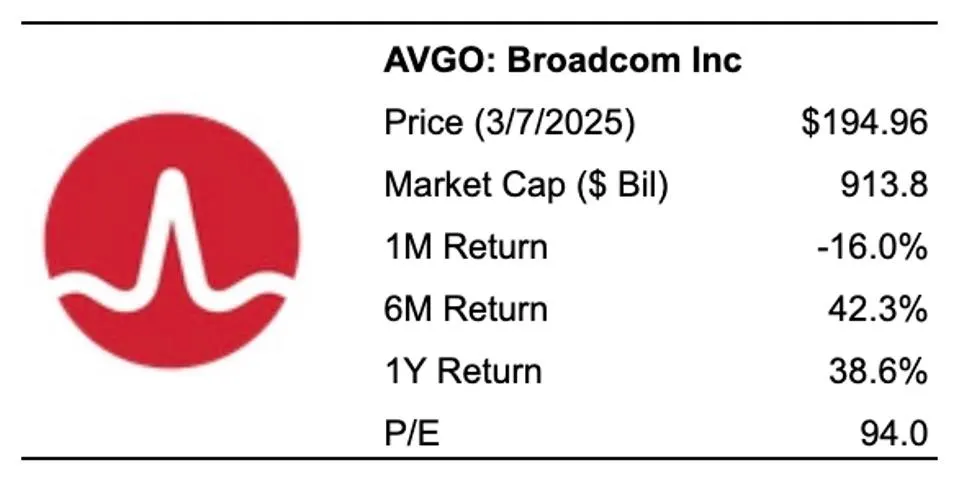

AVGO stock surged this week after Broadcom Inc. reported stronger-than-expected results for its fiscal third quarter of 2025. The semiconductor and software giant posted double-digit revenue growth and solid profit margins, driven by continued strength in AI-related demand and steady enterprise software sales.

Broadcom Earnings Surprise Wall Street

Broadcom reported revenue of nearly $16 billion for the quarter, up 22% year-over-year. Net income reached $4.14 billion, showing significant improvement from the prior year. Adjusted earnings per share came in ahead of analyst forecasts, fueling optimism around Broadcom stock as a key beneficiary of the AI investment wave.

The company’s CEO highlighted that demand from hyperscale data center operators remains robust, with AI infrastructure driving higher chip sales. This performance gave investors confidence that Broadcom can maintain its momentum despite global economic uncertainty.

The market reaction was immediate. AVGO stock price jumped in after-hours trading, extending gains that had already built up in anticipation of the results.

AVGO Earnings Reinforce AI Tailwinds

The latest AVGO earnings reinforced the narrative that Broadcom is one of the biggest winners from the AI boom. Alongside competitors like Nvidia, Broadcom has benefited from explosive demand for networking and custom silicon used in AI data centers.

While other semiconductor companies have struggled with inventory challenges, Broadcom has managed to keep supply chains tight and aligned with customer demand. This discipline has translated into stronger margins and a solid outlook, boosting investor confidence in avgo stock.

Dividend and Capital Returns Add to Investor Appeal

Broadcom also announced a steady dividend policy, maintaining its reputation as a shareholder-friendly company. With a forward dividend yield of just under 1%, the payout continues to attract long-term investors seeking stability in a volatile sector.

Additionally, management reiterated its commitment to capital returns through share repurchases, further strengthening the case for Broadcom stock as a defensive play in the tech-heavy Nasdaq index.

Broadcom AVGO Earnings Signal Strength Amid Competition

The Broadcom AVGO earnings report stood out not only for its headline numbers but also for the company’s resilience in a competitive landscape. Rivals in the semiconductor and networking space have struggled to match Broadcom’s scale and integration of hardware with software solutions.

Its enterprise software segment continues to provide steady recurring revenue, helping balance the cyclical nature of the chip business. This diversified model is a key reason why avgo stock price has consistently outperformed many of its peers.

Outlook: Can Broadcom Keep Its Momentum?

Looking ahead, Broadcom guided for continued growth in the fourth quarter, citing AI-related demand and strong backlog visibility. Analysts believe that the company’s ability to secure multi-year contracts with cloud providers will underpin sustained revenue growth.

However, risks remain. Potential regulatory scrutiny of tech consolidation and ongoing geopolitical tensions in chip supply chains could present headwinds. Still, for now, the market appears convinced that avgo earnings momentum is intact.

With Broadcom stock now ranked as the sixth-largest company in the S&P 500, its results carry broader implications for the market. Investors are watching closely to see if AVGO can maintain its leadership position as AI spending accelerates globally.

Investor Takeaway

The latest Broadcom earnings beat solidified the company’s standing as a dominant force in both semiconductors and enterprise software. With AI infrastructure demand fueling record results, AVGO stock continues to attract strong interest from institutional and retail investors alike.

While valuation remains elevated, the combination of robust fundamentals, capital returns, and AI-driven growth has made avgo stock price one of the most closely watched in the market.

Stay Updated

For investors and entrepreneurs tracking disruptive innovations and stock market shifts, keep up with the latest updates at Startup News.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)