Recently, global semiconductor giant Infineon Technologies pioneered the development of the world’s first 300 mm power gallium nitride (GaN) wafer technology. While GaN semiconductors have been in use since the 1990s, primarily in light-emitting diodes (LEDs), this advancement in larger wafer technology is a major step forward to bring both increased capability and cost efficiency to the industry.

The growing importance of GaN-based semiconductors is evident across sectors like automotive, computing, and wireless communications, including 5G and radar systems. From powering AI system infrastructure and solar inverters to enabling EV chargers, adapters, and motor-control systems, GaN semiconductors are at the forefront of technological innovation that requires high-speed performance.

Although India’s semiconductor manufacturing capabilities lag behind its global peers, the government’s ambition to position the country as a global semiconductor hub has made GaN technology a top priority for domestic R&D.

During his 2022 visit to the Gallium Nitride Ecosystem Enabling Centre and Incubator (GEECI) at the Indian Institute of Science (IISc) in Bengaluru, the then minister of state for skill development and entrepreneurship, Rajeev Chandrasekhar, highlighted that GaN could play a pivotal role in India’s quest to lead innovation in the automotive and mobility sectors.

For decades, IISc, Bengaluru has been a centre of semiconductor innovation, fostering numerous startups. One of these, AGNIT Semiconductors, stands out as India’s first startup focussed on developing GaN-based wafers.

Built from the ground up with proprietary technology and supported by 15+ years of research by top IISc professors and students, AGNIT will be the first to utilise The Gallium Nitride Ecosystem Enabling Centre and Incubator’s (GEECI) infrastructure for GaN wafer and radio frequency (RF) device production.

lockquote>

If AGNIT scales, it is set to capture a growing market for gallium nitride semiconductor devices expected to cross $2 Bn by 2030. A research report from Deloitte further suggests that consumer electronics chargers are expected to compose 66% of the GaN chip market by 2026.

AGNIT’s Deeptech Story

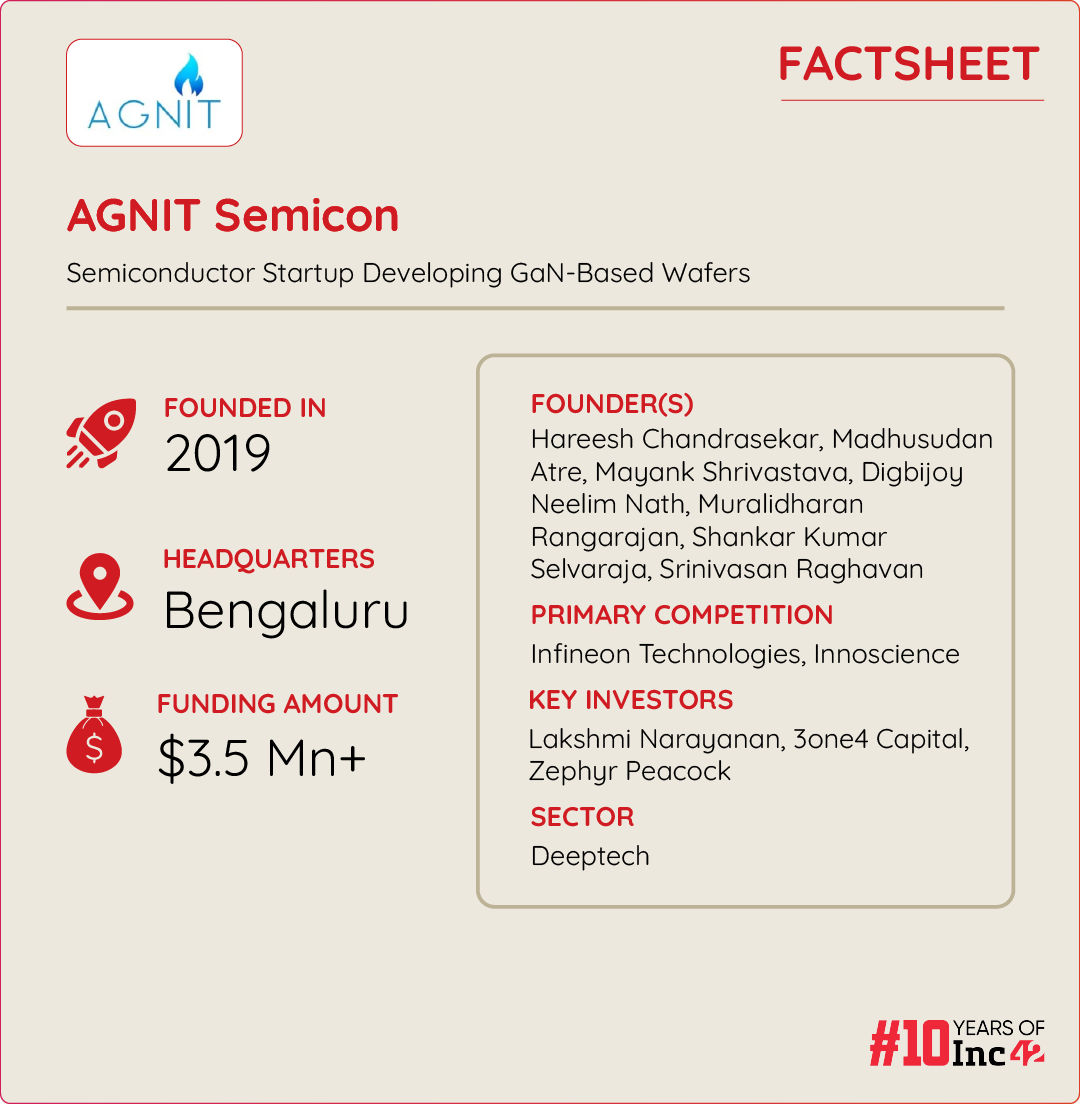

AGNIT was founded in 2019 by seven industry experts – Hareesh Chandrasekar, Madhusudan Atre, Mayank Shrivastava, Digbijoy Nath, Muralidharan Rangarajan, Shankar Kumar Selvaraja, and Srinivasan Raghavan – who bring more than 100 years of cumulative experience in GaN technology.

