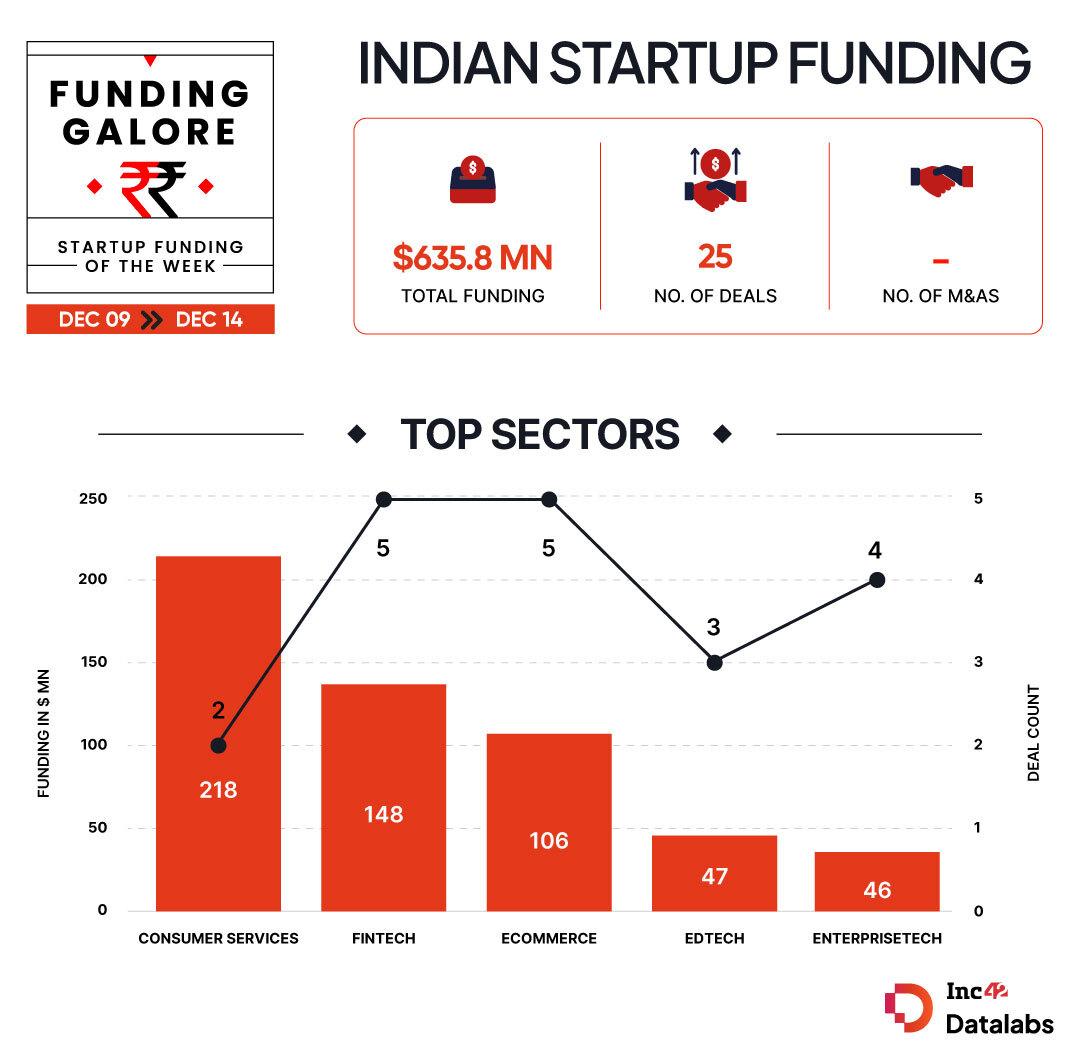

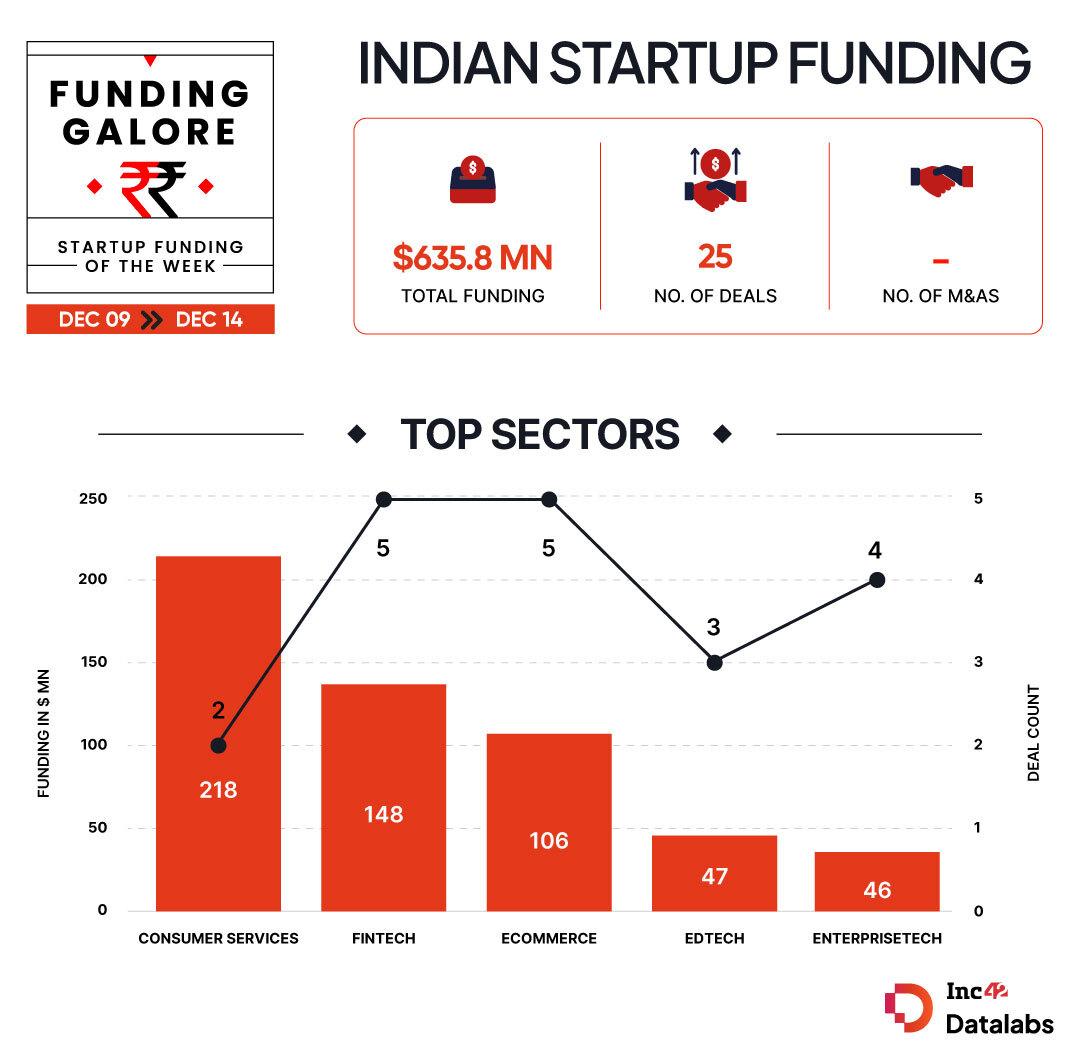

Between December 9 and 13, Indian startups cumulatively raised $635.8 Mn via 25 deals, up 155% from the $249.6 Mn secured across 18 deals in the preceding week

The week saw two mega funding deals materialise in the form of Rebel Foods and Mintifi

With MobiKwik set to list next week, Bluestone and IndiQube began their IPO journeys this week

As 2024 comes to an end, investor interest in the world’s third-largest startup ecosystem has started picking up the pace. Startup funding in the second week of the year’s last month grew leaps and bounds on a week on week basis.

Between December 9 and 13, Indian startups cumulatively raised $635.8 Mn across 25 deals, marking a 155% jump from the $249.6 Mn secured via 18 deals in the preceding week.

With the funding trends gaining momentum, the ecosystem continued to show some signs of maturity. Already seeing a great number of listings coming out of the startup world this year, more startups began their bid to become public entities in the final month of 2024.

With that said, let’s take a look at the happenings of the week.

