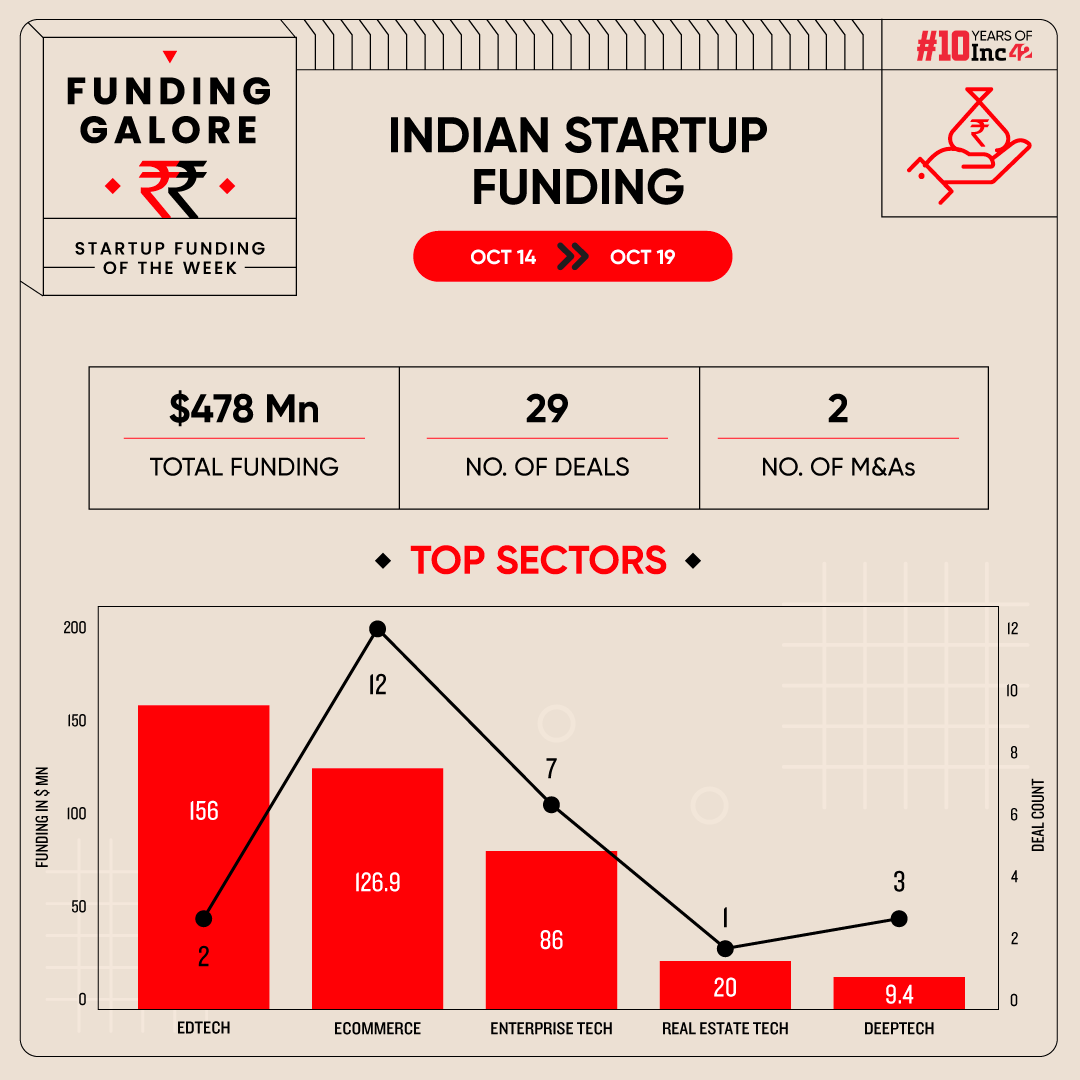

Startups raised $478 Mn across 29 deals, marking a 319%% increase from the $114 Mn raised across 22 deals in the preceding week

Buoyed by Eridutus’s mega funding round, edtech emerges as the most funded sector for the week at $126.9 Mn

Seed funding for the week stood at $26.5 Mn, which was an increase of 48.8% from previous week’s $17.8 Mn

After two consecutive weeks of tepid funding, investment activity in the startup ecosystem gained significant momentum this week.

In the week between October 14 and 19, Indian startups raised $478 Mn across 29 deals. This was an increase of 319% from $114 Mn raised across 22 deals in the preceding week.

