — providing skilled software engineering and back-office services at competitive costs.

However, enterprise AI tools increasingly automate:

- Code generation

- Testing workflows

- Customer support

- Infrastructure monitoring

If clients can deploy AI systems that reduce headcount needs, the demand for large offshore teams may soften.

Spending uncertainty

Beyond AI disruption, global macroeconomic caution is also weighing on the sector. Enterprises in the US and Europe — key revenue markets — have signaled slower discretionary tech spending.

For listed Indian IT giants, even modest contract delays can materially affect quarterly guidance.

Adaptation versus erosion

Industry leaders have responded by integrating AI into service offerings rather than resisting it. Many firms now market AI-led consulting, automation frameworks, and productivity enhancements.

The challenge is whether these offerings:

- Offset revenue compression

- Preserve billing rates

- Sustain long-term growth

Investors appear unconvinced in the near term, triggering the steep selloff.

Structural shift or temporary shock?

The Indian IT sector has weathered prior technological shifts — from cloud migration to digital transformation waves. Whether generative AI represents incremental evolution or existential disruption remains contested.

For now, markets are pricing in uncertainty. The coming quarters will test whether India’s outsourcing champions can reposition themselves as AI integrators rather than casualties of automation.

The $50 billion erosion in market value is not just a weekly statistic — it signals a broader debate about the future economics of global IT services.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)