Their expertise spans the entire GaN semiconductor ecosystem, from material growth and device fabrication to integrating these devices into systems.

For context, GaN material is deposited or grown on top of another silicon or silicon carbide in a process called epitaxy to develop the wafers. However, the path to building AGNIT had multiple prerequisites, primarily solving the requirement for a fabrication plant.

Speaking with Inc42, cofounder and MD of AGNIT, Raghavan, said, “Around 2015, when there was a wave to build a fab in India, we thought silicon was definitely something the country needed but it was a lot more difficult because the size of the fab necessary to put out silicon chips is much bigger… While technology-wise gallium nitride is not any easier, the size of the fab required to start gallium nitride production in India would be much simpler.”

lockquote>

It was then that IISc’s team, working on GaN technology, approached the government to set up a GaN foundry instead of a silicon foundry, realising it was a time-consuming process.

By then (around 2021), IISc’s professor Raghavan and other cofounders incorporated AGNIT and had raised the first tranche of funding from Lakshmi Narayanan, the former CEO of Cognizant Technologies, to keep their boat afloat. Also, the Indian government’s financial support to IISc for building GEECI came in after two years of AGNIT’s establishment, helping the semiconductor advance its efforts in developing GaN wafers.

Currently, AGNIT is focussed on building GaN wafers on silicon carbide, primarily catering to RF applications and not the power electronics market. Its immediate potential market entails applications in the strategic sector such as defence radar, electronic warfare, and others.

Broadly, the startup will cater to the semiconductor and electronics manufacturing ecosystem in two ways. While, on the one hand, it will develop and sell the wafers to the semiconductor fab companies, on the other hand, it will also sell GaN devices or the discrete RF power transistors built on the wafers.

As AGNIT is buckling up for the reliability check of its devices and plans to make about 1 Lakh devices in the next 12-24 months, it recently raised $3.5 Mn in a funding round co-led by 3one4 Capital and Zephyr Peacock, with the participation from Cognizant’s Narayanan.

lockquote>

AGNIT’s Tech Focus & Challenges

Semiconductor manufacturing is capital-intensive, and GEECI’s support enables AGNIT to avoid building its own foundry. However, given that GEECI has capability limitations, it wouldn’t allow AGNIT to build wafers beyond 8 inches. Therefore, building 300 mm or 12-inch wafers, which are well-suited for the power electronics market, needs to be figured out.

Currently, per cofounder Digbijoy Nath, AGNIT is leveraging its technological know-how and GEECI’s existing capabilities to build 4-inch wafers on silicon carbide, which is also more expensive than building larger GaN wafers on silicon that Infineon has manufactured.

“Silicon carbide is a superior platform on which you can grow gallium nitride material of superior quality, but at a high price. However, it is primarily for RF applications and the market is ready to pay this price. While gallium nitride on silicon is relatively low cost and has a much larger market opportunity, AGNIT is focussed on the former also because of its strategic importance,” Nath added.

lockquote>

Meanwhile, AGNIT aims to foray into the power electronics market gradually after establishing itself in its primary focus market.

On the other hand, the founders said that making the wafers and RF devices at a global standard while keeping the startup’s focus intact is another challenge for them.

In fact, AGNIT is looking to cater to the global market for both of its products where it faces competition from not only Infineon, Mitsubishi Electric and Texas Instruments but also integrated device manufacturers like Innoscience and Stanford Advanced Materials.

However, Nath claimed that most other startups working on GaN in India are fabless design companies that are designing subsystems or circuits using global foundries or buying GaN modules from abroad to make two-wheeler EV chargers or other such power electronics in the country.

The Road Ahead For AGNIT

In the next 12 months, AGNIT has its eyes on three main areas – completing the reliability qualification, starting the production of components for the strategic market, and entering the power electronics market.

Before AGNIT can start making GaN RF devices in abundance, the company will have to undergo reliability qualification, which is testing these devices under high temperatures, high electrical stress, and other such conditions.

lockquote>

“We need to show that there is minimal degradation, or degradation within an acceptable limit as per the industry standards, before starting commercial production. While there are different categories of reliability tests, including qualifying for automotive or space, etc., we will start with basic,” Nath said.

With this, AGNIT also expects to start clocking revenue in the next 12-24 months. Besides, Raghavan emphasised on the startup’s hunger to add value to the broader domestic semiconductor ecosystem with its manufacturing capabilities.

“We are also looking to enable Indian semiconductor designers and fabless startups, which are currently dependent on companies outside of the country, by giving them the option to work through AGNIT and indigenously manufacturer devices,” Raghavan said.

As the world moves towards high-computer devices and more efficient and smaller consumer electronics devices, it would be interesting to track AGNIT’s journey from here on, especially when GaN as a technology is in its infancy.

[Edited By Shishir Parasher]

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)