Same-day and next-day deliveries have grown 4-5X during peak periods, now accounting for 12-15% of total ecommerce deliveries, which is a big leap from almost zero just 18 months ago

While fast delivery services are in high demand, they come with operational challenges. One of the biggest hurdles is optimising inventory placement

As the industry stands at the precipice of super-fast deliveries, building an efficient supply chain will be the most critical element for the long-term sustainability of India’s quick delivery realm

This festive season will be all about the need for speed, as ecommerce majors have now entered the paradigm of swift deliveries (same day or next day), pivoting from their earlier timeline of 4-5 days.

Making the game of deliveries insanely difficult to play will be quick-commerce players that are expected to capture the majority of the customer base seeking instant gratification. All in all, ecommerce platforms will be seen upping the ante in staying ahead of the delivery curve and ensuring that no shopper is left craving amid the festive rush.

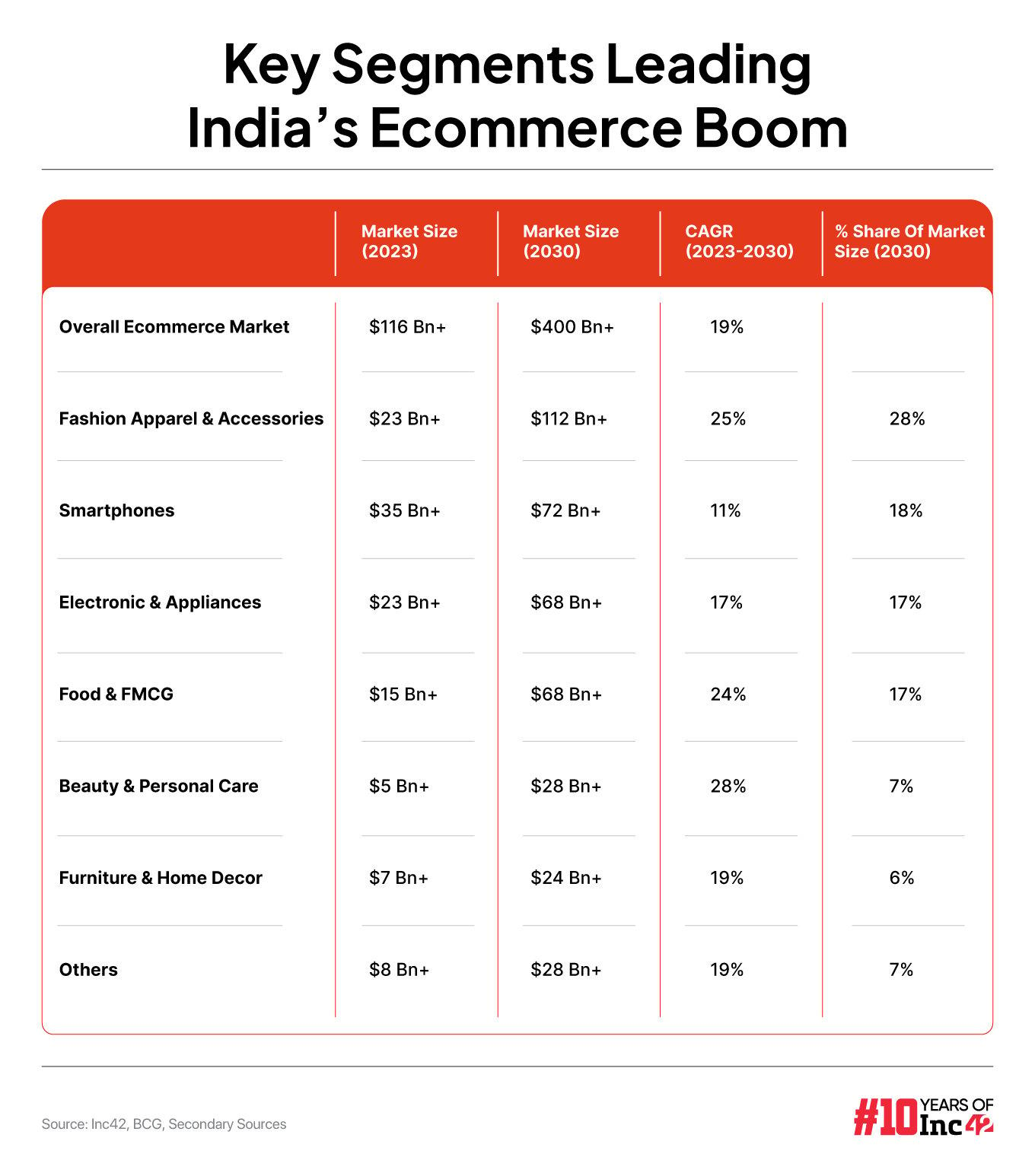

However, this shift in ecommerce behaviour has been in the making for some time, and the trigger has been the maturity of the Indian quick delivery ecosystem, which currently drives 40% of online grocery sales.

Over the past year, ecommerce marketplaces have made significant strides in enhancing delivery speed, introducing same-day and next-day services to cater to customer demands. A vibrant example is Flipkart, which, at the start of the year, announced that it would offer same-day delivery across multiple product categories at no additional cost.

