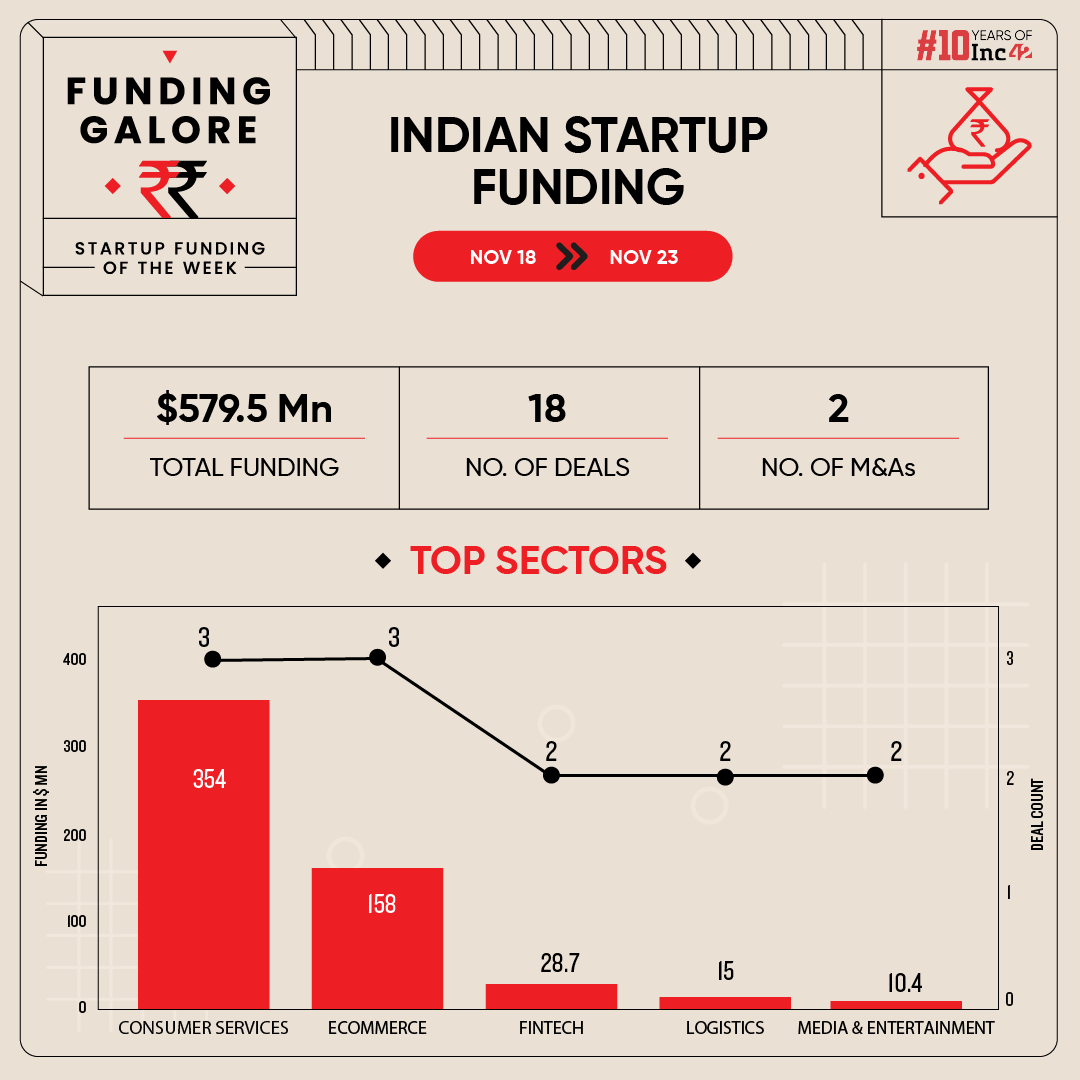

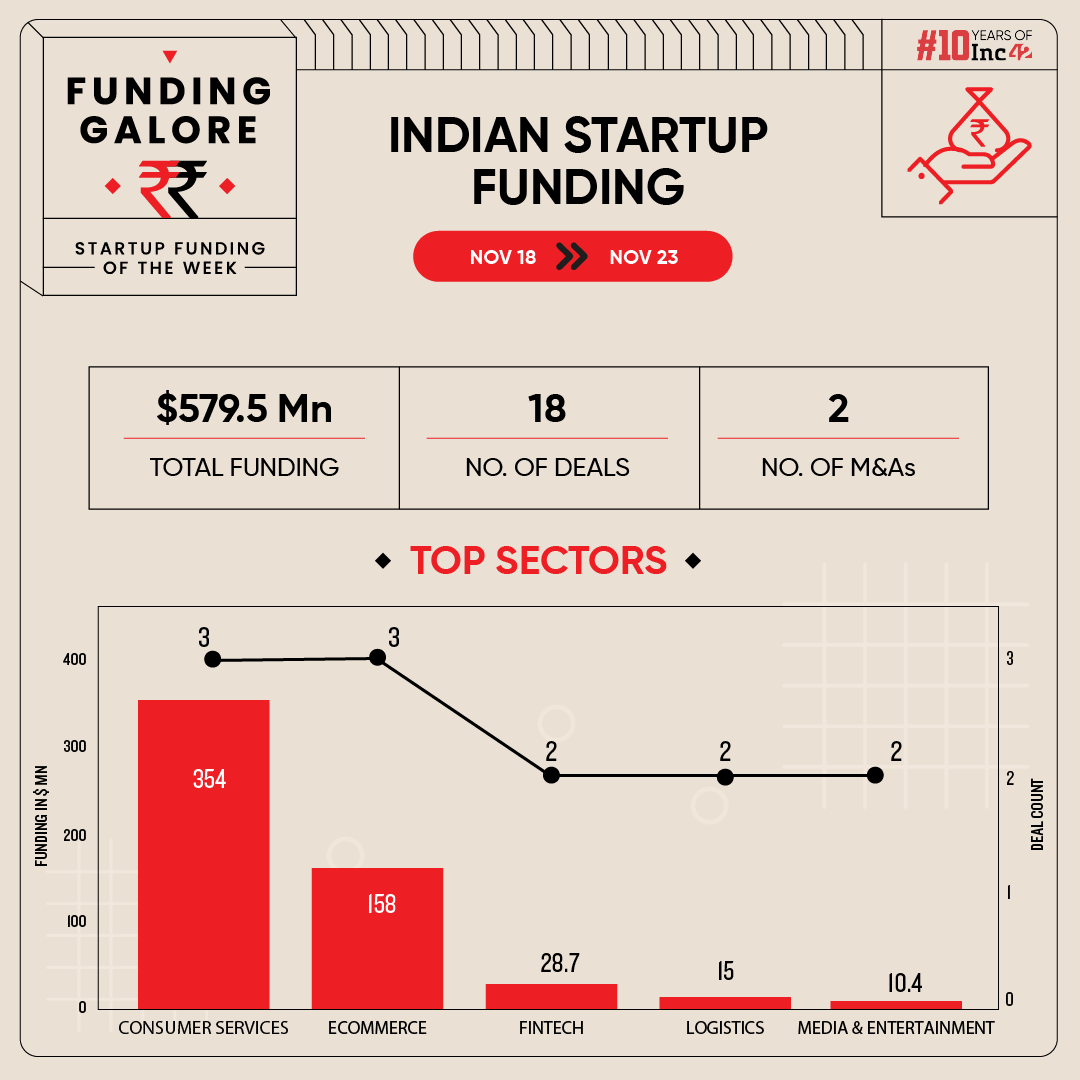

Indian startups cumulatively $579.5 Mn across 18 deals, a 212% increase from the $185.8 Mn raised across 21 deals in the previous week

The week saw two mega funding deals materialise for quick commerce startup Zepto and ecommerce HealthKart

Seed funding also jumped 85% to $10.9 Mn this week

After months of speculations, Zepto finally sealed its third mega funding deal of the year this week. The quick commerce unicorn’s $350 Mn funding round fuelled overall funding momentum in the Indian startup ecosystem during the third week of November.

