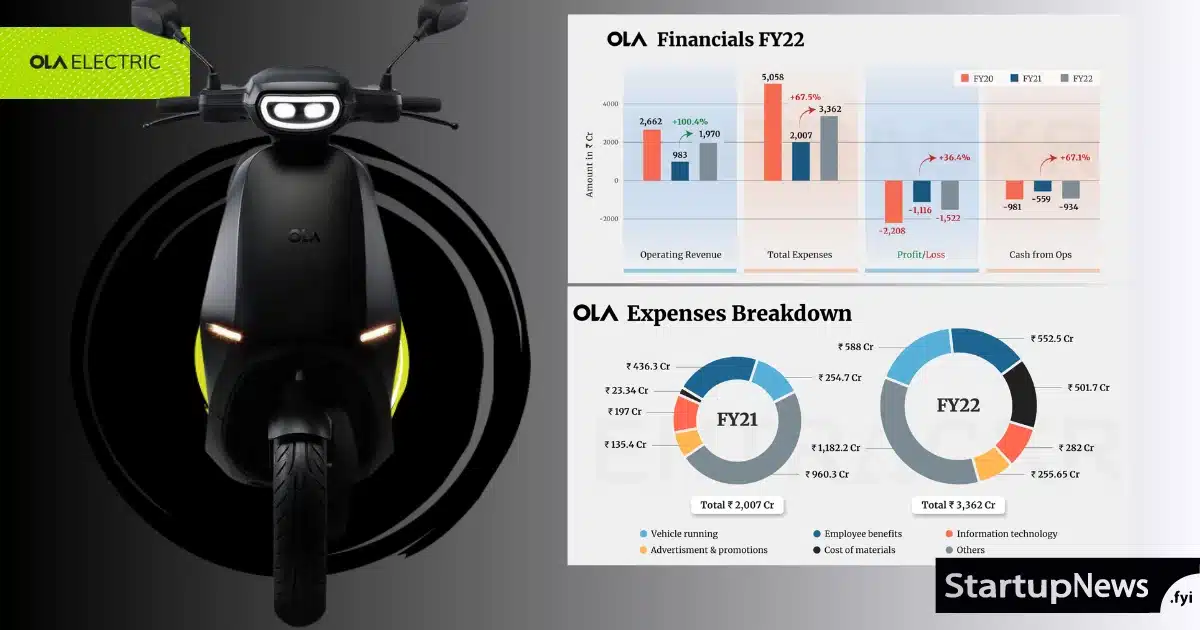

Bhavish Aggarwal-led Ola Electric has witnessed a significant increase in net loss, nearly quadrupling to INR 784.1 Cr during the financial year 2021-22 (FY22) from INR 199.2 Cr in FY21.

Non-Comparable Numbers Due to EV Delivery Commencement

It’s important to note that the figures for FY22 are not directly comparable with those of FY21, as the electric vehicle (EV) startup initiated the delivery of its escooters only from December 2021.

Ola Electric Revenue and Expenditure Details

The operating revenue for FY22 reached INR 373.4 Cr. Ola Electric’s primary source of revenue is the sale of its escooters. The startup earned INR 348.2 Cr from the sale of products and INR 19.7 Cr from services during the financial year ending on March 31, 2022.

On the expenditure side, the total expenses surged to INR 1,240.4 Cr in FY22 from INR 305.4 Cr in the previous fiscal. The highest contributor to expenses was the cost of material consumed, with INR 584.9 Cr spent on purchases. Notably, this expense category reported zero spending in the previous fiscal.

Employee Benefit and Other Expenses

Ola Electric allocated INR 282.4 Cr to employee benefit expenses in FY22, marking a 43.2% increase from the INR 197.2 Cr in the previous year. This category includes employee salaries, PF contributions, and other welfare contributions.

Marketing expenses surged to INR 49.4 Cr in FY22, a significant rise from INR 1.5 Cr in FY21. Additionally, the startup allocated INR 44.1 Cr to legal professional charges in FY22, reflecting a 60% increase from INR 27.5 Cr in FY21.

Ola Electric Growth Trajectory

Established in 2017, Ola Electric swiftly entered the coveted unicorn club within just two years of its inception, securing $250 Mn from SoftBank led by Masayoshi Son. The startup introduced its S1 and S1 Pro in August 2021, but a technical glitch postponed the live sale from September 8, 2021, to September 15, 2021.

Despite previous claims of surpassing INR 500 Cr in revenue during the first two months of FY23, Ola Electric reported an operating loss of $136 Mn (about INR 1,116 Cr) and revenue of $335 Mn (about INR 2,750 Cr) in FY23, missing its publicly disclosed revenue goal. The startup remains determined to achieve significant growth, aiming to exceed a $1 Bn run rate by the end of the year.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)