Funding Galore: Indian Startup Funding Of The Week [ Dec 9 – Dec 14 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 12 Dec 2024 | Rebel Foods | Consumer Services | Hyperlocal Delivery | B2C | $210 Mn | Series G | Temasek, Evolvence | Temasek |

| 10 Dec 2024 | Mintifi | Fintech | Lendingtech | B2B | $100.1 Mn* | Series E | Teachers’ Venture Growth, Prosus, Premji Invest | Teachers’ Venture Growth, Prosus |

| 11 Dec 2024 | CarDekho SEA | Ecommerce | B2C Ecommerce | B2C | $60 Mn | – | Navis Capital Partners, Dragon Fund | – |

| 9 Dec 2024 | Wooden Street | Ecommerce | D2C | B2C | $43 Mn | Series C | Premji Invest | Premji Invest |

| 12 Dec 2024 | K-12 Techno Services | Edtech | Edtech SaaS | B2B | $40 Mn | – | Kenro Capital, Piyush Gupta | – |

| 12 Dec 2024 | SolarSquare | Cleantech | Solar Tech | B2C-B2B | $40 Mn | Series B | Lightspeed, Lightrock, Elevation Capital, Lowercarbon, Rainmatter, Gruhas Proptech | Lightspeed |

| 10 Dec 2024 | LambdaTest | Enterprisetech | Horizontal SaaS | B2B | $38 Mn | – | Avataar Venture Partners, Qualcomm Ventures | Avataar Venture Partners |

| 9 Dec 2024 | Pixxel | Deeptech | Spacetech | B2B | $24 Mn* | Series B | M&G Catalyst, Glade Brook Capital Partners | – |

| 12 Dec 2024 | Snapmint | Fintech | Lendingtech | B2C | $18 Mn | pre-Series B | Prashasta Seth, Perpetuity Ventures, Pegasus Fininvest | Prashasta Seth |

| 9 Dec 2024 | Varthana | Fintech | Lendingtech | B2C | $15 Mn | Debt | BlueOrchard Microfinance Fund | BlueOrchard Microfinance Fund |

| 11 Dec 2024 | Avanti Finance | Fintech | Lendingtech | B2C-B2B | $14.2 Mn | Series B | Dia Vikas Capital, IDH Farmfit Fund, NRJN Family Trust, Rabo Partnerships | Dia Vikas Capital |

| 12 Dec 2024 | FirstClub | Consumer Services | Hyperlocal Delivery | B2C | $8 Mn* | Seed | Accel, RTP Global, Blume Founders Fund, Quiet Capital, 2am VC, Binny Bansal, Kunal Shah, Mukesh Bansal | Accel, RTP Global |

| 12 Dec 2024 | FinX | Edtech | Skill Development | B2C | $6 Mn | Seed | Elevar Equity | Elevar Equity |

| 11 Dec 2024 | Haber | Enterprisetech | Horizontal SaaS | B2B | $6 Mn* | Series C | Creaegis, BEENEXT, Accel India | Creaegis, BEENEXT, Accel India |

| 13 Dec 2024 | Inkers Technology | Real Estate Tech | Real Estate SaaS | B2B | $3 Mn | Series A | Ashish Kacholia | Ashish Kacholia |

| 11 Dec 2024 | Culture Circle | Ecommerce | B2C Ecommerce | B2C | $2 Mn | Seed | Info Edge Ventures | Info Edge Ventures |

| 12 Dec 2024 | Superfone | Enterprisetech | Horizontal SaaS | B2B | $1.9 Mn | pre-Series A | YourNest Venture Capital, Ankur Capital, Finsight Seed Fund | YourNest Venture Capital |

| 10 Dec 2024 | Sustainiam | Cleantech | Climate Tech | B2B | $1.5 Mn | pre-Series A | Orios Venture Partners, Shilpa Shetty Kundra, Rajesh Sawhney, Harsh Vardhan Bhagchandka, Vinit Bhansali | Orios Venture Partners |

| 11 Dec 2024 | Power Gummies | Ecommerce | D2C | B2C | $1.2 Mn | – | Jaipuria family office, Quadrant, 100Unicorns, DSGCP, Wipro Consumer, Venture Catalysts, Agility | Jaipuria family office, Quadrant |

