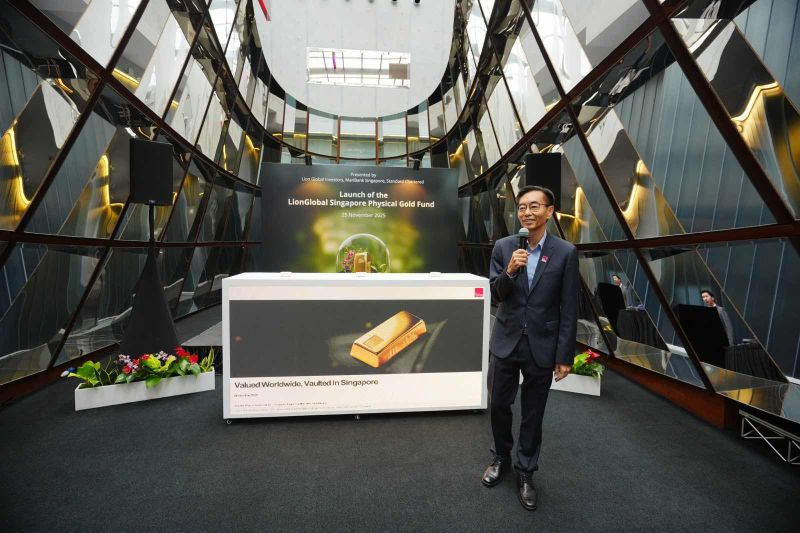

MariBank has launched Mari Invest Gold, a new investment offering that enables its customers to invest in the LionGlobal Singapore Physical Gold Fund with a minimum of just $1, making it the first digital bank in Singapore to do so.

Mari Invest Gold will be offered through a new unit class, Class MariBank SGD Hedged (Acc), exclusive to MariBank’s customers, and is managed by asset management company Lion Global Investors. Standard Chartered Bank Singapore serves as the fund’s custodian and ensures the secure storage of the physical gold holdings. The fund invests in physical gold bars of at least 99.5% purity, stored securely in vaults in Singapore, and tracks the performance of the London Bullion Market Association (LBMA) Gold Price AM, which is a widely used benchmark for daily gold prices.

In line with MariBank’s goal of providing a simple, reliable, and rewarding banking experience, Mari Invest Gold offers a convenient option for customers to access the gold market. Investing in gold is generally viewed as a strategy for wealth preservation during periods of economic uncertainty and may act as a safety net for an investor’s portfolio.

Now available to the public, Mari Invest Gold expands MariBank’s growing suite of investment products launched since 2023. To date, approximately 30% of MariBank’s customers have taken up a MariBank investment product.

Mari Invest SavePlus, the first fund launched under the Mari Invest product line, distributes the Lion-MariBank SavePlus fund also managed by Lion Global Investors, which invests in MAS bills and high quality bond funds. It has grown to S$1.135 billion in assets under management as of 30 November 2025. MariBank also offers instant daily withdrawal1 of up to S$10,000 for Mari Invest SavePlus, providing flexibility alongside security.

Mari Invest Income, which joined the Mari Invest product line in February 2025, distributes the PIMCO GIS Income Fund Admin SGD Hedged – Inc, caters to users seeking steady monthly payouts. This product has seen an exceptional reception from MariBank’s customers, with its assets under administration growing tenfold since the first month of launch.

Both Mari Invest SavePlus and Mari Invest Income have seen steady growth in terms of both new user sign-ups and amount of investment. This is indicative of MariBank’s success in providing its users access to fuss-free investing solutions, tying in with its mission of serving underserved needs. The bank is also continually innovating its products to give its users the financial confidence to navigate challenging economic times.

“MariBank continues to identify new ways to meet our customers’ evolving financial needs. Our latest partnership with Lion Global Investors to launch Mari Invest Gold extends the

About MariBank Singapore Private Limited

MariBank, a digital bank, is a wholly owned subsidiary of Sea Limited and operates under a license from the Monetary Authority of Singapore (MAS). At MariBank, we aim to support the banking needs of digital natives and small businesses in Singapore through the provision of simple and purpose-built banking products. MariBank’s initial offering was the Mari Savings Account, which was subsequently complemented by a suite of credit and payment facilities, as well as wealth management products.

About Lion Global Investors Limited

Lion Global Investors Limited (Co Reg No. 198601745D) is a part of Great Eastern Holdings and a member of the Oversea-Chinese Banking Corporation Limited (OCBC) Group.

Established since 1986, it is a leading and one of the largest asset management companies in Southeast Asia, uniquely positioned to provide Asian equities and fixed income strategies and funds to both institutional and retail investors. As at 30 September 2025, our assets under management (AUM) stands at S$78.6 billion (US$60.9 billion). For more about Lion Global Investors Limited, please visit: www.lionglobalinvestors.com

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)