Gramophone founder and CEO Tauseef Khan attributed the sharp decline in revenue to the startup shutting its output vertical

In line with the sharp decline in revenue, Gramophone’s net loss fell 39.9% to INR 34.8 Cr in FY24

It’s EBITDA loss also decreased to INR 32.2 Cr from INR 55 Cr in FY23

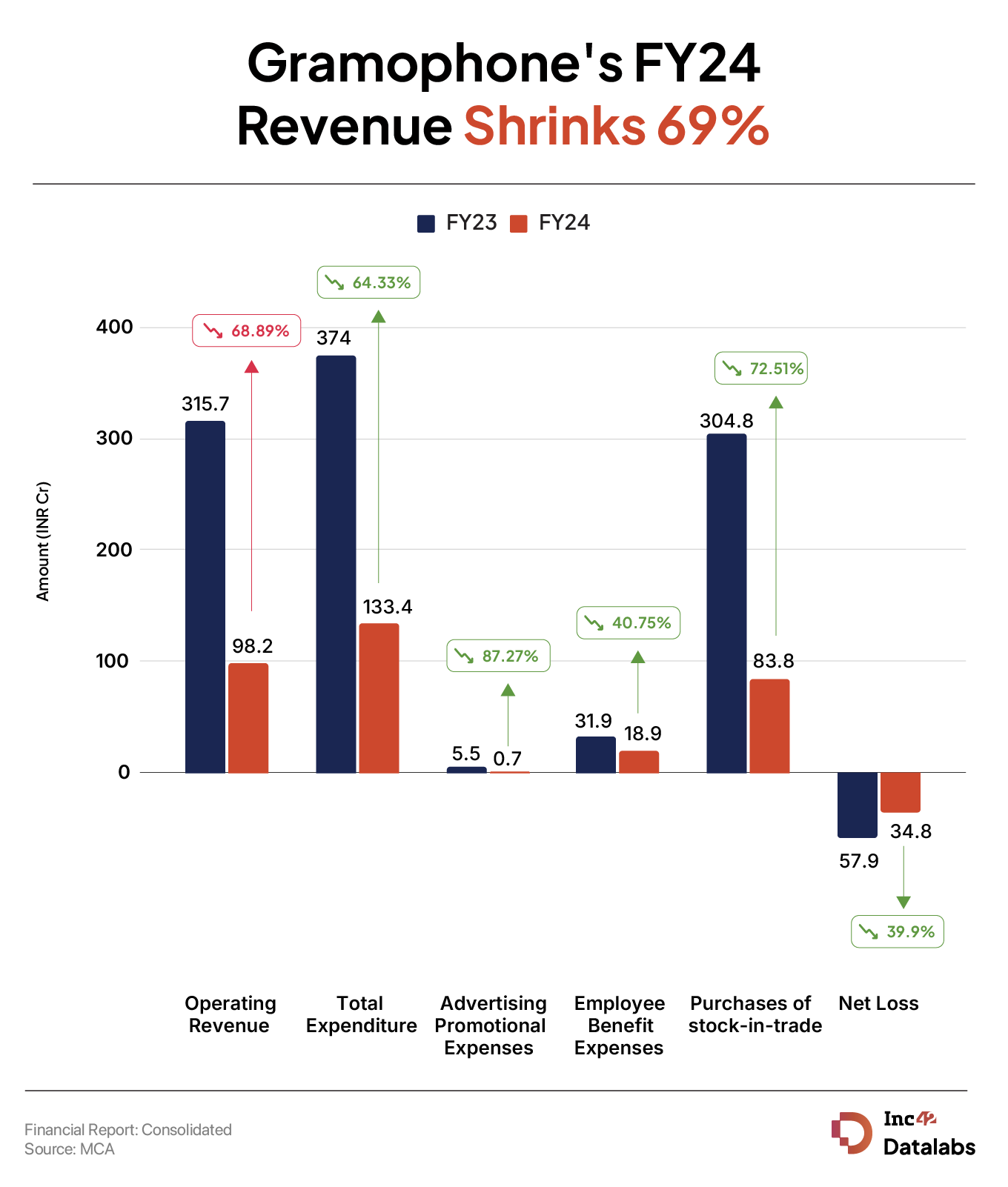

Info Edge-backed agritech startup Gramophone’s revenue declined 68.9% to INR 98.2 Cr in the financial year 2023-24 (FY24) from INR 315.7 Cr in FY23, as it discontinued one of its verticals.

Founded in 2016, Gramophone

The startup also had a marketplace business called ‘Gram Vyapaar’ via which farmers could sell their yields. However, it shuttered this vertical in FY24.

“The reason behind the sharp decline in revenue was because the company closed down its output (marketplace) business in FY24,” Tauseef Khan, founder and CEO of Gramophone, told Inc42.

“While the output business brought in 70% of the total revenue of FY23, the margins were very thin. It was a low margin and high capital business and hence, we shuttered it,” Khan said.

When asked if the startup also undertook a restructuring exercise, as its employee benefit expenses for the financial year were down 40.75%, the CEO said that it had to let go of employees from the output vertical.

Gramophone also went omnichannel during the year and launched over 60 brands for farm inputs, the CEO said.

Khan said that the startup’s own brands accounted for 20% of its revenue in FY24 as against 2% in FY23. He expects this number to increase to 35%-40% in FY25.

“In the next fiscal year, we’re expecting our cash burn to be under $1 Mn,” he added.

In line with the sharp decline in revenue, Gramophone’s net loss fell 39.9% to INR 34.8 Cr in FY24 from INR 57.9 Cr in the previous fiscal year. EBITDA loss also decreased to INR 32.2 Cr from INR 55 Cr in FY23.

However, EBITDA margin slipped to -32% from -17% in the previous year.

Notably, Info Edge is the startup’s largest backer, with about 40% ownership. Most recently, the VC firm decided to invest INR 15 Cr (about $1.8 Mn) in the startup in two tranches.

Overall, Gramophone has raised about $20.5 Mn in funding to date from investors like Z3 Partners, Asha Impact, Siana Capital, among others. It competes against DeHaat, AgroStar, Ninjacart, Bijak and Crofarm.

Zooming Into The Expenses

As Gramophone shut its output vertical, its total expenditure declined 64.33% to INR 133.4 Cr from INR 374 Cr in FY23.

Advertising & Promotional Expenses: Gramophone reduced its advertising expenses to a mere INR 70 Lakh during the year under review from INR 5.5 Cr in FY23.

Employee Benefit Expenses: On the back of the restructuring exercise, the startup managed to cut its employee costs by 40.75% to INR 18.9 Cr from INR 31.9 Cr in FY23.

Purchases Of Stock-In-Trade: Expense under this head decreased by 72.5% to INR 83.8 Cr from INR 304.8 Cr in FY23.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)