Led by Isha Ambani, Reliance Retail operates both online and offline and across diverse verticals, including grocery, electronics, fashion apparel, beauty, footwear, food, jewellery, and lifestyle

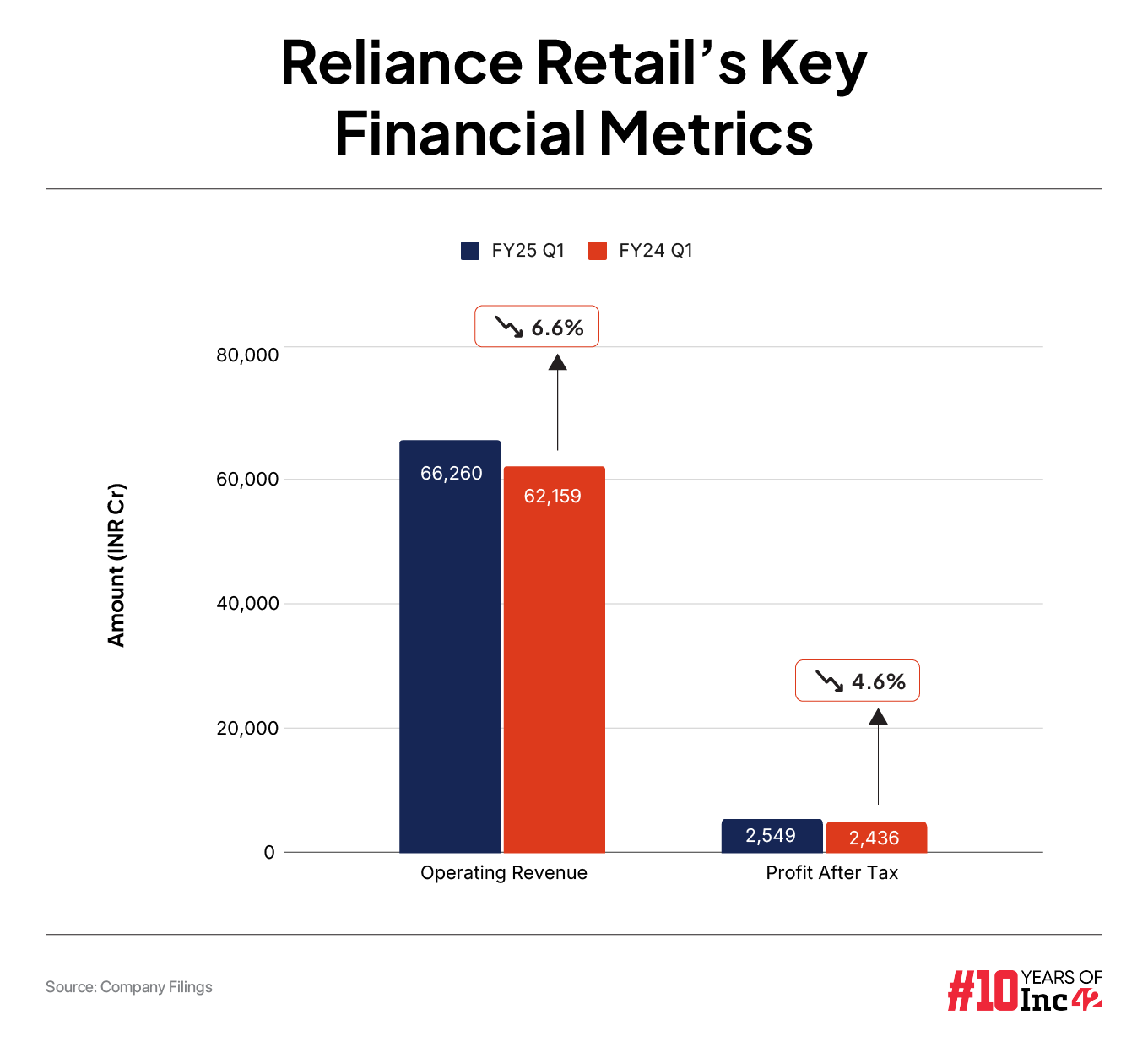

In Q1 FY25, Reliance Retail’s revenue rose 6.6% year-on-year (YoY) to INR 66,260 Cr, even as the numbers reveal a slight sequential dip from INR 67,610 Cr in the previous quarter

The company’s digital commerce and new commerce businesses contributed 18% of the total Q1 FY25 revenues, reflecting its efforts to integrate online and offline channels

With plans to double its sales over the next three to four years, Reliance Retail, the retail arm of Reliance Industries Ltd (RIL), continues to be a key driver of the group’s growth.

Led by Isha Ambani, Reliance Retail operates both online and offline and across diverse verticals, including grocery, electronics, fashion apparel, beauty, footwear, food, jewellery, and lifestyle.

In Q1 FY25, Reliance Retail’s revenue rose 6.6% year-on-year (YoY) to INR 66,260 Cr, even as the numbers reveal a slight sequential dip from INR 67,610 Cr in the previous quarter.

The company’s digital commerce and new commerce businesses contributed 18% of the total Q1 FY25 revenues, reflecting its efforts to integrate online and offline channels. Despite a 7% sequential decline in profit, Reliance Retail posted a 4.6% increase in net profit year-on-year to INR 2,549 Cr in Q1 FY25.

lockquote>

While grocery and consumer electronics have been key drivers of growth, Reliance Retail seems to have its sharp focus on fashion and lifestyle, too. With an expanding portfolio of brands, including Yousta, Azorte, and Gap, the company is actively scaling its presence in this segment.