Between November 18 and 23, startups cumulatively raised $579.5 Mn across 18 deals. This marked a 212% increase from the $185.8 Mn raised across 21 deals in the preceding week.

Funding Galore: Indian Startup Funding Of The Week [ Nov 18 – 23 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 22 Nov 2024 | Zepto | Consumer Services | Hyperlocal Delivery | B2C | $350 Mn | – | Motilal Oswal, Taparia Family Office, Mankind Pharma Family Office, RP Sanjiv Goenka Group, Cello Family Office, Haldiram Snacks Family Office, Sekhsaria Family Office, Kalyan Family Office, Happy Forgings Family Office, Mothers Recipe Family Office, Abhishek Bachchan, Sachin Tendulkar | Motilal Oswal |

| 18 Nov 2024 | HealthKart | Ecommerce | B2C Ecommerce | B2C | $153 Mn | – | ChrysCapital, Motilal Oswal Alternates, Neo Group, A91 Partner | ChrysCapital, Motilal Oswal Alternates |

| 21 Nov 2024 | Zopper | FIntech | Fintech SaaS | B2B | $25 Mn | Series D | Elevation Capital, Dharana Capital, Blume Ventures | Elevation Capital, Dharana Capital |

| 21 Nov 2024 | Kratos Gaming Network | Media & Entertainment | Gaming | B2C | $10 Mn | – | Aptos Labs, Polygon, Game7 | Aptos Labs |

| 20 Nov 2024 | Locad | Logistics | Integrated Logistics | B2B | $9 Mn | pre-Series B | Global Ventures, Reefknot Investments, Sumitomo Equity Ventures, Antler Elevate, Febe Ventures, JG Summit | Global Ventures, Reefknot Investments |

| 20 Nov 2024 | Blitz | Logistics | Ecommerce Logistics | B2B | $6 Mn | Series A | IvyCap Ventures, IndiaQuotient, Alteria capital, Ramesh Bafna, Siddharth Dungarwal, Vinit Gautam, Amitabh Suri | IvyCap Ventures |

| 20 Nov 2024 | Billion Hearts Software Technologies | Comsumer Tech | – | B2C | $4 Mn | Seed | Blume Ventures, General Catalyst, Athera Venture Partners. | – |

| 21 Nov 2024 | CredFlow | FIntech | Fintech SaaS | B2B | $3.7 Mn | pre-Series B | Inflexor Ventures | Inflexor Ventures |

| 19 Nov 2024 | Proost | Alcoholic Beverages | – | B2C | $3.5 Mn | Series A | Chimes Group, Srinavasan Namala, Hyderabad Angels, The Chennai Angels | Chimes Group, Srinavasan Namala |

| 20 Nov 2024 | Doodhvale Farms | Ecommerce | D2C | B2C | $3 Mn | – | Atomic Capital, Singularity Early Opportunities Fund, Indigram Labs Foundation, Ramakant Sharma, Ankit Tandon, Saurabh Jain, Arjun Vaidya | Atomic Capital, Singularity Early Opportunities Fund |

| 20 Nov 2024 | Abyom SpaceTech | Deeptech | Spacetech | B2B | $2.5 Mn | Seed | SCOPE Ventures | SCOPE Ventures |

| 19 Nov 2024 | Swish | Consumer Services | Hyperlocal Delivery | B2C | $2 Mn | Seed | Accel, Karthik Gurumurthy, Abhiraj Bhal, Varun Khaitan | Accel |

| 18 Nov 2024 | Biryani By Kilo | Consumer Services | Hyperlocal Delivery | B2C | $2 Mn | – | Pulsar Capital | Pulsar Capital |

