Food delivery in India is a two-bike race, but Rebel Foods

Reports suggest that global investment giant Temasek Holdings is looking to acquire a significant stake in Rebel Foods as the homegrown cloud kitchen unicorn prepares to go public.

The Singapore-based investor is likely to become the largest shareholder in Rebel Foods after the transaction, which adds a spicy new dimension to the food delivery rivalry, and with an IPO on the cards, Rebel Foods will soon go directly up against Zomato and IPO-bound Swiggy.

Interestingly, even as it is looking to raise funds, the company might see a drop in its valuation. Nevertheless, this infusion is critical for Rebel Foods as it looks to expand its digital food court model and its brand network. Will Rebel Foods’ differentiated play in food delivery pay off?

We’ll try to answer this, but let’s first take a look at the key stories from our newsroom this week:

- Private Equity’s New Avatar: VC and private equity firms have always been fundamentally different but PE funds are showing VC-like risk appetite in some recent deals. What does this mean for the growth and late stage ecosystems?

- Fast Fashion’s Festive Season: With the return of Shein and homegrown marketplaces such as NewMe, fast fashion seems to be the flavour of the festive season sales. Plus, a look at the premiumisation wave in fashion ecommerce!

- Swiggy’s Revenue Stack: The IPO-bound food delivery and quick commerce giant is not just looking at adding to the order value, but unlocking new use cases in its core products. Will this revenue push pay off?

The Rebel Foods Moat

Rebel Foods began in 2011 as a delivery-only company, with Faasos as a singular brand. Over the past 13 years, it has added Behrouz Biryani, Mandarin Oak, Oven Story Pizza, Sweet Truth, LunchBox, The Good Bowl, Firangi Bake, The Biryani Life and US-based fast food giant Wendy’s to its stable of brands.

Given that it was an early mover in the cloud kitchen space, Rebel Foods has the widest network of kitchens among all players in India. The cloud kitchen major operates more than 450 kitchens across 75 cities, and is also present in the Middle East, North Africa, Indonesia, and the UK.

The biggest differentiator for Rebel Foods compared to other cloud kitchens and aggregators such as Zomato and Swiggy is that it is looking to own the full stack and offer a multi-brand experience to consumers. This was the idea behind the launch of the smart food court in Pune in 2023, where consumers could pre-order food for takeaways or order from multiple outlets for home deliveries.

The thesis is that consumers — especially large groups — do not want to place orders from one outlet, but want to see a variety of options, just like in a real food court.

Ahead of the IPO, the Mumbai-based unicorn is looking to invest INR 200 Cr in the next two to three years to expand the food court format under the EatSure brand. It claims to be working on more cloud kitchens and branded outlets for a dine-in experience as well.

Sagar Kocchar, the company’s cofounder and CEO, said that the offline opportunity is relevant for brands under the EatSure and Rebel Foods umbrella. In the pipeline are plans to open 100 EatSure food courts within the next two to three years, and expand Rebel Foods and EatSure’s delivery footprint to 150-200 cities by 2028.

“We are now making the brands accessible to Tier II and Tier III cities as well, while we further penetrate in Tier I cities. The plan is to add a couple of dozen restaurants by December 2024,” Kochhar was quoted as saying in recent reports.

lockquote>

Another differentiator for Rebel is the fact that it has launched on the ONDC network, which is fast emerging as a challenger to Zomato and Swiggy, the two largest aggregators. Rebel Foods and EatSure brands aim to create multiple consumer touchpoints through the ONDC integration, which means its brands will be available on apps such as Paytm, Magicpin, Ola Consumer, among others, in the ONDC buyer app space.

Building A Cloud Kitchen For Others

But the digital food court is just one model that Rebel Foods is going after. It’s also aggregating popular chains and brands through a SaaS product, Rebel Launcher.

Through this, Rebel Food leverages its expertise in this field by offering supply chain support and full-stack technology solutions to established brands such as Naturals, Mad Over Donuts, Nirula’s, Chai Point, Big Wong and others.

Envisioned as an OS for food brands and cloud kitchens, Rebel Launcher brings features such as inventory and kitchen management, demand management, fulfilment services, procurement, as well as culinary expertise and capabilities, allowing brands to scale up on food delivery platforms instantly. More importantly, this is a funnel for the company to add more brands to the EatSure app and therefore adopt a hybrid aggregation and owned brand model.

While Zomato and Swiggy also offer SaaS products for restaurants to manage orders, procurement, and even for hiring staff, Rebel is banking on its experience and knowledge as an operator of cloud kitchens and not just a delivery app. Through Rebel Launcher, brands get cloud kitchen space under the EatSure banner and do not have to invest in infrastructure to launch delivery-only kitchens.

This is a crucial distinction for Rebel because it allows the company to occupy a niche of its own in the Indian market. While it competes with Curefoods, Eat Club, Box8, Wow! Momo Foods, FreshMenu, Call Chotu among other cloud kitchens, the competition lacks the breadth of revenue streams that Rebel Foods has built over the years.

