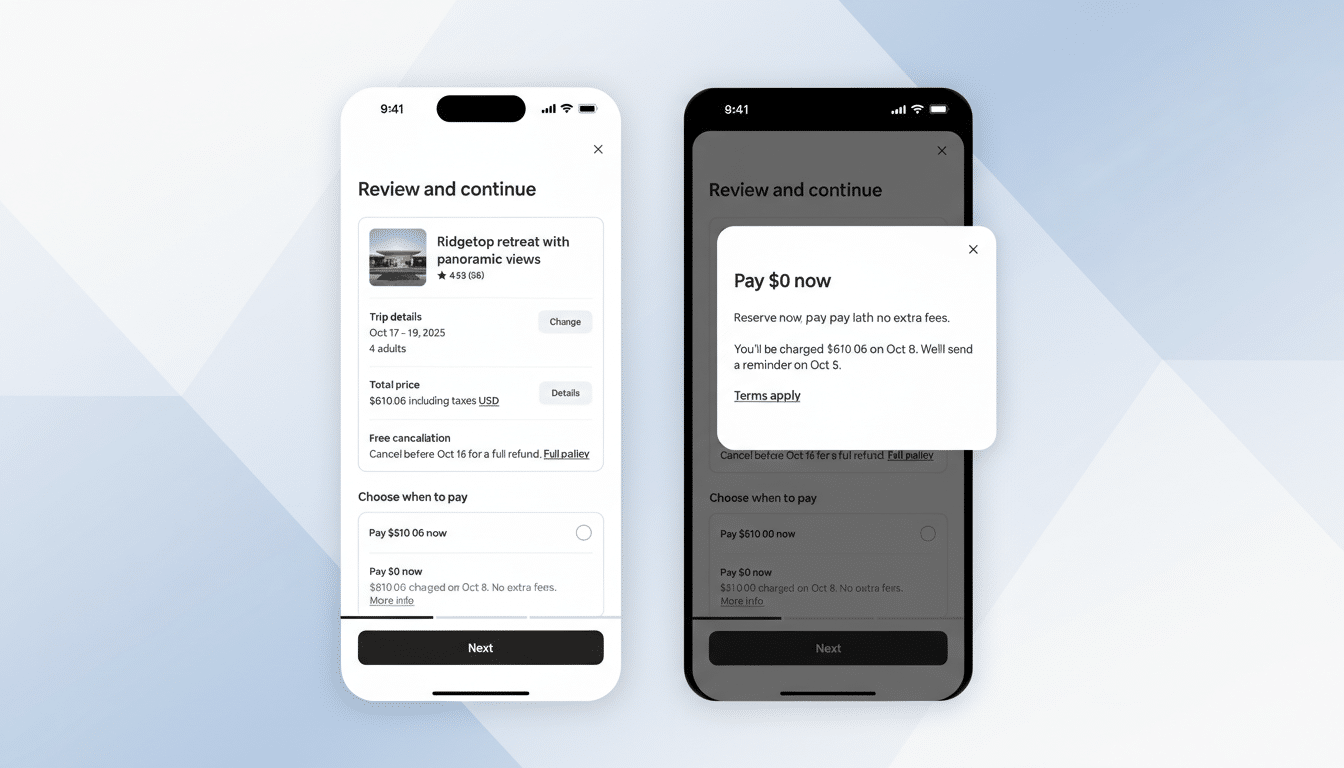

Airbnb is expanding its “Reserve Now, Pay Later” option globally, allowing travelers to secure bookings while deferring payment under structured timelines

Airbnb is deepening its fintech footprint in global travel.

The company is expanding its “Reserve Now, Pay Later” feature to more markets worldwide, enabling customers to lock in bookings while spreading out or deferring payments. The move reflects a broader shift toward flexible payment structures in online travel.

As travel demand normalizes post-pandemic volatility, platforms are exploring tools that reduce friction at checkout.

Payment flexibility as growth lever

Travel purchases often represent high upfront costs.

By allowing deferred payments, Airbnb aims to:

- Lower booking hesitation

- Increase conversion rates

- Encourage early trip planning

- Improve occupancy visibility for hosts

Flexible payment options have become common in ecommerce and are increasingly embedded in travel platforms.

Fintech integration trend

Buy-now-pay-later (BNPL) models have expanded rapidly across retail.

Travel, with its seasonal demand spikes and high ticket sizes, represents a logical extension.

Airbnb’s expansion suggests confidence that structured deferred payments can stimulate demand without materially increasing default risk.

Host ecosystem considerations

Airbnb operates a two-sided marketplace.

Payment flexibility must align with host expectations around payout timing.

Ensuring predictable cash flow for property owners remains critical.

Operationally, the company must balance traveler convenience with host reliability.

Competitive landscape

Online travel agencies and hospitality platforms are increasingly embedding financial services.

Flexible payment tools can differentiate user experience in competitive markets.

Airbnb’s global rollout positions it alongside peers that integrate payment innovation into booking flows.

Economic backdrop

Consumer budgets in many markets remain sensitive to interest rates and inflation.

Offering deferred payment options may cushion short-term demand fluctuations.

However, fintech expansion also introduces regulatory compliance requirements across jurisdictions.

Strategic signaling

Airbnb’s move underscores a broader transformation.

Travel platforms are evolving into integrated commerce ecosystems that combine booking, payments, and financial services.

Flexible payments represent not merely a feature but a strategic lever to sustain growth.

As competition intensifies, reducing friction at checkout may prove as valuable as expanding listings.

Airbnb’s global rollout suggests it sees payment innovation as central to the next phase of travel tech competition.

In digital marketplaces, convenience often determines conversion.

And payment flexibility is becoming part of that equation.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)