The rapid expansion of artificial intelligence has created new leaders on Wall Street, and CoreWeave stock is increasingly catching investors’ attention. Traded under the ticker CRWV, the company has become a focal point for analysts who believe the AI infrastructure boom is far from over. Recent coverage suggests that CoreWeave could see significant upside, with bullish projections pointing to a possible 40% rise in the near term.

Why CoreWeave Stock Matters Right Now

CoreWeave has quickly emerged as a powerful player in the cloud infrastructure market, specializing in GPU-powered computing services. With demand for AI applications like machine learning, generative AI, and large language models surging, investors see CoreWeave stock as well-positioned to capture this growth.

While Nvidia remains the dominant chip supplier in the sector, CRWV stock benefits by offering cloud access to GPUs that many companies cannot afford to own outright. This niche has turned CoreWeave into a vital partner for enterprises racing to scale AI operations.

Analysts Weigh In on CRWV Stock

Recent reports highlight a new bullish stance on CRWV stock, with analysts arguing that the company’s unique business model justifies aggressive valuation multiples. One case being made is that CoreWeave stock could rise another 40% if demand for AI-focused cloud services continues at its current pace.

The reasoning is simple: the AI arms race is far from slowing down. As more businesses adopt generative AI platforms and experiment with advanced models, they require scalable, cost-efficient infrastructure. CoreWeave sits at the intersection of this demand, making CRWV a compelling play in the eyes of growth-oriented investors.

Competition and Market Challenges

Despite the optimism, CoreWeave stock faces headwinds. Cloud giants like Amazon Web Services, Microsoft Azure, and Google Cloud are also pushing aggressively into the AI infrastructure space. These companies have deeper pockets and established customer bases, which could put pressure on CRWV stock in the long run.

However, analysts note that CoreWeave’s agility and GPU-first strategy differentiate it from larger rivals. Instead of competing across all cloud services, CRWV stock is tied directly to the AI revolution, allowing it to capture niche demand without spreading resources too thin.

Investor Sentiment and Future Outlook

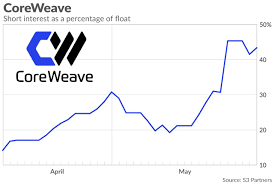

Investor sentiment toward CoreWeave stock remains highly optimistic, particularly as AI-related companies dominate both headlines and portfolios. While volatility is expected, CRWV stock represents the type of high-growth opportunity that attracts risk-tolerant investors willing to bet on transformative technologies.

The future of CRWV may depend on two key factors: sustained access to GPU supply and its ability to scale infrastructure at a pace that matches rising demand. If CoreWeave executes on both fronts, analysts argue that CoreWeave stock could justify its bullish projections and potentially exceed them.

Is CRWV Stock a Buy Now?

For investors weighing whether CRWV stock is a buy, the decision comes down to risk appetite. The stock’s potential upside is significant, but so are the risks associated with competition and market volatility. What’s clear is that CoreWeave has firmly established itself as a serious contender in the AI ecosystem.

As generative AI continues to expand beyond tech giants into industries such as healthcare, finance, and manufacturing, the demand for CoreWeave’s GPU-based cloud solutions is expected to rise. This makes CoreWeave stock a key name to watch in 2025 and beyond.

Want more insights on fast-growing companies and investment opportunities? Visit Startupnews

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)