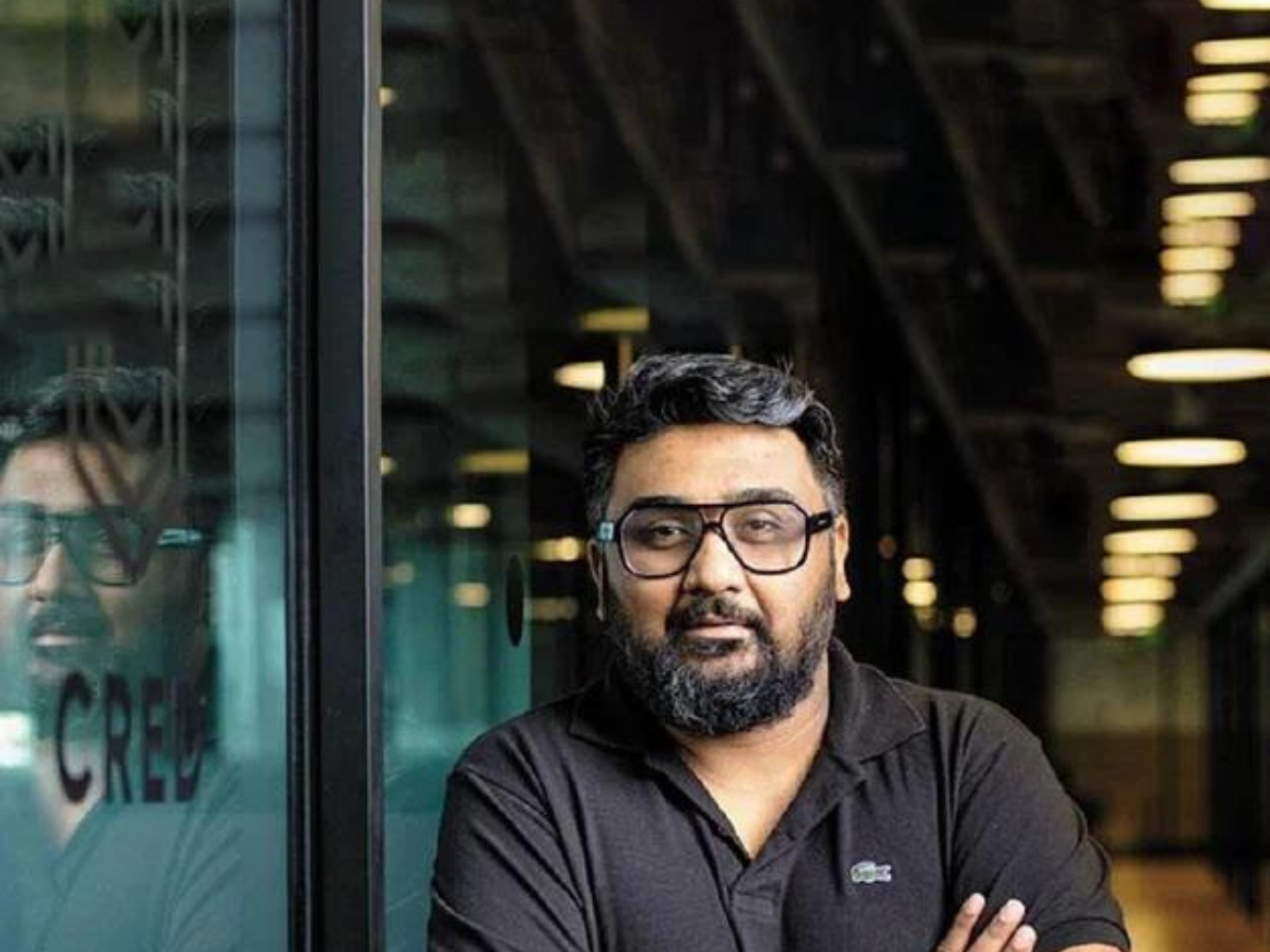

At a time when big-ticket Indian startups have come under the spotlight for soaring losses, fintech major CRED’s founder and CEO Kunal Shah has said that the Indian fintech ecosystem would not have experienced its current levels of growth without these loss-making companies.