| 19 Nov 2024 | Indic Wisdon | Ecommerce | D2C | B2C | $2 Mn | pre-Series A | Rockstud Capital | Rockstud Capital |

| 19 Nov 2024 | Theranautilus | Deeptech | Robotics | B2B | $1.2 Mn | Seed | pi Ventures, Golden Sparrow Ventures, Abhishek Goyal, Lalit Keshre | pi Ventures |

| 20 Nov 2024 | Taqtics | Enterprisetech | Horizontal SaaS | B2B | $1.2 Mn | Seed | Sprout Venture Partners, Capital-A, Java Capital | Sprout Venture Partners, Capital-A |

| 18 Nov 2024 | Matrix Geo Solutions | Deeptech | Spacetech | B2B | $1 Mn | – | Chittorgarh Infotech Limited, Viney Equity Markets LLP, Tryrock Capital, Trust AIF | – |

| 19 Nov 2024 | Baanheim Ventures | Media & Entertainment | Digital Media | B2C | $391K | – | Mudhal Partners | Mudhal Partners |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Quick commerce major Zepto reaffirmed its position as the most heavily backed startup of the year. Bagging a mega cheque of $350 Mn from investors like Motilal Oswal, Sachin Tendulkar, Mankind Pharma Family Office this week, Zepto’s cumulative fundraise for the year now stands at $1.3 Bn.

- On the back of Zepto’s fundraise, the consumer services sector emerged as the investor favourite sector this week. Startups in the space bagged $354 Mn across three deals.

- Besides Zepto, the week also saw another mega funding round materialise in the form of HealthKart’s $153 Mn fundraise. With this, the ecommerce sector saw the second highest capital infusion this week. Startups in the space raised $163 Mn across three deals.

- Venture capitalist firm Blume Ventures was the most active investor this week, backing fintech startup Zopper and Mayank Bidawatka’s latest venture Billion Hearts.

- Seed funding continued its upward movement this week, with startups at this stage cumulatively bagging $10.9 Mn. This marked an 85% jump from the $5.9 Mn raised by startups at this stage last week.

Mergers & Acquisitions This Week

Updates On Indian Startup IPOs

- Reports this week said that B2B marketplace startup OfBusiness has roped in Axis Capital, Morgan Stanley, JPMorgan, Citigroup and Bank of America for a near $1 Bn IPO in 2025.

- With its public issue seeing an oversubscription of 1.86X, shares of logistics major BlackBuck got listed on the BSE and NSE this week at a premium of 2.9%.

- Bhavish Aggarwal-led Ola Consumer initiated its IPO journey this week by receiving its shareholder nod to drop the word “private” from the company’s name.

Other Developments Of The Week

- IN-SPACe’s chairman Pawan Goenka told Inc42 that the Centre-led INR 1,000 Cr spacetech fund is set to become operational by the first quarter of fiscal year 2025-26 (Q1 FY26).

- Solar solutions startup SolarSquare plans to raise $30 Mn at a $130 Mn valuation. This marks a 2.7X jump from its previous valuation of $47.7 Mn.

- A secondary share sale at omnichannel eyewear unicorn Lenskart is likely to value $6 Bn, up 20% from its last valuation of $5 Bn.

- Hospitality unicorn OYO’s founder Ritesh Agarwal is looking to infuse $65 Mn to increase his stake in the startup.

- Listed online travel aggregator MakeMyTrip will be acquiring fintech unicorn CRED’s expense management platform Happay in a bid to become the go-to platform for comprehensive corporate travel and expense management solutions.

- Former International Finance Corporations’s executive Sayan Ghosh launched his own VC firm Ortella Global Capital (OG Capital) this week along with a $36 Mn fund.

- IIT Bombay’s Society for Innovation & Entrepreneurship (SINE) will be launching its maiden VC fund with a target corpus of $11.8 Mn. Through the fund, it aims to back 1,000 startups over the next 10 years with an average ticket size of INR 2-15 Cr.