With the market at stake, Amazon followed suit, while beauty platform Nykaa and fashion site Myntra began testing same-day delivery options. Witnessing this, many D2C brands are also adapting to remain competitive.

While they may not match online marketplaces in order volume, they’re eager to offer quicker delivery options to stay competitive. A case in point is GenZ-focussed fashion startup NEWME, which recently launched 90-minute delivery for its products in select Delhi NCR areas.

Speaking with Inc42, logistics experts said that the demand for fast delivery has surged dramatically compared to last year’s festive sales. Same-day and next-day deliveries have grown 4-5X during peak periods of festive sales, now accounting for 12-15% of total ecommerce deliveries, which is a big leap from almost zero just 18 months ago.

lockquote>

This surge comes as ecommerce firms like Amazon, Flipkart, and Meesho are expected to register a 20% year-on-year rise in gross merchandise value, generating sales in the range of INR 1 Lakh Cr to 1.2 Lakh Cr this festive season, according to Redseer Strategy Consultants. Quick commerce is anticipated to contribute around 8% to this overall growth.

Festive Rush Paves The Way For 5X Surge In Same-Day Delivery

Speaking with Inc42, COO of Ecom Express, Vishwachetan Nadamani, said that during the festive season, the speed of deliveries naturally improves due to increased demand, with line-haul trucks operating more frequently. However, the surge in fast delivery requests is more pronounced this year.

Therefore, the executive added that the company has rolled out same-day delivery and next-day deliveries in India’s top 10 metro cities, with the infrastructure fully established to support these services.

Meanwhile, Shadowfax’s cofounder and chief business officer, Praharsh Chandra, said that the company is well prepared to tackle the same or next-day delivery rush.

“We started focussing on fast delivery with both brands and marketplaces about a year and a half ago. Back then, the industry had 0% same-day delivery, but now 10-14% of all intra-city orders are delivered the same day,” Chandra said.

lockquote>

Chandra noted that this trend is gaining momentum as we are nearing the peak sales season. “In fact, our same-day delivery channel saw five times growth in just one day, on the second day of the sales. We experienced some very high peaks,” he said.

Chandra sees a clear shift in consumer behaviour here, with more and more customers now wanting instant gratification. “Even for nearby zones, like orders from Bangalore to Mysore, which used to take two days, people now expect next-day deliveries,” he said.

The sentiment is being echoed across the industry. For instance, Zipee’s founder & CEO, Madhav Kasturia, sees registering 6-8X growth as all its partner brands continue to scale during the festive season.

Fast Delivery Fever Grips All Categories

Fast delivery demand has risen across categories this festive season. Electronics, beauty and personal care, fashion, and home goods have seen strong interest, with mobile phones being the most popular choice. Interestingly, on the first day of sales, Shadowfax delivered 15,000 iPhones.

However, the demand landscape is not solely dominated by electronics. Categories such as beauty and personal care, fashion, and home goods are also seeing high demand, with brands like Decathlon experiencing increased sales of sports goods, showing that consumers are diversifying their purchases.

“There’s demand in various categories. However, it’s crucial to focus on where the concentration of that demand is and whether brands have optimised their supply chains with warehouses in these top metros,” the Ecom Express COO said.

lockquote>

So far, demand for fast delivery is highest in metro cities like Bangalore, Mumbai, and Delhi. However, this trend is not limited to urban areas. Brands are now stocking inventory in Tier II and Tier III cities like Patna, Jaipur, and Guwahati to offer faster delivery options in these regions as well.

Navigating The Complexities Of Fast Delivery

While fast delivery services are in high demand, they come with operational challenges. One of the biggest hurdles is optimising inventory placement. Quick deliveries not only require faster transportation but also strategic positioning of inventory closer to customers.

This requires maintaining fewer pin codes per dark store, which complicates logistics, Zippee’s Kasturia said, adding that the logistics startup was addressing it by establishing localised inventory hubs, enabling quicker access and more streamlined delivery routes.

Additionally, the rising demand for same-day deliveries translates to an increased need for delivery riders, resulting in escalating costs month after month. During peak seasons, the volume can increase by 4-5X, necessitating supplementary capacity through hyperlocal delivery fleets.

“Historically, logistics have a rigid model where shipments from multiple clients are picked up, sent to a central sortation centre, and then dispatched to last-mile hubs. That entire process used to take around 16 hours. But for same-day delivery, we can’t afford that kind of delay. So, we have restructured the supply chain to bypass certain nodes when possible. This is both a technology and operational shift,” Shadowfax’s Chandra said.

While same and next-day deliveries typically carry a premium — around 25% higher than express delivery — logistics startups are actively working to optimise operational costs. By increasing order volumes and refining their processes, many have reduced the cost difference to approximately 5-10% compared to regular delivery.

Now, as the industry stands at the precipice of super-fast deliveries, building an efficient supply chain will be the most critical element for the long-term sustainability of India’s quick delivery realm.

[Edited By Shishir Parasher]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)