“Unless we had these loss-making companies, we would have not seen the fintech growth that we have seen so far,” Shah said during Global Fintech Fest 2023.

Speaking at the Global Fintech Fest 2023, Shah emphasized that such companies have been instrumental in driving the growth of the UPI as they help establish distribution networks and foster a positive change in consumer behavior.

While speaking with CNBC-TV18’s Shereen Bhan, Shah urged people to shift their focus from celebrating “unicorns” to lauding founders who have built profitable enterprises without relying heavily on capital.

“Stop worshipping unicorns, they are mythical.. We should not celebrate people like Kunal Shah way more than we should be celebrating hundreds of founders who have built very very profitable companies who are not even known. The country always had entrepreneurial spirit, it is the capital that is a new thing,” added Shah.

The CRED founder also noted that the country’s startup ecosystem was entering a ‘very problematic time’ where founders believed that business could be built without capital. He further noted that raising serious capital, going forward, would require some traction and demonstration of product-market fit by startups.

Expressing optimism about the fintech space, Shah said that financial services have the potential to make money. He added that he was ‘lucky’ to have investors who helped him build his company at scale and focus on credit And credit cards.

He also estimated that a majority of Indian unicorns that have a revenue run rate in excess of $100 Mn – $200 Mn are fintechs. The CRED founder also claimed that nearly 40% of 183 Indian companies, with more than INR 1,000 Cr profit after tax (PAT), were within the financial services sector.

Curiously, CRED continues to be a loss-making entity. The fintech startup saw its losses balloon more than 2.4X year-on-year (YoY) to INR 1,279 Cr during the financial year 2021-22 (FY22), compared to INR 524 Cr in FY21. On the other hand, revenue from operations jumped 4.4X to INR 393.5 Cr in FY22 from INR 88.6 Cr in the previous fiscal.

Pegged at a valuation of $6.4 Bn and having raised over $800 Mn in funding till date, CRED counts marquee names such as Singapore’s sovereign wealth fund GIC, Sequoia Capital, Tiger Global and Alpha Wave as its investors.

Despite a long list of influential backers, CRED, just like its peers, has been facing heat from its investor ecosystem as losses mount with a sustainable path to profitability. As a result, the fintech juggernaut has tried to get its act together in the past few months.

From venturing into the UPI space to strengthening its lending play, CRED has taken a host of measures to alternate revenue streams while looking to monetise existing channels. It has also undertaken a slew of launches, from venturing into luxury travel space with CRED escapes to unveiling its buy-now-pay-later (BNPL) service, called CRED Flash. It also rolled out a tap-to-pay offering for retail payments using credit cards.

While primarily banking on its product sophistication and design so far to distinguish itself from other players in the market, the mounting pressure for profits was evident as it laid off about 35% of its subsidiary Happay’s workforce earlier this year.

However, CRED is not alone in this. Financial data analysed by Inc42 of 48 fintech unicorns and soonicorns revealed that a majority, 40, posted losses in FY22. Besides, top 28 Indian fintech startups, 13 unicorns and 15 soonicorns, surveyed by Inc42 splurged INR 5,495.16 Cr in FY22 on marketing expenses even as funding winter continued to grip the ecosystem.

As capital drought continues to batter the ecosystem, the focus appears to be back on generating profitable numbers. With Shah and investors now betting on the startups making moolah, it remains to be seen whether sanity returns to the markets as local players chart a clear path to sustainable growth.

The post title=”Fintech Sector Wouldn’t Have Achieved Current Growth Levels Without Loss-Making Companies: Kunal Shah” href=”https://inc42.com/buzz/fintech-sector-wouldnt-have-achieved-current-growth-levels-without-loss-making-companies-kunal-shah/”>Fintech Sector Wouldn’t Have Achieved Current Growth Levels Without Loss-Making Companies: Kunal Shah appeared first on Inc42 Media.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)