Novo Nordisk, the Danish pharmaceutical giant behind the blockbuster weight-loss drug Wegovy and diabetes treatment Ozempic, is facing its toughest challenge yet. According to a recent report from Yahoo Finance and Investopedia, the company has cut its full-year outlook for the fourth time in 2025, citing slowing demand for its GLP-1 treatments and mounting competition from Eli Lilly (LLY).

Weaker Financial Results Signal Market Saturation

In its latest quarterly report, Novo Nordisk posted lower-than-expected profits and revenue, reflecting the cooling momentum in what was once a red-hot obesity drug market.

- Adjusted earnings per share: DKK 4.50 ($0.69), slightly below analyst expectations.

- Revenue: DKK 74.98 billion ($11.53 billion), up 5.1% year over year but short of forecasts.

- Wegovy sales: DKK 20.35 billion ($3.13 billion), up 18% but still below expectations.

- Ozempic sales: DKK 30.74 billion ($4.73 billion), rising 3%, slightly better than forecast.

These figures reveal that while Novo Nordisk continues to grow, its momentum is slowing, especially in the U.S. market where Eli Lilly’s competing GLP-1 drugs, including Zepbound and Mounjaro, are gaining market share.

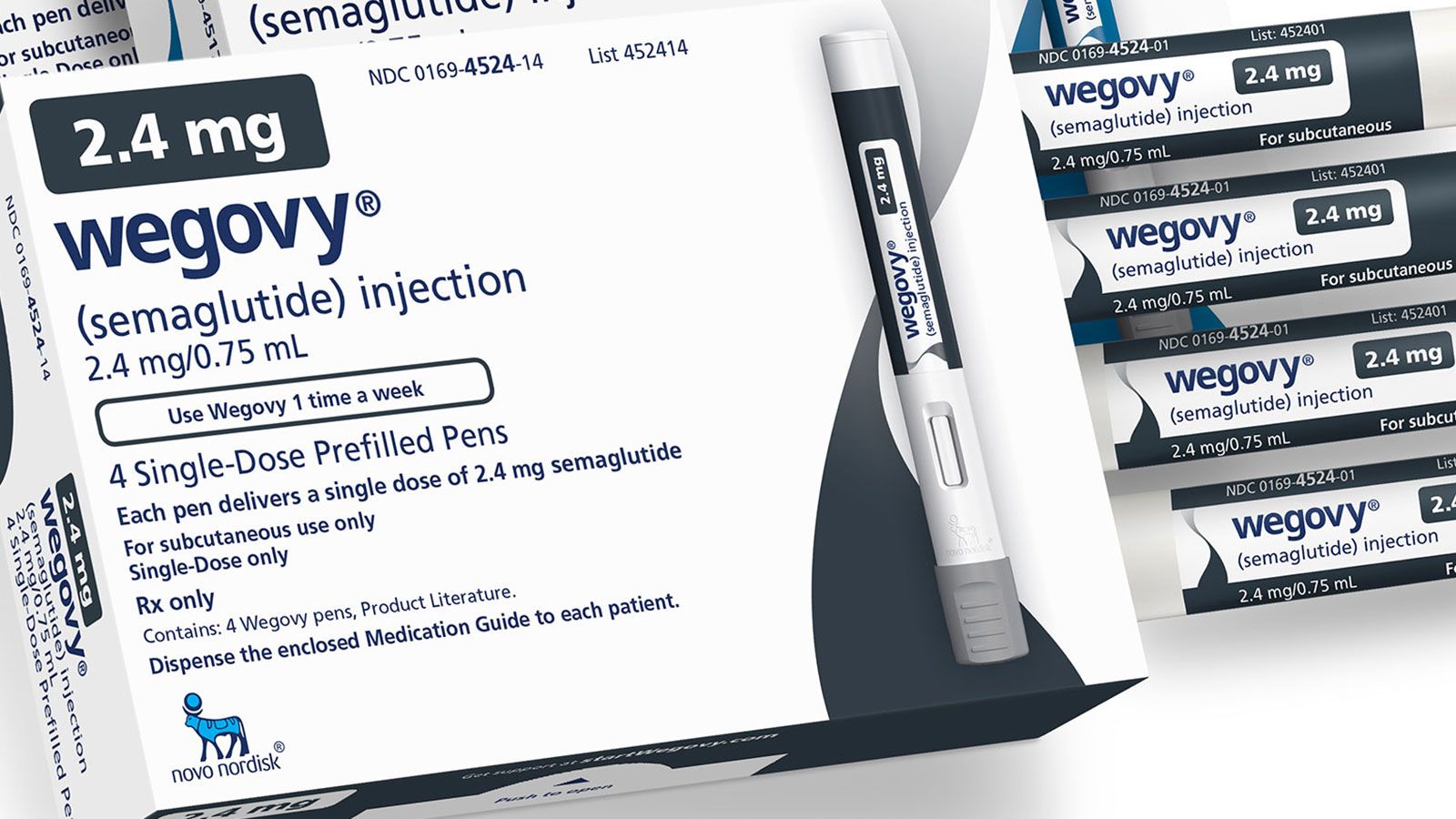

Wegovy Demand Slows as Competition Heats Up

When Wegovy first hit the market, it revolutionized the weight-loss industry with its strong efficacy and rapid adoption. However, as new entrants like LLY’s Mounjaro (tirzepatide) have gained regulatory approval and expanded availability, Novo Nordisk’s market dominance has weakened.

Analysts note that Eli Lilly (LLY) has leveraged more aggressive pricing strategies, improved supply chains, and a broader production base to meet rising global demand. In contrast, Novo Nordisk has struggled to balance supply and pricing, leading to reduced prescription growth in several key regions.

Repeated Outlook Cuts Reflect Mounting Pressure

This marks the fourth time in 2025 that Novo Nordisk has revised its guidance downward — a clear sign of persistent headwinds. The company now projects:

- Operating profit growth: 4%–7% (previously 4%–20%)

