The venture arm of Nvidia participated in a $67 million Series B round for a U.S. manufacturing startup, reinforcing the chipmaker’s strategic interest in industrial AI applications.

While Nvidia is best known for powering large language models and cloud AI workloads, its investment signals growing attention to manufacturing transformation.

Nvidia AI’s Expanding Industrial Role

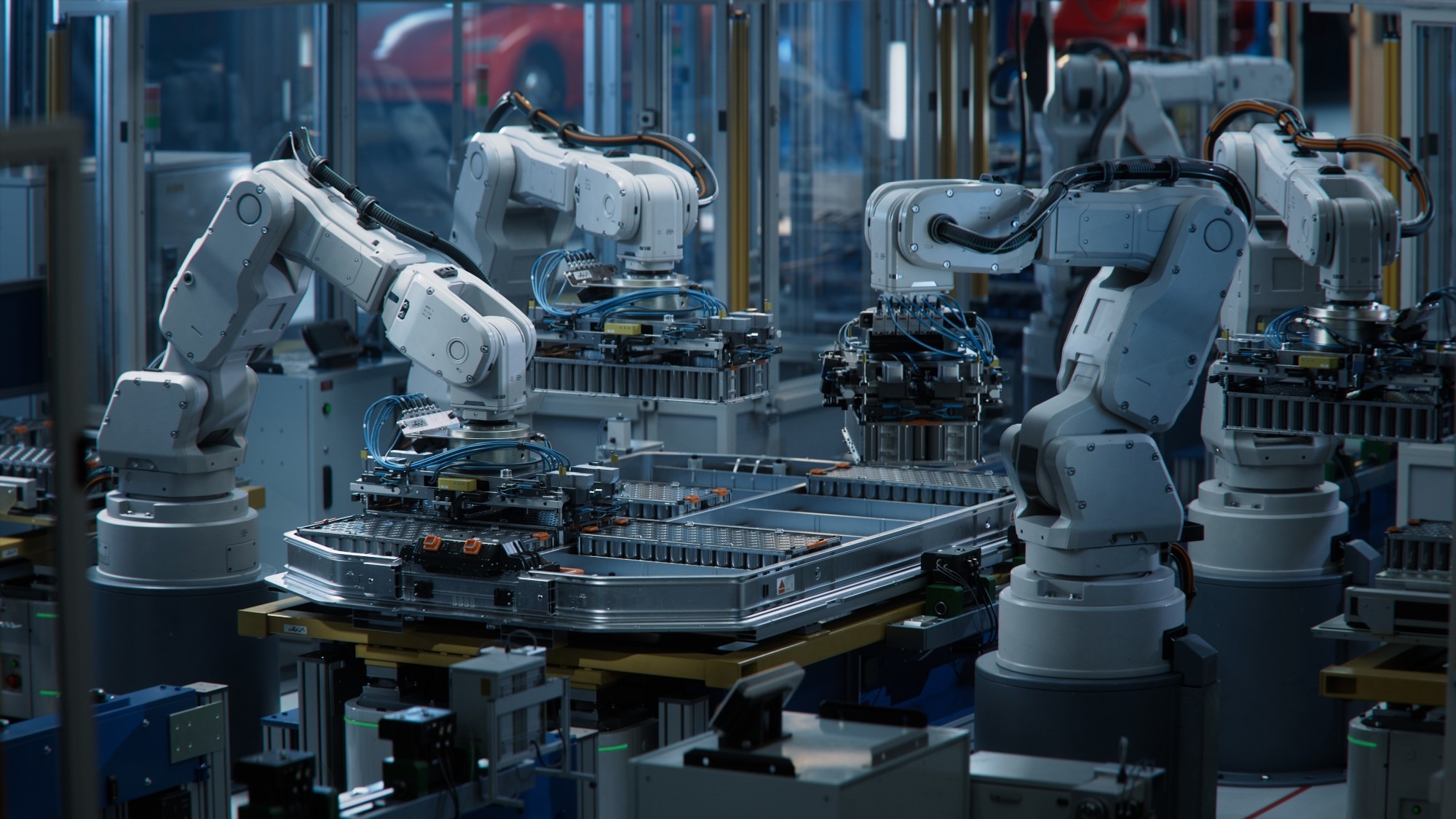

Manufacturing is undergoing digitization driven by robotics, computer vision, and predictive analytics.

AI systems can optimize production lines, detect defects in real time, and simulate operational improvements before physical implementation.

For industrial startups, combining hardware innovation with AI-driven software platforms offers differentiated value.

Nvidia’s ecosystem — spanning GPUs, edge computing hardware, and AI software frameworks — aligns naturally with such applications.

Strategic Venture Positioning

Corporate venture capital arms often invest to strengthen long-term ecosystem positioning rather than pursue purely financial returns.

By backing manufacturing startups, Nvidia can:

- Encourage adoption of AI-enabled hardware

- Expand use cases for edge AI chips

- Strengthen ties with industrial customers

Manufacturing represents a large, under-digitized market compared to consumer AI.

Investment at the Series B stage typically supports scaling operations, expanding production capacity, or accelerating commercial deployment.

U.S. Manufacturing Resurgence

The funding round also intersects with broader policy trends.

The United States has increased focus on domestic manufacturing resilience, supply chain security, and advanced industrial capacity.

AI-enabled factories align with these objectives, promising higher efficiency and global competitiveness.

For policymakers and enterprise buyers, industrial AI can reduce waste, improve quality control, and enhance supply chain visibility.

Beyond Data Centers

Nvidia’s dominance in AI infrastructure is closely associated with data centers and cloud providers.

However, long-term growth may increasingly depend on edge deployments — AI systems embedded directly within industrial environments.

Manufacturing offers a natural expansion frontier.

For startups in the sector, backing from a major semiconductor player provides validation and potential access to broader partnerships.

A Diversified AI Investment Cycle

The $67 million Series B illustrates a widening AI investment thesis.

Rather than focusing solely on foundation models and consumer applications, capital is flowing into industrial transformation.

As AI technology matures, its commercial value may increasingly depend on real-world deployment across logistics, energy, healthcare, and manufacturing.

Nvidia’s venture participation signals recognition that the next growth wave in AI may be built not just in code repositories — but on production lines.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)