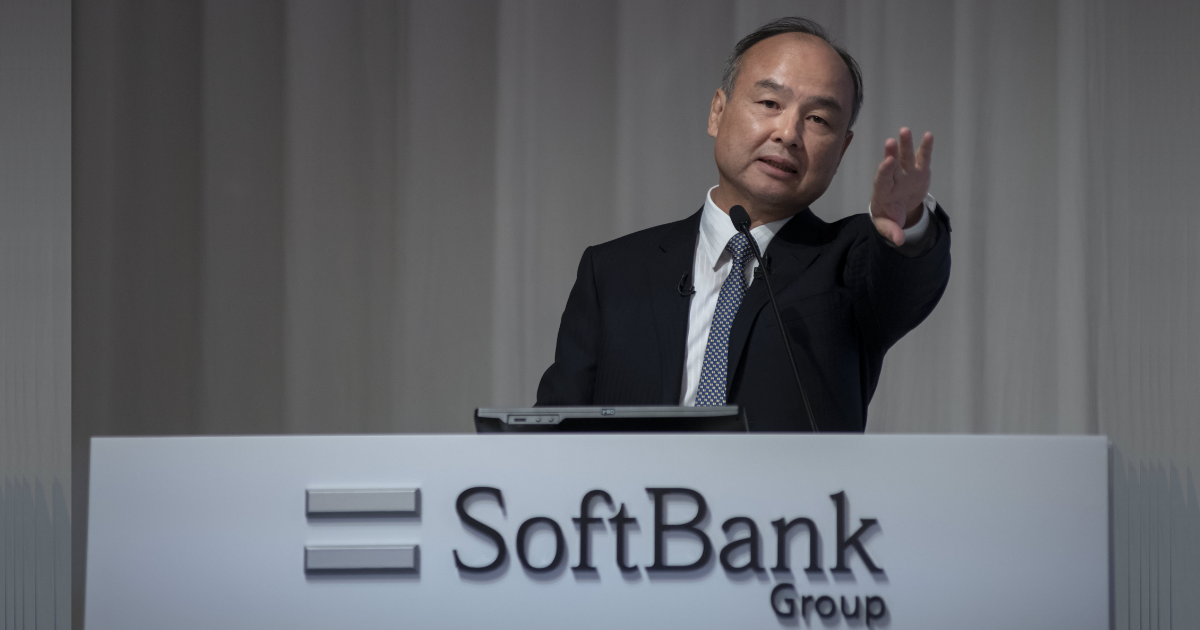

Japanese investor SoftBank is in discussions with several Indian startups, aiming to invest, support, and nurture their growth to unicorn status. The Masayoshi Son-led firm is reportedly considering investments ranging from $50 million to $100 million in each of these startups.

According to Business Standard, SoftBank’s primary focus is on startups operating in the B2C, enterprise, and media sectors. These startups fall within a valuation range of $400 million to $500 million, making them potential candidates for significant growth.

SoftBank is also exploring opportunities to invest in businesses where existing investors are looking for an exit through a secondary sale, especially in cases where startups are delaying their initial public offerings (IPOs).

In recent years, SoftBank has made substantial investments in Indian software-as-a-service (SaaS) startups, totaling around $500 million. However, this figure is significantly lower compared to the $3.2 billion investment it made across various sectors in 2021. SoftBank’s overall investment in Indian startups now stands at $15 billion, with $7 billion already withdrawn.

India ranks as SoftBank’s third-largest investment market, following the United States and China, in terms of deal volume.

During the last fiscal year, SoftBank reaped over $100 million in gains from four prominent Indian startups that are listed, including Zomato, Paytm, Delhivery, and PB Fintech.

Recently, there were reports that SoftBank is considering launching a private credit strategy to invest in late-stage startups through a debt or debt-like structure. Although this plan is still in its early stages, establishing credit funds would enable SoftBank to finance tech startups that are delaying their IPO plans due to the prevailing macroeconomic situation but require fresh capital to sustain their operations.

Despite a funding winter, Indian tech startups managed to raise approximately $3 billion in the first quarter of 2023. However, a survey conducted by Inc42’s Indian Tech Startup Funding Report Q1 2023 revealed that 84% of Indian venture capitalists faced significant challenges in securing growth-stage capital. Additionally, the report indicated a 77% year-on-year decline in the number of mega deals. While 21 startups achieved unicorn status in 2022, no new unicorns have emerged so far this year.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)