I’ve written before about Copilot’s crucial role in my life, making it extraordinarily easy (and even enjoyable!) to track my finances. Over the last several months, Copilot has gotten even better with new “Tags” and “Cash Flow” features.

Copilot is also expanding to yet another platform: the iPad. Here’s everything you need to know about what’s new with Copilot and how I’m using the new features every day.

Before we begin, a quick reminder that 9to5Mac readers can use code 9TO5MAC to unlock an extended two-month free trial of Copilot.

iPad app

First, Copilot is now on the iPad. I’ve been using Copilot for years and an iPad app has always been towards the top of my wishlist. It can be challenging to create a budget and stick to it, but the consistent experience across iPhone and Mac has always stood out. I’m thrilled to see this expand to the iPad for the first time.

Copilot hasn’t just ported the iPhone app to the iPad but rather meticulously optimized the experience to ensure it feels right at home on the iPad. Copilot for iPad features a sidebar that can easily be hidden with a single tap. You can quickly navigate between the different tabs of the app, such as Transactions, Cash Flow, Accounts, and more.

The “Dashboard” tab is what really shines on the iPad’s screen. At a single glance, you can see your monthly spending, assets and debt, transactions, top categories, and net income so far this month. The Dashboard interface has always been one of my favorite things about Copilot, and the experience on the iPad is next-level useful.

The Copilot layout on iPad is fully responsive, so it automatically adapts to different screen sizes and orientations. The on-screen keyboard in Copilot on iPad has also been optimized to make data entry and navigation as easy as possible. This optimization, in particular, shows the extent to which Copilot went to perfect the iPad experience.

Copilot for iPad also supports multitasking with Split View and Slide Over. I’ve found this to be key, as I often find myself working on my budget in Copilot while paying bills and simultaneously pulling up receipts and other transaction details.

There’s also a lifestyle upgrade to Copilot being on the iPad. I find the Copilot app for iPad to be the best way to sit down with my wife and review our budget each Sunday. It’s not as intimidating as using a Mac, but it also has a more expansive and capable display than an iPhone. It’s the sweet spot for reviewing spending and transactions.

There are few apps that offer as great of an experience across all three of Apple’s primary platforms as Copilot.

I love the Tags feature, which adds a new way to organize your transactions and spending.

Tagging is meant to give you as much flexibility as possible when it comes to tracking and monitoring your transactions. As such, you can create as many tags as you need in Copilot, plus assign different colors to each tag so you can easily find what you’re looking for.

One of the biggest ways I’m using tags is to create a better picture of my income sources. My income comes from multiple different sources every month, and assigning specific tags to each transaction gives me a much clearer view of things every month. I’ve created specific tags for things like “Adsense,” “Amazon Affiliate,” “Podcast Sponsorships,” and more.

Another use case of tags is getting a clearer picture of my total subscription spend in specific categories each month. I’ve created specific tags for things like “streaming services,” “apps,” “memberships,” and more.

Visit multiple grocery stores each month? Create a tag for each of those stores to clearly show where you spend the most each month: Trader Joe’s, Costco, Harris Teeter, and so on.

I’ve also already thought about ways I’ll use Tags in the future. This holiday season, for example, I plan on using Tags to monitor holiday spending and gift-giving. I also can’t help but wish I had tags in Copilot when my wife and I were planning our wedding a few years ago. The opportunities really do feel endless, and I’m sure I’ll come up with even more use cases going forward.

Cash Flow

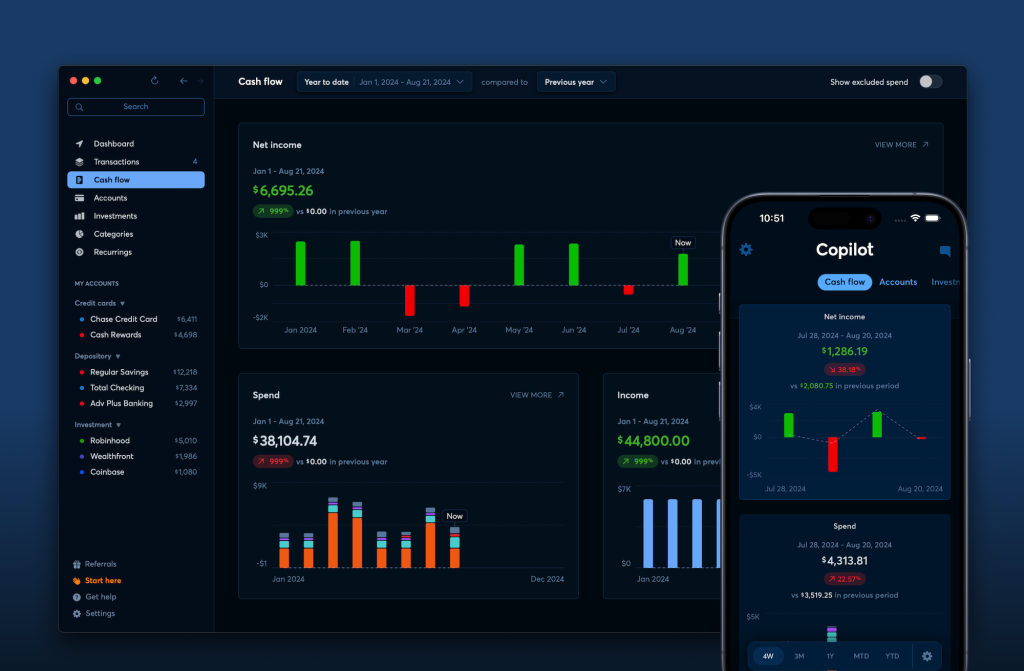

One of the most important aspects of living a healthy financial life is having a clear picture of your income and spending habits. The new Cash Flow feature in Copilot does precisely that.

It shows you a clear and concise breakdown of your income and spending over the last year, plus a dedicated net income graph. The graphs show you a quick comparison of how your numbers so far this year compare to the same time period last year. You can also dive into each graph to view more historical data, giving a clear breakdown of how your income and spending have changed.

I feel like I’m the target audience for the Cash Flow feature in Copilot. My income varies quite a bit over the course of a year, which makes it hard to have a clear picture of things at any given moment. Cash Flow gives me the clarity I need on a month-to-month basis and a year-over-year basis.

Even if your income is relatively stable over the years, chances are you still need to monitor the ebbs and flows in your expenses. Copilot’s Cash Flow makes that simple, whether it’s on a weekly, monthly, or yearly basis.

Wrap up

Copilot really has helped me take control of my financial health. I tried and failed to establish a budget routine for years, and failed miserably each and every time. With Copilot, however, I’ve created a system that works for me and my family, and these new features even further improve the experience.

9to5Mac readers can use code 9TO5MAC and unlock an extended two-month free trial of Copilot. The app is available on iPhone, iPad, and Mac, and a universal subscription unlocks all three platforms.

You can read more about my experience with Copilot over the years at the links below.

More on Copilot:

Written by Chance Miller

FTC: We use income earning auto affiliate links. More.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)