For years, buying insurance in India has been a confusing and often overwhelming process. Between complicated terms, pushy sales tactics, and endless policy comparisons, most people either end up with the wrong plan or avoid buying insurance altogether. That’s where Ditto steps in—reshaping the way Indians choose life and health insurance with a refreshingly simple, transparent, and advisory-driven approach.

From Financial Education to Insurance Innovation

Ditto wasn’t born out of a boardroom strategy but from a deep understanding of how people struggle with financial decisions. Before Ditto, its founders—Pawan Kumar Rai, Shrehith Karkera, Bhanu Harish Gurram, and Lokesh Gurram—had already made waves with Finshots, a platform simplifying financial news for everyday Indians. Their bite-sized, jargon-free financial insights quickly became a favorite among young professionals, amassing over 700,000 subscribers.

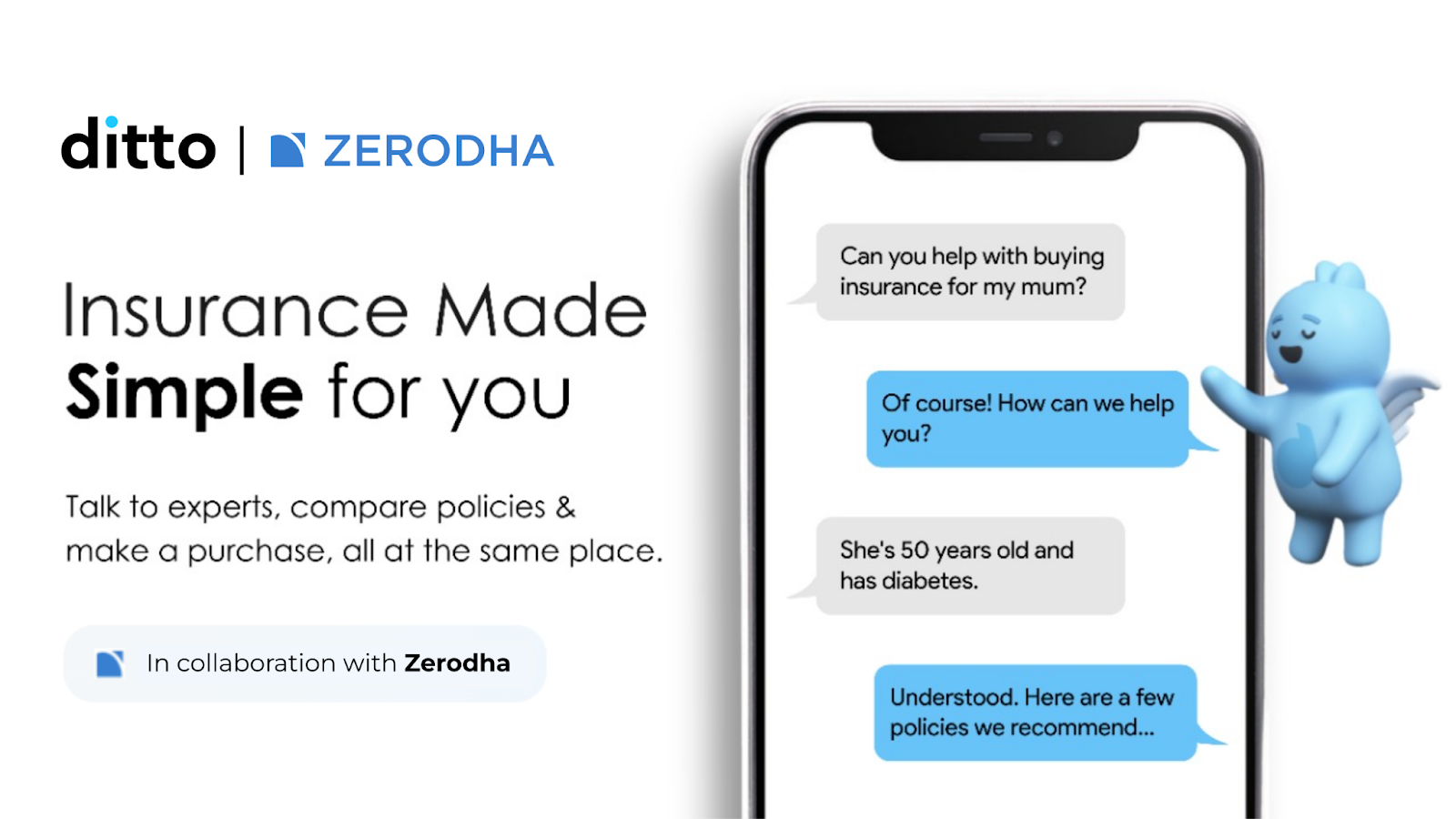

This experience revealed a deeper problem—financial literacy alone wasn’t enough. People needed hand-holding when making critical financial decisions, especially in insurance. The realization sparked the creation of Ditto, a platform that removes the guesswork from insurance buying by providing expert, unbiased, and pressure-free advisory services.

What Makes Ditto Different?

Unlike traditional insurance brokers or aggregator websites that bombard users with endless policy listings, Ditto takes a human-first approach. Instead of pushing products, Ditto’s expert advisors offer free 30-minute consultations to understand individual needs, break down complex policies, and suggest the right options—without any hidden agendas.

Customers appreciate this transparent and no-pressure experience. It’s why over 330,000 individuals have trusted Ditto to guide them in choosing the right health and life insurance policies. The platform’s commitment to honest advice has also earned it a stellar 4.9/5 rating on Google, based on thousands of genuine customer reviews.

Growth, Backing, and a Vision for the Future

Ditto’s unique approach caught the attention of industry leaders, securing ₹34 crore ($4 million) in seed funding, led by Zerodha’s founders and Rainmatter Capital. With this backing, Ditto has been able to expand its services, refine its advisory process, and reach a larger audience across India.

However, the road ahead isn’t without challenges. The Indian insurance industry is deeply entrenched in aggressive sales tactics and complex product structures. But Ditto is determined to change the game by putting customer education and trust first.

Redefining Insurance—One Call at a Time

In a country where insurance penetration remains low and myths around policies run high, Ditto’s mission is more important than ever. By replacing cold calls with meaningful conversations, misleading jargon with clarity, and sales-driven pitches with genuine guidance, Ditto is empowering Indians to make informed financial decisions.

As more individuals turn to Ditto for their insurance needs, the company is proving that a simple idea—helping people without selling to them—can reshape an entire industry. And in the process, it’s making insurance something it has rarely been in India: trustworthy, transparent, and truly helpful.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)