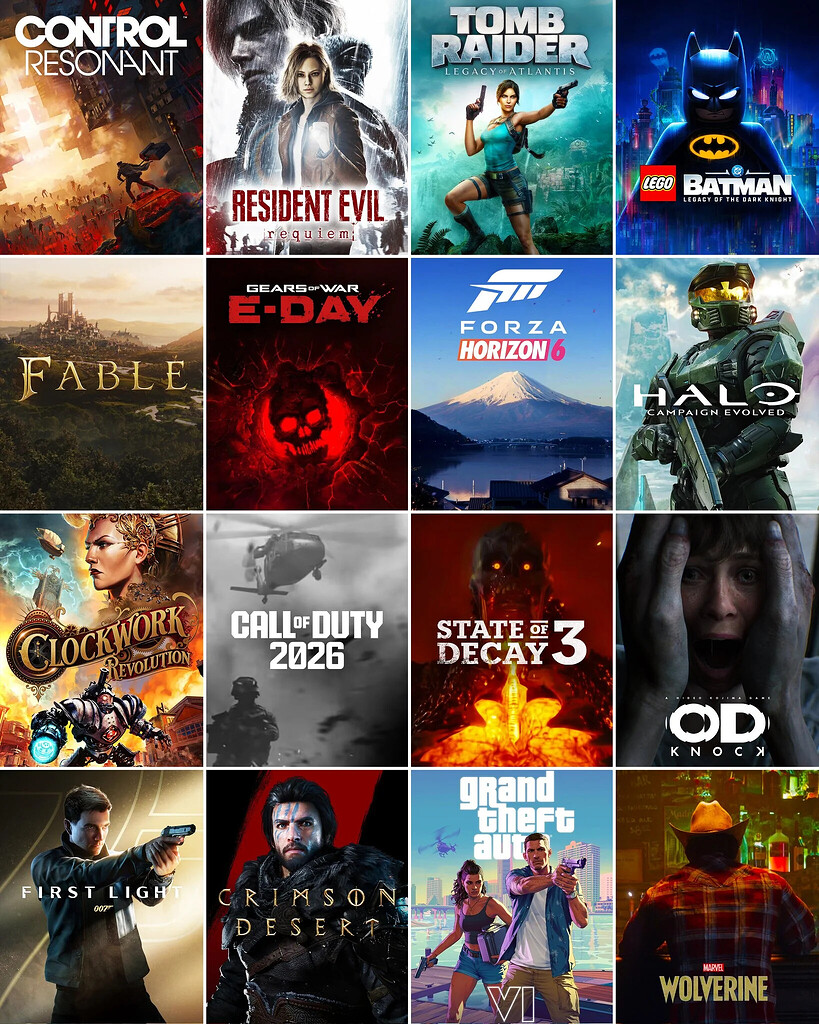

The 2026 lineup of major video game releases highlights a mix of franchise expansions and new intellectual property. After years of industry volatility, publishers are prioritizing high-confidence launches and longer development cycles.

The global gaming industry enters 2026 in a markedly different posture than it did during the pandemic-era boom.

Following waves of studio layoffs, project cancellations, and delayed releases, major publishers are returning with a curated slate of high-budget titles. The year’s anticipated releases suggest a recalibration: fewer experiments, more franchise depth, and selective bets on new intellectual property.

The message is clear — ambition remains, but discipline now shapes execution.

Franchise depth over expansion sprawl

Several of 2026’s most anticipated games are extensions of established universes.

Publishers increasingly lean on recognizable IP to reduce risk in an environment where development costs can exceed hundreds of millions of dollars. Long production cycles, cross-platform launches, and post-launch live-service support demand predictable engagement.

Franchise installments offer:

- Built-in fan bases

- Stronger pre-order pipelines

- Lower marketing uncertainty

- Merchandising and transmedia tie-ins

However, reliance on sequels can constrain creative exploration.

Studios must balance player familiarity with mechanical innovation to avoid franchise fatigue.

New IP still breaks through Video Game

Despite financial caution, 2026 is not devoid of new concepts.

Select publishers are introducing original worlds — particularly in science fiction and fantasy genres — often built on next-generation engines designed for advanced lighting, procedural environments, and AI-enhanced NPC behavior.

New IP plays an important role in long-term portfolio health.

While sequels stabilize revenue, fresh universes can become the next decade’s flagship franchises. Investors and fans alike watch closely for breakout successes that redefine genre expectations.

Technology pushes immersion further

Advances in hardware performance and engine capabilities continue to expand environmental scale.

In 2026, major Video Game are showcasing:

- Larger seamless open worlds

- Advanced physics simulation

- Adaptive AI-driven NPC interactions

- Real-time lighting enhancements

Cloud integration and AI-assisted development tools are also quietly reshaping production workflows behind the scenes.

These technical gains support player immersion — but they also increase production complexity and cost.

Live-service recalibration

The Video Game industry’s earlier enthusiasm for live-service games has moderated.

While ongoing multiplayer ecosystems remain profitable for select franchises, many publishers are scaling back attempts to convert every title into a persistent service platform.

In 2026, more single-player narrative experiences are returning to prominence.

This shift reflects player feedback and commercial realities: not every title sustains long-term engagement through microtransactions or seasonal content updates.

Market dynamics and player behavior

Video Game remains one of the largest entertainment sectors globally, but consumer behavior is evolving.

Players increasingly:

- Split time between blockbuster releases and free-to-play titles

- Expect post-launch updates

- Demand cross-platform accessibility

- Evaluate value against subscription offerings

Subscription services and digital storefront promotions influence purchasing patterns, shaping how and when major titles launch.

Publishers must now design release windows with ecosystem competition in mind.

A disciplined optimism

The 2026 release slate signals cautious confidence.

After a turbulent stretch marked by overexpansion and restructuring, the industry appears to have stabilized around:

- Selective greenlighting

- Longer development timelines

- Focused marketing campaigns

- Revenue diversification strategies

While not every anticipated title will meet expectations, the lineup reflects a more deliberate development philosophy.

In 2026, the industry is betting that measured ambition — rather than aggressive expansion — will define the next growth phase.

For Video Game players, that may mean fewer titles overall, but more polished experiences.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)