Silver prices have climbed close to $79 per ounce, marking an all-time high. The rally is being driven by strong industrial demand, rising investor interest, and tightening global supply, pushing silver into focus as one of the best-performing commodities.

Introduction

The precious metals market is witnessing a historic moment as silver prices approach levels never seen before. Long viewed as both an industrial metal and a store of value, silver is benefiting from a rare alignment of macroeconomic, technological, and investment-driven factors.

What’s Driving the Silver Price Rally

Strong Industrial Demand

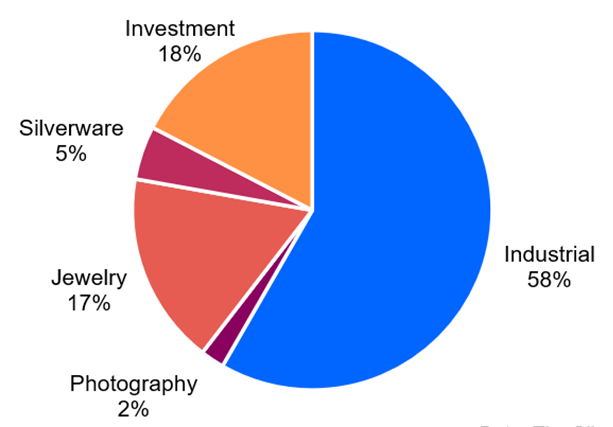

- Silver plays a critical role in solar panels, electric vehicles, and electronics.

- Clean energy expansion has significantly increased long-term consumption.

- Industrial usage now accounts for a growing share of total demand.

Investor Interest Accelerates

- Investors are increasingly turning to silver as a hedge against inflation.

- High interest in physical silver and exchange-traded products has tightened supply.

- Comparisons with gold valuations have also boosted silver’s appeal.

Supply Constraints

- Global silver production growth has lagged behind demand.

- Mining output has been constrained by operational and regulatory challenges.

- Limited new supply has amplified price pressure.

Market Context and Comparisons

Silver vs Gold

- Silver has outperformed gold during the recent rally.

- The gold-to-silver ratio has narrowed, reflecting stronger silver momentum.

- Analysts note silver’s dual role gives it higher volatility during upcycles.

Broader Commodities Landscape

- Rising commodity prices reflect inflation concerns and geopolitical uncertainty.

- Energy transition metals are attracting sustained capital inflows.

- Silver sits at the intersection of industrial growth and financial hedging.

Risks and Volatility

Price Swings

- Silver remains more volatile than gold.

- Rapid gains can be followed by sharp corrections.

Economic Sensitivity

- Industrial demand ties silver closely to global economic conditions.

- Slowdowns in manufacturing could temper future gains.

Conclusion

Silver’s surge toward $79 per ounce represents a landmark moment for the metal. Driven by industrial transformation, investor demand, and constrained supply, the rally highlights silver’s evolving role in global markets. While volatility remains a risk, the current momentum underscores why silver has captured renewed attention from both investors and industry participants.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)