Zomato and Swiggy looked to enter the cloud kitchen game, but eventually both majors decided to pull out of this vertical and focus on aggregation and delivery as their core businesses. The advent of quick commerce has given both these giants a new lease of life.

Rebel Foods’ Overseas Push

With another fund infusion on the cards, Rebel Foods will be looking for its quick commerce moment too. Plus, it has to break free from the loss malaise and hit breakeven and possibly even turn profitable. The company managed to narrow its net loss by 42% to INR 378.2 Cr in FY24, while revenue neared the INR 1,500 Cr mark.

While this pales in comparison with Zomato and Swiggy’s revenue figures, it is the industry benchmark among cloud kitchens. For instance, Wow! Momo is looking at INR 650 Cr in topline in FY25, while as per its last available financials, Ankit Nagori-led Curefoods had reached INR 450 Cr in revenue as of March 2023.

Of course, Rebel Foods has also raised the most amount among cloud kitchen companies, with over $510 Mn in investment from the likes of Coatue Management, Lightbox and Peak XV Partners. These and potentially other investors are reportedly selling shares ahead of the IPO.

CEO Kocchar said the company will likely look to list in 18-24 months and is currently identifying bankers for the IPO.

And by then, Rebel Foods will be hoping it will also have cracked profitability. One thing that is key for Rebel Foods to get out of the red is its international business, where take rates and average order values are said to be higher.

In fact, it has launched brands specifically for international markets and is looking to become a fast food chain in these regions, particularly the UAE. It launched Fricken, a fried chicken fast food chain in the UAE and is looking to take Behrouz Biryani to the UK market in the coming few months.

These steps will contribute significantly in padding up the bottom line for Rebel Foods in the coming few quarters.

But there is a big brand challenge that Rebel Foods has to hurdle. Despite being around just as long as Zomato and being even older than Swiggy, Rebel Foods is not really a brand that consumers think of when pulling up food delivery apps.

One might choose a Rebel Foods brand on Zomato or Swiggy, but EatSure’s reach and brand awareness pales in comparison. Plus, competing with QSR giants such as Jubilant Foodworks (the master franchisee of Domino’s in India), KFC and Pizza Hut owner Devyani International as well as Westlife Foodworks (McDonald’s) will be a huge uphill battle. These companies are between 2X to 5X in revenue scale in comparison to Rebel Foods.

So for Rebel Foods and EatSure, battling these giants will arguably be the biggest test, and even more crucial than outperforming Zomato and Swiggy.

