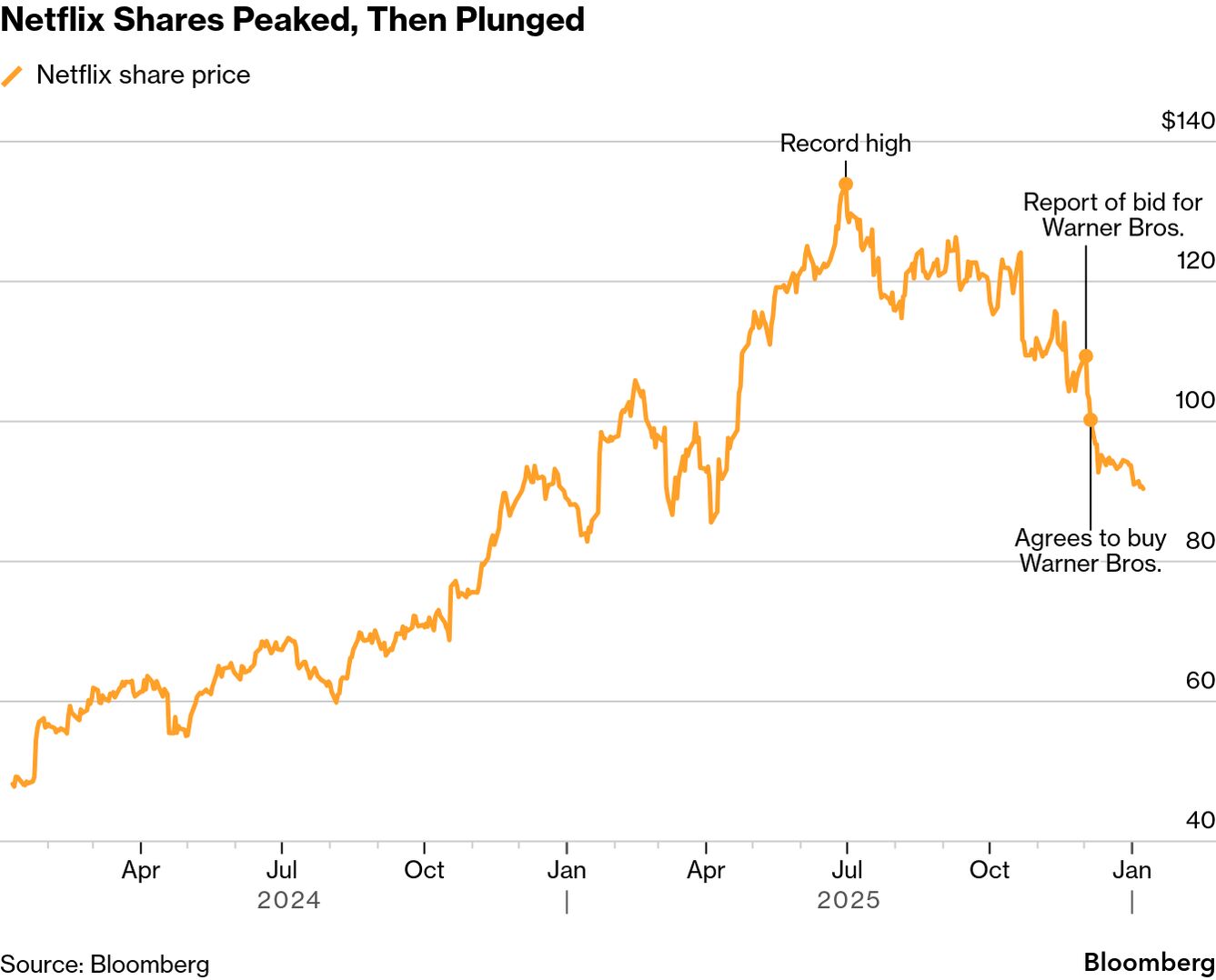

Netflix shares pulled back following a broader media-sector selloff triggered by Warner Bros. Discovery, but valuation concerns remain. Despite strong fundamentals and subscriber momentum, Netflix stock still trades at a premium, raising questions about upside potential at current levels.

Introduction

Netflix shares have come under renewed scrutiny after a sharp selloff across media and entertainment stocks sparked by disappointing signals from Warner Bros. Discovery. While Netflix was not at the center of the warning, the broader sector reaction dragged its shares lower, prompting investors to reassess valuations across streaming platforms.

Even after the pullback, many analysts argue that Netflix stock remains expensive relative to peers and historical benchmarks. The company’s strong execution, profitability improvements, and leadership in global streaming are well recognized. However, the current share price reflects high expectations, leaving limited room for error.

This article examines why Netflix stock is still considered pricey despite the selloff, how the Warner Bros.-induced market reaction reshaped sentiment, and what investors should watch next.

The Warner Bros.-Induced Selloff Explained

The recent decline in streaming and media stocks followed cautionary commentary and financial updates from Warner Bros. Discovery, which raised concerns about advertising trends, content costs, and broader demand uncertainty.

Although Warner Bros. Discovery operates under a different business model than Netflix, investors often treat media stocks as a sectoral group. Negative news from one major player can trigger reassessments across the entire space.

The selloff reflected broader concerns including:

- Slower advertising recovery

- High content spending

- Pressure on margins

- Intensifying competition in streaming

Netflix shares declined in sympathy, even though the company’s fundamentals differ meaningfully from traditional media firms.