Earlier this year, Reliance Retail signed a licencing agreement with UK-based fast fashion retailer ASOS to bring the brand to India, challenging the dominance Myntra and the ilk in the GenZ space and the emergence of D2C fast fashion brands.

Notably, the strategy to increase its folio of brands has helped Ajio, the company’s B2C online fashion platform, add nearly 2 Mn new customers in Q1 FY25. In addition, Jio Luxe, its premium luxury segment, now hosts over 700 global brands, making it a leading destination for luxury fashion in India. Not just this, its catalogue for the overall online fashion business has grown more than 20% year-on-year.

However, not all is going as planned. The company is facing headwinds due to a fall in discretionary spending of users in the fashion and lifestyle segments.

Despite this, the president & CEO of Reliance Retail Fashion & Lifestyle, Akhilesh Prasad, told Inc42 that the company will remain focussed on expanding its store count and digital presence to cash in on growth opportunities in India’s evolving retail space.

So, what’s the CEO’s plan when it comes to making a significant leap in the fashion and lifestyle space? More so, what made him recite the theory of “survival of the fittest” in a tête-à-tête with Inc42?

Here are the edited excerpts…

Inc42: The fashion and lifestyle segment has seen noteworthy growth over the past few quarters on the back of the company’s omnichannel strategy and multiple partnerships. What have been the key growth drivers so far, and how do you plan to sustain this momentum?

Akhilesh Prasad: We are part of the Reliance group, therefore we aren’t resource-constrained in any way. However, we may be formula-constrained in the sense that it could take some time to decode what works in the market and what people are looking for.

What we’ve understood is that consumers are very aware of fashion. They want to consume it if it’s offered at a price point they can afford. Now, we’ve reached some maturity in the range we offer. While we’ve already started adding footwear, we now plan to add categories like beauty and personal care, etc. to provide a complete range of youth offerings.

Inc42: Ajio has expanded its customer base and catalogue. How do you ensure it continues to stand out in the competitive fashion industry?

Akhilesh Prasad: Competition is crucial for market growth. If there’s no competition, the market will stop growing. So, we welcome competition. Competition is a good metric and does not mean that the industry has saturated in the absence of innovation.

For example, a Fiat car used to be sold in India, and people might say it became competitive when more brands entered the market. Now, we have 25 different brands, but we sell 150 times the number of cars we used to sell back then.

It’s about survival of the fittest. The market is never a limitation, but what matters is if you’re fit to survive in it. For those who are fit, competition is the best thing. It all boiled down to the mindset — are you a winner, a survivor, or a complainer?

lockquote>

Inc42: Mono-brand websites like Tumi and Pottery Barn are becoming popular. How does this align with Reliance’s overall strategy?

Akhilesh Prasad: Mono-brand websites will be big because they offer digital access to customers who can’t reach physical stores. Direct-to-consumer (D2C) is an individual way of offering products, and specialists will enter the market as D2C brands. It’s going to be a significant play.

Inc42: Reliance has also acquired stakes in brands like Ed-a-Mamma. How do these acquisitions align with your long-term strategy?

Akhilesh Prasad: We play in all segments of the market — mass, economy, mid-premium, and bridge-to-luxury. We acquire brands that add to our offerings in any of these segments. Ed-a-Mamma, for instance, is in the premium and bridge-to-luxury segment and thus serves our cause.

Inc42: How is Reliance leveraging AI and data analytics to enhance the customer experience in the fashion and lifestyle segment?

Akhilesh Prasad: We are moving towards full automation in fashion. We will use AI for predictive models in designing, speeding up production, and improving logistics. However, human intelligence will still play a crucial role at every stage.

Inc42: What are your plans for the fashion and lifestyle segment, particularly digital sales platforms, in the next year?

Akhilesh Prasad: Digitally, we cover all PIN codes in the country, so our reach extends to even the remotest of the villages. As for physical stores, no one in India offers a network as extensive as ours. We’ve covered towns, districts, state capitals, A-class cities, mini metro citiess, and metros. We aim to be present in every segment.

For example, we opened our first store in a small town, Guntur, when nobody else had. In 10 years, we now have six stores there. That’s how markets grow.

Inc42: How are new formats like Azorte and Yousta performing, and what are their prospects for future growth?

Akhilesh Prasad: All the formats we’re in will see growth. We have a population of 1.4 Bn people, and the demand within India alone makes us one of the largest markets in the world.

We’ve segmented the market and are catering to it through both online and offline channels. Our goal is to reach every customer, whether it’s a clerk’s son in a small town or someone in South Bombay. Every customer is important to us.

Inc42: Has the lifestyle and fashion segment seen a turnaround ahead of the festive season, especially the slowdown earlier this year?

Akhilesh Prasad: The festive season has been great. We’ve seen huge growth in Kolkata during Durga Puja. So, how can there be a decline in demand when the festive season is thriving?

It’s not that demand has decreased; it’s more about whether you’re catering to the customer’s changing needs. The market evolves. For example, if you only make luxury jeans, but the market shifts to cargo pants, you’ll think the market is shrinking. But it’s not, it’s just moved on to something else.

lockquote>

[Edited By Shishir Parasher]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)