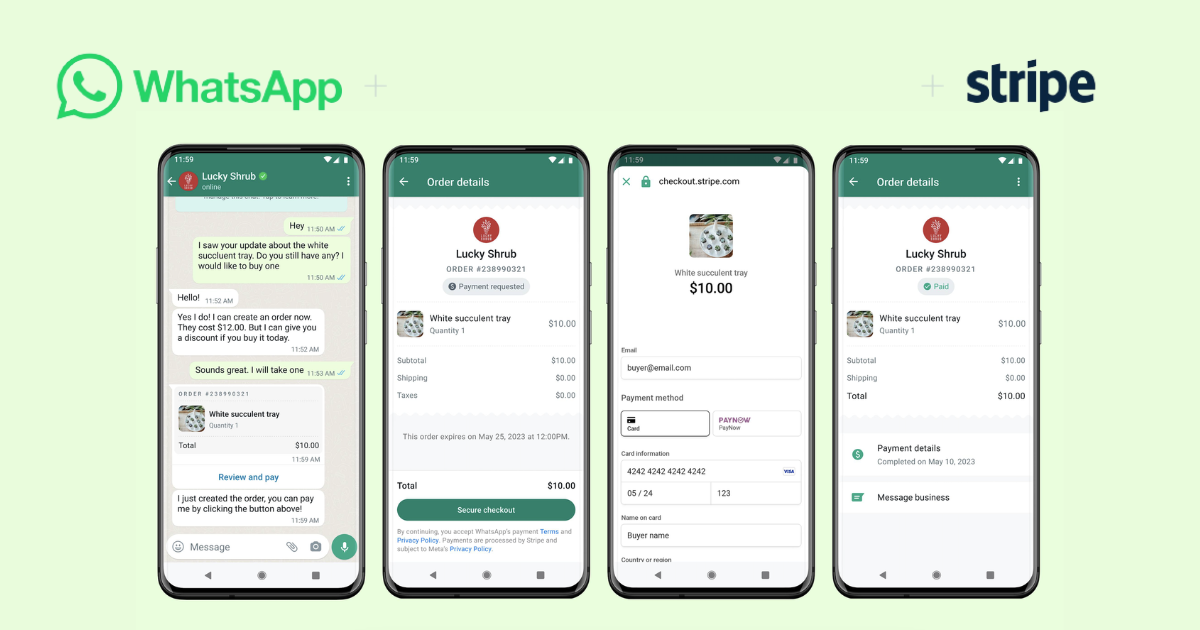

WhatsApp is launching its payment feature for businesses within a chat in Singapore. Meta, the parent company of WhatsApp, has partnered with Stripe to make in-app payments available both online and offline, allowing customers to pay businesses using credit cards, debit cards, or Singapore’s PayNow fund transfer system. Meta has built the payment feature using Stripe Connect and Stripe Checkout solutions.

At present, the payment feature is available only to a few businesses, but Meta plans to expand its availability to more merchants in the coming months. Businesses can set up the feature through WhatsApp Business, which will guide them in getting a Stripe account. Sarita Singh, Regional Head and Managing Director for Southeast Asia at Stripe, said that the speed and convenience of payments through WhatsApp would help businesses expand their revenue streams with new channels and access a wider customer base.

WhatsApp first launched its payment services in India in 2020, based on the country’s Unified Payment Interface (UPI) network. The National Payments Corporation of India allowed Meta to expand the service to 100 million users in 2022. In August 2022, the company introduced an end-to-end shopping experience with Reliance Jio in India, allowing customers to order groceries using the app. Last month, WhatsApp also launched merchant payments in Brazil, after allowing peer-to-peer payments for nearly three years.

WhatsApp’s payment feature will be available for businesses to use in Singapore in a similar way, allowing the chat app’s 2 billion user base to launch payment services in different regions. With WhatsApp having no subscription fees or ads, its business offerings are the primary means for Meta to earn money from the app. Starting next month, WhatsApp will switch from a notification-based pricing system to a conversation-based pricing structure for the usage of its business services.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)