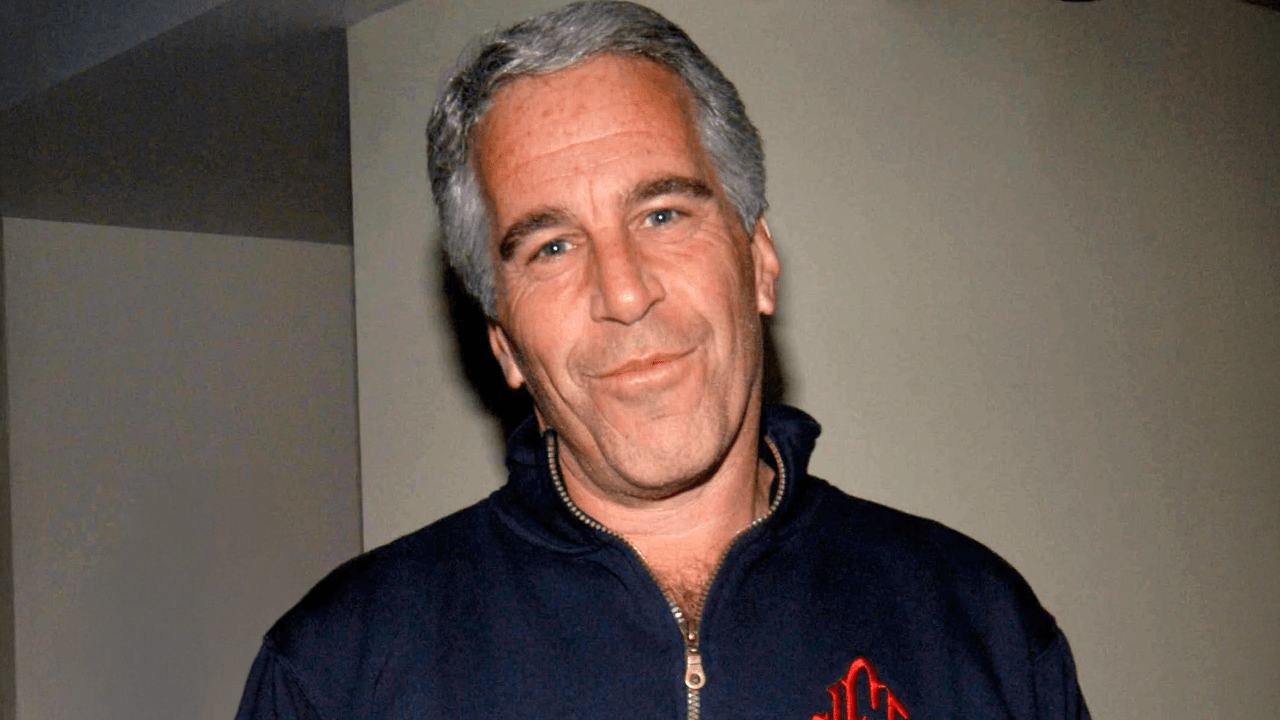

Recent disclosures tied to the Epstein files have drawn attention to past associations between Silicon Valley figures and controversial networks, prompting renewed scrutiny of startup governance and investor due diligence.

Newly surfaced material linked to the so-called “Epstein files” has reignited scrutiny around historical relationships between powerful business figures and controversial social networks — including individuals tied to electric vehicle (EV) startups and venture capital circles in Silicon Valley.

While no new criminal allegations against companies themselves have emerged, the revelations have intensified questions around reputational risk, governance oversight, and the informal power networks that shape early-stage funding ecosystems.

The shadow of association

In venture-backed industries like EV manufacturing — where founders often rely heavily on elite investor networks — reputational exposure can ripple quickly.

Silicon Valley has long operated through tightly knit social and financial circles. Critics argue that informal dealmaking environments, exclusive retreats, and private gatherings can blur the lines between professional collaboration and personal affiliation.

Even historical, non-operational ties can create public-relations fallout for startups already navigating regulatory hurdles, capital-intensive growth, and intense competition.

Governance and due diligence pressures

The broader issue isn’t limited to EV startups alone. As venture funding becomes more global and institutional, limited partners and public market investors increasingly demand transparency in:

- Founder-investor relationships

- Board oversight structures

- Risk disclosure policies

Public companies in adjacent sectors have faced shareholder pressure after controversies involving executive associations, regardless of legal culpability.

Silicon Valley’s evolving accountability

In the past decade, the startup ecosystem has undergone cultural shifts — from #MeToo-era reckonings to governance reforms tied to public listings and SPAC mergers.

Investors today operate in an environment where social scrutiny can move markets as quickly as earnings reports.

The Epstein Files-linked disclosures serve as a reminder that informal networks, once considered peripheral to business fundamentals, can become material risk factors in the age of social transparency.

Epstein Files’ bigger picture

For EV startups already navigating production delays, supply chain challenges, and capital burn concerns, reputational turbulence adds another layer of complexity.

Ultimately, the story is less about any single company and more about how concentrated power structures in Silicon Valley are increasingly exposed to public accountability.

As capital markets mature — and as institutional investors demand tighter governance — the cost of proximity to controversy may rise.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)