- Sales growth: 8%–11% (previously 8%–14%)

According to the company, these revisions “reflect lowered growth expectations for Novo Nordisk’s GLP-1 treatments within diabetes and obesity.”

U.S.-listed shares of Novo Nordisk (NVO) have fallen around 46% year-to-date, highlighting investor concern about the company’s ability to maintain its early advantage in the GLP-1 sector.

Eli Lilly’s Rising Influence

Eli Lilly (LLY) has become the biggest competitive threat to Novo Nordisk, thanks to the rapid commercial success of Mounjaro (for diabetes) and its obesity-focused twin Zepbound. Both drugs use tirzepatide, a next-generation GLP-1/GIP dual agonist that has shown even greater weight-loss efficacy in clinical trials compared to Wegovy.

As demand for LLY’s treatments accelerates and production capacity expands, Novo Nordisk’s Wegovy faces an uphill battle to maintain market share.

Market Outlook and Investor Concerns

Despite slowing growth, analysts say the GLP-1 market is still in its early stages, with long-term potential for expansion. However, pricing pressures, generic entrants, and government scrutiny on drug affordability could weigh on profits for both Novo Nordisk and LLY in the coming years.

Novo Nordisk is expected to invest further in expanding its production capacity and developing next-generation weight-loss drugs to remain competitive. Still, the company’s near-term growth trajectory appears constrained by increased rivalry and moderating consumer demand.

Conclusion

The Wegovy slowdown underscores a major turning point for Novo Nordisk and the broader weight-loss drug industry. Once viewed as an unstoppable growth engine, the market is now entering a more competitive and cost-sensitive phase — with Eli Lilly (LLY) emerging as a dominant force.

For Novo Nordisk, the challenge lies in balancing innovation, production, and pricing to sustain its leadership amid growing competition.For ongoing updates on pharmaceutical innovation, biotech competition, and health-tech startups, visit StartupNews.fyi — your trusted source for breaking business and healthcare insights.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)