Funding Galore: Indian Startup Funding This Week [Oct 7-12]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 18 Oct 2024 | Eruditus | Edtech | Online Certification | B2C | $150 Mn | Series F | TPG’s The Rise Fund, Softbank Vision Fund II, Leeds Illuminate, Accel, CPP Investments and Chan Zuckerberg Initiative | TPG’s The Rise Fund |

| 14 Oct 2024 | Purplle | Ecommerce | B2C Ecommerce | B2C | $60 Mn | Series F | ADIA, Premji Invest, Blume Ventures, Sharrp Ventures | ADIA |

| 16 Oct 2024 | Neuron7 | Enterprise Tech | Horizontal SaaS | B2B | $44 Mn | Series B | Smith Point Capital, Nexus Venture Partners, Battery Ventures | Smith Point Capital |

| 14 Oct 2024 | GIVA | Ecommerce | D2C | B2C | $30.3 Mn | Series B | Premji Invest, Epiq Capital, Edelweiss Discover Fund | – |

| 16 Oct 2024 | Everstage | Enterprise Tech | Horizontal SaaS | B2B | $30 Mn | Series B | Eight Roads Ventures, Elevation Capital, 3one4 Capital | Eight Roads Ventures |

| 16 Oct 2024 | Primus Senior Living | Real Estate Tech | Shared Spaces | B2C | $20 Mn | Seed round | General Catalyst, Nikhil Kamath and Gruhas | General Catalyst |

| 15 Oct 2024 | Troo Good | Ecommerce | D2C | B2C | $9 Mn | – | Puro Wellness, Oaks Asset Management, V Ocean Investments | Puro Wellness |

| 18 Oct 2024 | WROGN | Ecommerce | D2C | B2C | $8.9 Mn | Aditya Birla Digital Fashion Ventures | Aditya Birla Digital Fashion Ventures | |

| 15 Oct 2024 | Simplismart | Enterprise Tech | Horizontal SaaS | B2B | $7 Mn | series A | Accel, Shastra VC, Titan Capital | Accel |

| 18 Oct 2024 | Yu Foods | Ecommerce | D2C | B2C | $6.5 Mn | Series B | Ashish Kacholia and Asian Paints Promoter Group | Ashish Kacholia and Asian Paints Promoter Group |

| 17 Oct 2024 | Suraasa | Edtech | Online Certification | B2C | $6 Mn | Reach Capital, ETS Capital, NB Ventures, TSM ventures, TRTL Ventures, and other strategic investors. | Reach Capital | |

| 15 Oct 2024 | Evenflow | Ecommerce | Roll Ups | B2C | $5 Mn | Series A | Shail Patel and some existing investors | Shail Patel |

| 17 Oct 2024 | Budy | Enterprise Tech | Horizontal SaaS | B2B | $4.2 Mn | pre seed round | BeeNext, The Neon Fund, BITS SPARK Angels, Raju Reddy, Abhinav Asthana (CEO and cofounder of Postman), John Hayes (cofounder of Pure Storage), Bruno Kurtic (cofounder of Sumo Logic) and former executives of GreyOrange. | RTP Globa |

| 17 Oct 2024 | AGNIT Semiconductors | Deeptech | IoT & Hardware | B2B | $3.5 Mn | seed round | 3one4 Capital, Zephyr Peacock, Lakshmi Narayanan (former chief executive at Cognizant) | 3one4 Capital and Zephyr Peacock (co led) |

| 14 Oct 2024 | The Good Bug | Ecommerce | D2C | B2C | $3.5 Mn | Series A | Sharrp Ventures, Fireside Ventures, Keshav Biyani | Sharrp Ventures |

| 15 Oct 2024 | Yoho | Ecommerce | D2C | B2C | $3.2 Mn | pre-Series B | Gulf Islamic Investments, Rajeev Misra, Vijay Shekhar Sharma, Rukam Capital, Pankaj Chaddah | Gulf Islamic Investments |

| 14 Oct 2024 | Perceptyne | Deeptech | IoT & Hardware | B2B | $3 Mn | Seed | Endiya Partners, Yali Capital, Whiteboard Capital | Endiya Partners, Yali Capital |

| 16 Oct 2024 | Optimized Electrotech | Deeptech | Defencetech | B2B | $2.9 Mn | grant | Government of India | |

| 17 Oct 2024 | Febi | Fintech | Fintech SaaS | B2B | $2 Mn | Pre Series A | Lumis Partners, Virender Rana, Amit Chaudhary, Padmaja Ruparel, Rohan Bhargava, Rajat Jain | |

| 14 Oct 2024 | Elixia | Logistics | Logistics SaaS | B2B | $1 Mn | Pre-Series A | JITO Incubation and Innovation Foundation (JIIF), Motilal Oswal , Vimal Shah, Sparsh Jain, Vinod Dugar, Vimal Khinvasara, Ashok Shah and Amit Chandwar | JITO Incubation and Innovation Foundation (JIIF) |

| 16 Oct 2024 | Tablesprint | Enterprise Tech | Horizontal SaaS | B2B | $1 Mn | group of prominent angel investors and syndicates including Ankit Bhati (Co-Founder, Ola), Ajeet Khurana (Founder, Reflexical), Sunil Sharma (CEO, Coingape), BlueLotus Ventures, TDV Partners, DGC Ventures, and Abhijeet Bhandari (Advisor-startups) | ||

| 17 Oct 2024 | Lifechart | Ecommerce | D2C | B2C | $500K | Prajay Advisors LLP, Agility Ventures, Expert Dojo, and angel investors like Ahana Gautam, Nitish Mittersain (Nazara Technologies founder), Sarath Sura (Sunn91 Ventures’s founder) and Marwari Angels | Prajay Advisors LLP | |