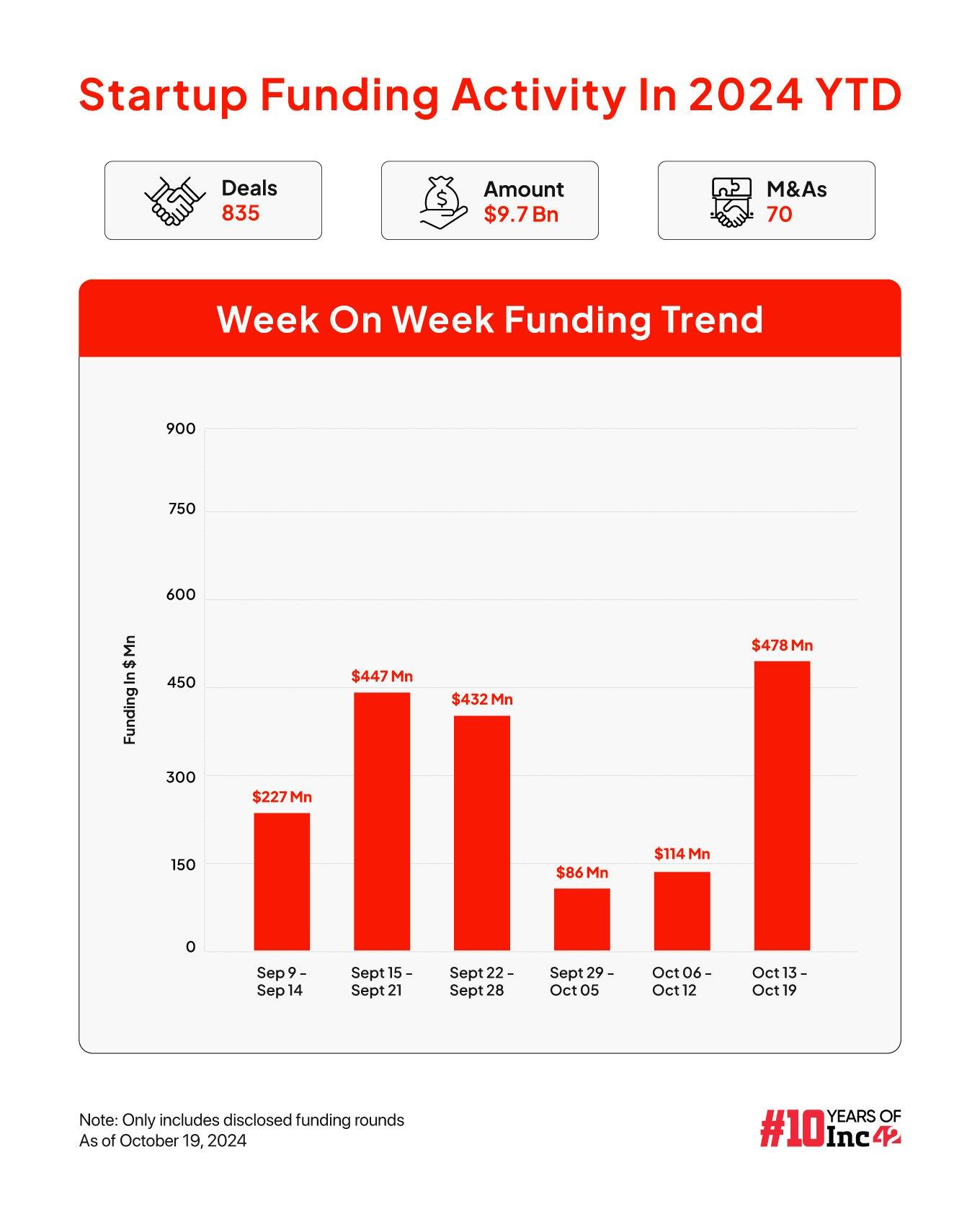

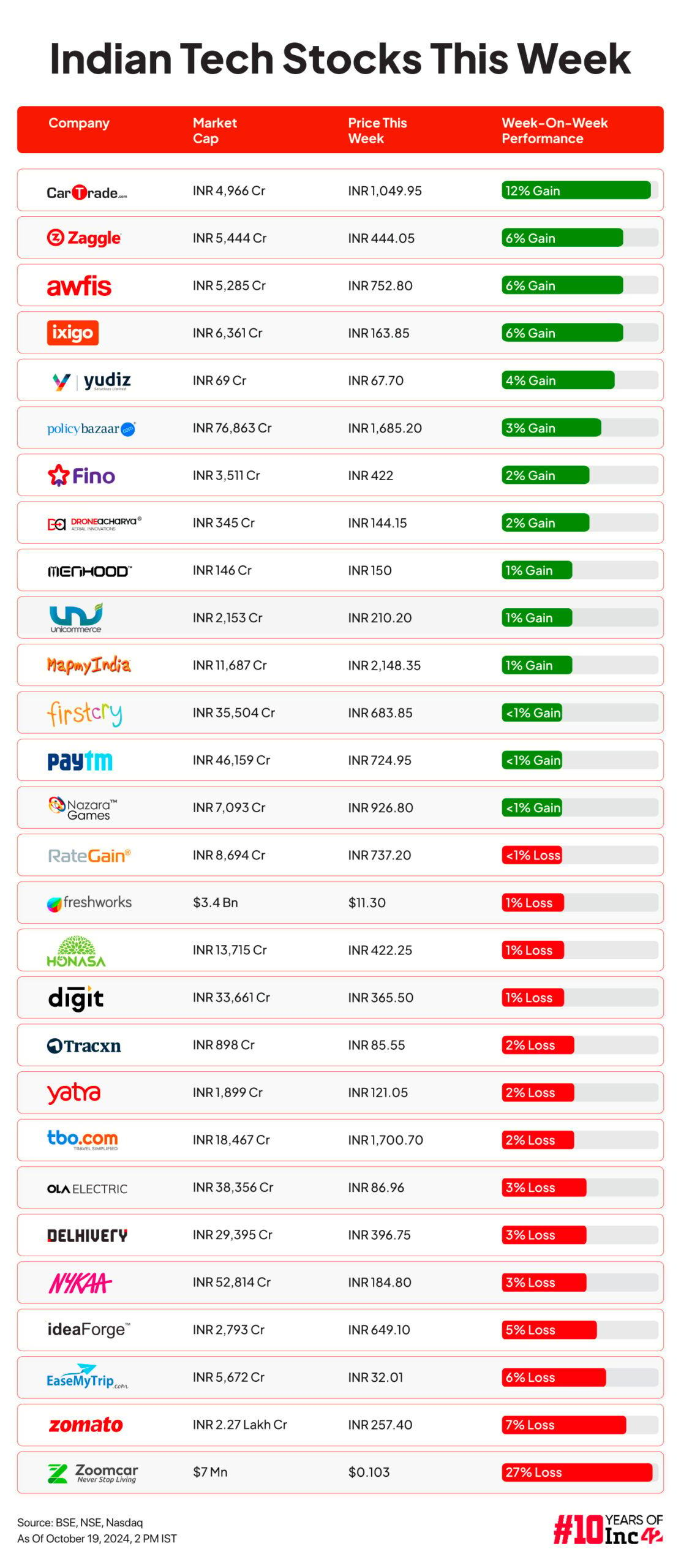

Sunday Roundup: Tech Stocks, Startup Funding & More

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)