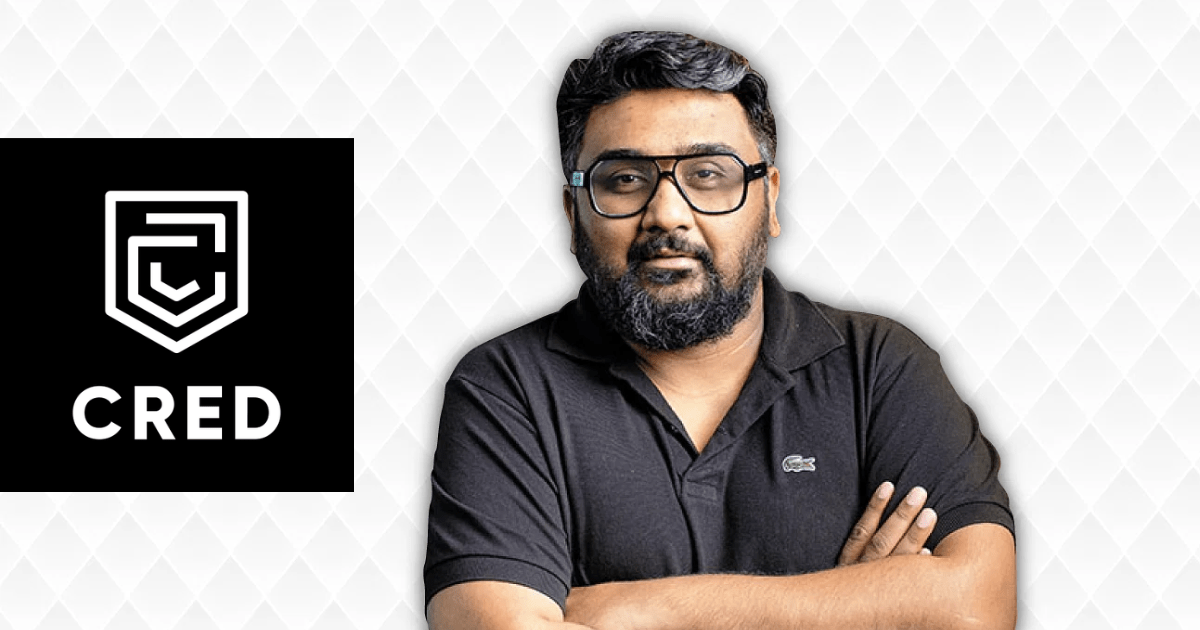

Kunal Shah-backed Cred is bolstering its credit play as it looks to raise separate capital for its non-banking finance company (NBFC) Newtap Technologies, at least three people in the know told ETtech.

Shah’s company, Newtap Technologies, was founded in 2021 and has proposed raising $50-70 million to assist increase its participation and credit exposure to Cred’s user base.

According to the sources stated above, Cred currently owns 20% of Newtap Technologies, with the remainder controlled by Shah himself. The firm’s directors are Shah and his brother Rohan Shah Naresh.

According to the sources, Shah has explored raising capital from Cred’s existing investors, including Sequoia Capital and Singapore’s sovereign fund GIC, which will value the NBFC subsidiary at around $250 million.

Sequoia was an early backer of Cred, and GIC led a Rs 617-crore (about $80 million) fundraising round in the fintech business last year, which included a mix of main and secondary funding.

ET originally reported in November 2021 that Shah had bought Parfait Finance & Investment, a Reserve Bank of India (RBI)-registered NBFC, through NewTap Technologies.

According to those familiar with Cred’s thinking, the objective behind infusing equity capital was to develop trust in its NBFC entity while raising loan capital to retain the same equity-to-debt ratio as most other NBFC businesses.

Cred has accelerated the development of its Unified Payments Interface (UPI) product in order to increase user engagement on its platform. It first made UPI available on its platform in October 2022. According to the sources, as interaction grows, the fintech platform will attempt to cross-sell other financial services such as credit.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)