Led by Gulf Islamic Investments, the round also saw participation from SoftBank’s Rajeev Misra, Paytm’s Vijay Shekhar Sharma, Rukam Capital and Pankaj Chaddah of Shyft

The company plans to use the fresh capital to fuel its domestic and international expansion, scale up investments in R&D and grow its product portfolio

Founded in 2020, Yoho manufactures affordable orthopaedic lightweight footwear using AI-powered solutions

Delhi-based D2C footwear brand Yoho has raised INR 27 Cr ($3.21 Mn) as part of its Pre-Series B round led by Gulf Islamic Investments (GII).

The round also saw participation from several high-profile investors, including Rajeev Misra, CEO of SoftBank Investment Advisers, and Paytm’s Vijay Shekhar Sharma, Rukam Capital and Pankaj Chaddah of Shyft.

The company plans to use the fresh capital to fuel its domestic and international expansion, scale up investments in research and development (R&D) and grow its product portfolio.

In a joint statement, the cofounders said in, “With this capital infusion, we are well-positioned to accelerate our product development, expand our market reach, and create an even more significant impact in the lives of consumers”.

“GII provides innovative growth funding solutions that address evolving consumer preferences. Yoho’s approach of combining biomechanical expertise with affordability targets a critical gap in the market that GII’s investment can address,” added GII’s cofounder and co-CEO Mohammed Al-Hassan.

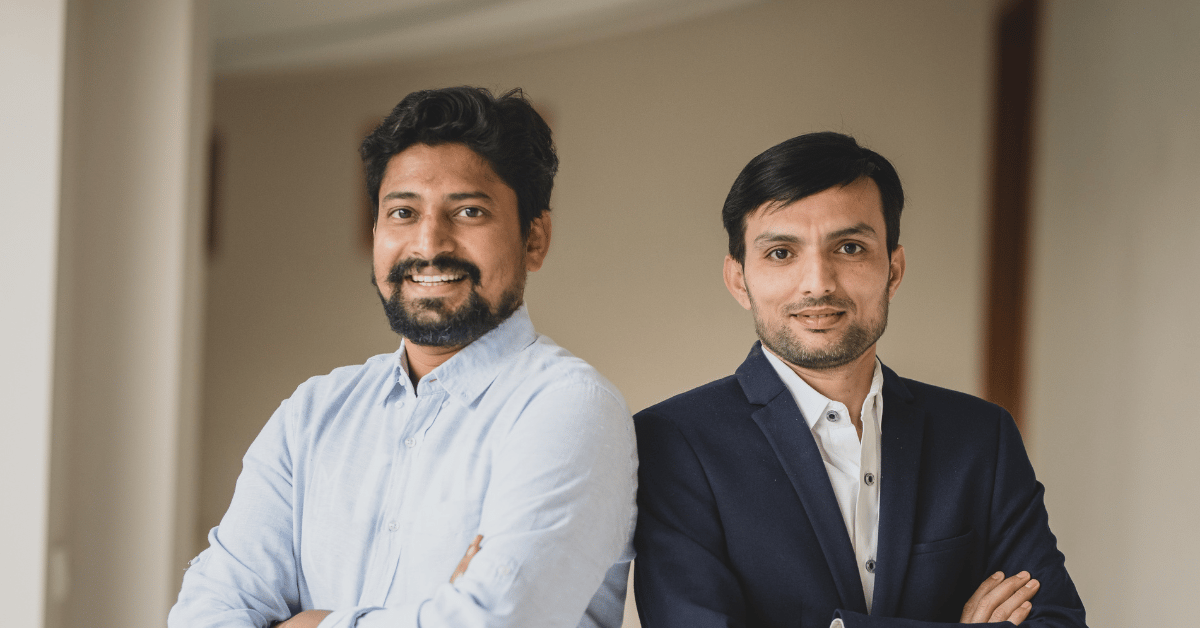

Founded in 2020 by Ahmad Hushsham and Prateek Singhal, Yoho manufactures affordable orthopaedic lightweight footwear using AI-powered solutions.

With this, Yoho has raised more than INR 47 Cr in funding to date. The company had previously secured INR 20 Cr in a Pre-Series A round in 2022, led by Rajeev Misra, Rukam Capital, and Vijay Shekhar Sharma.

Since its launch, Yoho claims to have sold over 1 Lakh pairs of footwear. The company sells its products on ecommerce platforms such as Amazon, Flipkart, Myntra, and Tata 1mg, as well as through their own website.

Going forward, the startup plans to boost its offline presence, partner with 2,000 multi-brand outlets (MBOs) in Tier-I and Tier-II cities and launch exclusive brand outlets (EBOs). It has also set its eyes on scaling up marketing initiatives and increasing its product catalogue from 100 to 300 styles by 2025.

In a statement, the company said that it will look to expand into international markets such as the Middle East, Africa and the US.

Yoho operates in the larger Indian D2C footwear space, which, as per reports, is projected to become a $14 Bn market by 2027.

The round also follows other notable investments in the Indian footwear sector. In July this year, Inc42 reported that D2C sneaker brand Comet secured INR 42 Cr from the likes of Elevation Capital and Nexus Venture Partners.

In October 2023, Mumbai-based omnichannel footwear brand Inc.5 Shoes raised $10 Mn in a Series A round led by Carpediem Capital. Earlier, in July last year, casual footwear startup Solethreads secured $3.7 Mn in Series A funding led by Fireside Ventures.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)