| 16 Oct 2024 | Alchemyst AI | Enterprise Tech | Horizontal SaaS | B2B | $300K | Pre-Seed | Inflection Point Ventures, 100Unicorns, Early Seed Ventures | Inflection Point Ventures |

| 15 Oct 2024 | SportsSkill | Enterprise Tech | Entetprise Services | B2B | – | – | KP Balaraj | KP Balaraj |

| 16 Oct 2024 | ANNY | Ecommerce | D2C | B2C | FAAD Capital, HNIs and industry leaders | FAAD Capital | ||

| 14 Oct 2024 | Brown Living | Ecommerce | D2C | B2C | Pre Seed | Blink Digital, Sanjay Nayar, Sorin Investments’ founder and investor Bharat | Blink Digital | |

| 15 Oct 2024 | PetStrong | Ecommerce | D2C | B2C | Auxano Capital | Auxano Capital | ||

| 15 Oct 2024 | class=”in-cell-link” href=”http://Traqo.io” target=”_blank” rel=”noopener”>Traqo.io | Logistics | Logistics SaaS | B2B | Pre-Seed | We Founder Circle | We Founder Circle | |

| 15 Oct 2024 | Healspan | Healthtech | Healthcare SaaS | B2B | Seed | Lead Angels, Ankitt Jain (Paper Arizona’s founder), Srijith Nair (Gowelnext Solutions’s founder) and The Doctorpreneur Academy | Lead Angels | |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Edtech unicorn Eruditus secured $150 Mn in its Series F funding round led by TPG’s global impact investing platform The Rise Fund.

- Buoyed by Eruditus’ mega funding round, edtech emerged as the most funded sector for the week at $156 Mn.

- Ecommerce witnessed the most number of deals materialise this week at 12.

- Seed funding for the week stood at $26.5 Mn, which was an increase of 48.8% from previous week’s $17.8 Mn.

Startup Fund Launches Of This Week

- Nikhil and Nithin Kamath-led fintech unicorn Zerodha launched a new fund, FLOSS/fund, aimed at supporting Free/libre and Open Source Software (FOSS) projects globally. The fund will provide annual funding of $1 Mn.

- In another development, alternate investment firm Anicut Capital raised $11 Mn (about INR 92 Cr) through a feeder fund based out of GIFT City for its Private Credit Fund III.

- Besides this, airline major Indigo received approval from the market regulator Securities and Exchange Board of India (SEBI) to float its venture capital (VC) arm IndiGo Ventures. The AIF will focus on backing startups across Pre-Series A, Series A, and Series B rounds, primarily in the aviation and allied industries such as travel, lifestyle, hospitality and transport.

- Masters’ Union founder’s global business school Tetr College of Business floated a $10 Mn fund to back student entrepreneurs

Updates On Indian Startup IPOs

Omnichannel jewellery startup BlueStone is preparing to go public by the second quarter of next year. The Prosus-backed startup is expected to raise $200 Mn to $250 Mn (about INR 1,681 Cr to INR 2,100 Cr) through its IPO at an estimated valuation of $1 Bn to $1.5 Bn.

Mergers and Acquisitions This Week

- D2C foodtech unicorn Licious acquired Bengaluru-based offline retailer My Chicken and More in a cash and equity deal, expanding its offline footprint by adding 23 stores to its network.

- MSME-focused fintech startup Lendingkart said that Temasek’s subsidiary Fullerton Financial Holdings (FFH) will acquire a controlling stake in the startup with an additional investment of INR 252 Cr.

Other Developments Of The Week

- Tiger Global-backed Mensa Brands, which operates consumer brands such as Pebble, MyFitness, Dennis Lingo, among others, is shifting its domicile from Singapore to Mumbai.

- Customer engagement and retention startup Clevertap is also in discussions with advisers to relocate its headquarters from San Francisco to India.

- Two major exits were reported this week. Early stage VC firm 8i Ventures made a full exit from fintech startup M2P Fintech with 12X returns in 4.5 years. Besides, Zodius Capital marked its full exit from B2B marketplace OfBusiness via a secondary share sale of around $100-120 Mn, against its initial $8 Mn investment.

- Singapore’s state investor Temasek is eyeing acquiring a 20-25% stake in Rebel Foods via a mix of primary equity infusion and secondary share sale for around $180 Mn to $200 Mn.

- Zomato’s board will meet on October 22 to consider raising funds via qualified institutional placement (QIP). As per reports, the board will consider raising INR 8,500 Cr (about $1 Bn).

- Zepto is in advanced discussions to raise $100 Mn from asset management company Motilal Oswal, as well as high-net-worth individuals (HNIs) and family offices.

- Bengaluru-based Jetapult made its maiden investment in the MENA (Middle East and North Africa) region by acquiring a stake in Saudi Arabia-based game developer UMX Studio for $4.5 Mn.

- Edtech unicorn upGrad’s cofounder and managing director Mayank Kumar stepped down from his executive role to launch a new venture.

- Listed gaming major Nazara received the approval from its shareholders to acquire a 47.7% stake in Pokerbaazi’s parent company Moonshine Technology for INR 831 Cr.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)