| 10 Dec 2024 | Netrasemi | Deeptech | Hardware & IoT | B2B | $1.2 Mn | pre-Series A | Unicorn India Ventures | Unicorn India Ventures |

| 10 Dec 2024 | Kreedo Early Childhood Solutions | Edtech | – | B2B | $1.2 Mn | Debt | Recur Club | Recur Club |

| 11 Dec 2024 | Navanc | Fintech | Fintech SaaS | B2B | $1 Mn | Seed | Prarambh Ventures, Inflection Point Ventures, Brigade REAP FirstPort Capital | Prarambh Ventures |

| 14 Dec 2024 | VOICE | Logistics | Last mile deliveries | B2B | $590K | – | BizDateUp | BizDateUp |

| 10 Dec 2024 | Fuzen.io | Enterprisetech | Horizontal SaaS | B2B | – | – | ah! Ventures | ah! Ventures |

| 11 Dec 2024 | MHYTH | Ecommerce | D2C | B2C | – | – | Sandeep Daga, Snehal Shah | Sandeep Daga, Snehal Shah |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- The week saw two mega funding deals materialise in the form of Rebel Foods and Mintifi.

- On the back of Rebel Food’s $210 Mn fundraise, consumer service emerged as the investor favourite this week. Startups in the space raised $218 Mn across two deals.

- Due to Mintifi’s mega fundraise announcement, fintech emerged as the second most funded sector this week. Startups in the sector raised $148.30 Mn across 5 deals.

- Pertinent to mention that the ecommerce sector also saw a similar number of funding rounds materialise to fintech this week. Startups like Wooden Street, Power Gummies, among others, cumulatively raised $106.20 Mn in the week.

- Premji Invest emerged as the most active investor this week, backing Mintifi and Wooden Street.

- Seed funding zoomed 246% to $17 Mn from $4.9 Mn last week.

Updates On Indian Startup IPOs

- Fintech MobiKwik’s initial public offering (IPO) closed with an oversubscription of 119.38X. The startup is expected to get listed on December 18.

- Omnichannel jewellery startup Bluestone filed its draft red herring prospectus (DRHP) with SEBI for an IPO comprising a fresh issue of shares worth INR 1,000 Cr and an offer-for-sale component of up to 2.40 Cr equity shares

- Non-banking finance company Aye Finance’s board gave its nod to an IPO worth INR 1,450 Cr. The IPO will comprise a fresh issue of shares worth up to INR 885 Cr and an OFS component of INR 565 Cr.

- Coworking startup IndiQube turned into a public limited company from a private limited company, taking the first step to its IPO.

- According to reports, ecommerce major Flipkart received internal approvals to shift its domicile from Singapore to India for an IPO in the next 12-15 months.

Funds Launches This Week

- Deeptech venture capital firm growX ventures floated its second fund with a target corpus $47.12 Mn. The VC aims to deepen its focus on deeptech and enterprise tech via the fund.

- Stride Ventures launched its largest fund till date with a target corpus of $300 Mn. The VC plans on making investments across sectors with the fund.

- Amazon India will be investing $120 Mn in startups that digitise consumer goods manufacturing and cater to both domestic and global demand through its VC arm Amazon Smbhav Venture Fund.

Other Developments Of The Week

- Ecommerce major Zetwork got board approval to raise $66.6 Mn. The round is expected to be led by Khosla Ventures, along with participation from The Schiehallion Fund and others.

- Listed fintech Veefin bought 50% stake in Singapore-based GenAI startup Walnut AI for $2 Mn.

- Edtech Veranda Learning Solutions will be raising $29.5 Mn through a preferential issue to fuel acquisitions, deferred consideration payouts and expanding its existing business operations,

- Recently launched ecommerce startup Worthy Cart is currently in discussions to raise $10 Mn its in Pre-Series A funding with investors.

- Mobile Premier League said that it has picked up a significant stake in gaming development tools provider CloudFeather Games this week.

- Dutch investor Prosus is reportedly in discussions to lead a $50 Mn funding round in fintech startup Jar.

- OTT platform STAGE will be raising $9.9 Mn from multiple investors via issuance of preference shares.