Netflix’s Business Model Stands Apart

Unlike many legacy media companies, Netflix is a pure-play streaming platform with a global subscription base. It does not rely on cable networks, theatrical releases, or advertising to the same extent as competitors.

Key distinctions include:

- Global scale across more than 190 countries

- Subscription-first revenue model

- Strong data-driven content strategy

- Growing free cash flow generation

These advantages have helped Netflix outperform peers over time, but they also contribute to its premium valuation.

Why Netflix Stock Is Still Considered Pricey

Elevated Valuation Multiples

Even after the Warner Bros.-induced selloff, Netflix continues to trade at valuation multiples that exceed most media and entertainment peers.

On a forward basis, Netflix’s price-to-earnings and enterprise value-to-EBITDA ratios remain elevated. Investors are paying a premium for perceived quality, stability, and long-term growth.

This pricing assumes:

- Continued subscriber growth

- Sustained pricing power

- Controlled content spending

- Expansion in operating margins

Any deviation from these assumptions could pressure the stock.

High Expectations Are Already Priced In

Netflix’s recent strategic wins — including password-sharing monetization and its ad-supported tier — have boosted investor confidence. However, these initiatives are now well understood by the market.

With expectations elevated, incremental upside becomes harder to achieve. Strong results may simply confirm what investors already expect, while even modest disappointments could lead to outsized downside reactions.

This dynamic is a key reason why some analysts caution against chasing the stock at current levels.

Impact of the Warner Bros. News on Netflix Sentiment

While Netflix was not directly affected by Warner Bros. Discovery’s guidance, the selloff prompted a broader valuation reset discussion.

Investors began asking:

- Are streaming growth rates slowing industry-wide?

- Can content spending remain disciplined?

- How resilient are margins in a weaker advertising environment?

For Netflix, these questions matter because its premium valuation depends on consistent outperformance relative to peers.

Netflix’s Financial Strengths

Improving Profitability

Netflix has made significant progress in improving margins over the past two years. Management has emphasized disciplined content spending and operational efficiency, leading to stronger operating income.

The company has also shifted its narrative from growth-at-all-costs to sustainable profitability, which has resonated with long-term investors.

Free Cash Flow Expansion

One of Netflix’s most notable improvements has been free cash flow generation. After years of heavy cash burn driven by content investments, the company now consistently generates positive free cash flow.

This shift strengthens Netflix’s balance sheet and supports share buybacks, further enhancing shareholder returns.

Competitive Landscape Remains Intense

Despite Netflix’s leadership position, competition in streaming remains fierce.

Key challenges include:

- Aggressive content spending by rivals

- Fragmentation of consumer attention

- Pricing sensitivity in certain markets

While some competitors have scaled back investments, others continue to prioritize subscriber growth, increasing pressure on Netflix to maintain differentiation.

Advertising Tier: Opportunity and Risk

Netflix’s ad-supported tier is often cited as a major growth driver. The model opens the platform to price-sensitive consumers while unlocking a new revenue stream.

However, advertising introduces new complexities:

- Exposure to advertising market cycles

- Need for advanced ad-tech infrastructure

- Competition with established ad-supported platforms

The Warner Bros.-related advertising concerns highlight why investors are watching this segment closely, even for Netflix.

International Growth and Currency Risks

Netflix’s international footprint remains a key growth engine. Emerging markets offer large addressable audiences but lower average revenue per user.

Currency fluctuations, regional regulations, and local competition can all affect profitability. While Netflix has navigated these challenges well so far, they remain ongoing risks.

What Analysts Are Saying

Wall Street remains divided on Netflix at current levels.

Bullish analysts point to:

- Market leadership

- Strong execution

- Expanding margins

More cautious voices argue:

- Valuation leaves little margin for error

- Growth may moderate

- Competitive pressures persist

The Warner Bros.-induced selloff has amplified these debates, even if Netflix’s fundamentals remain intact.

Investor Psychology After the Selloff

The recent pullback has attracted interest from momentum and long-term investors alike. However, the question remains whether the decline represents a buying opportunity or merely a pause in an overextended rally.

For valuation-conscious investors, patience may be warranted. For growth-oriented investors, Netflix’s dominance continues to justify attention, albeit with heightened risk awareness.

What Could Justify Further Upside

For Netflix stock to meaningfully outperform from current levels, several factors would likely need to materialize:

- Stronger-than-expected subscriber growth

- Significant advertising revenue acceleration

- Further margin expansion

- Successful content strategy execution

Absent these catalysts, returns may align more closely with earnings growth rather than valuation expansion.

Risks to Watch Going Forward

Key downside risks include:

- Slower global subscriber growth

- Rising content costs

- Advertising market weakness

- Regulatory changes in key markets

The Warner Bros. episode serves as a reminder that sentiment can shift quickly across the media sector.

Internal Linking Suggestions

To strengthen topical authority and SEO, consider adding internal links to:

- An article on streaming industry competition

- A deep dive into media sector valuations

- A feature on advertising trends in digital media

- A comparison piece on Netflix vs traditional media companies

- A broader market analysis on tech and media stock volatility

These links help contextualize Netflix within the wider industry narrative.

Conclusion

Netflix remains one of the strongest operators in global streaming, with improving profitability, solid free cash flow, and a clear strategic vision. However, even after the Warner Bros.-induced selloff, the stock continues to trade at a premium that reflects high expectations.

For investors, the debate is no longer about Netflix’s quality, but about valuation and future upside. The recent sector volatility has highlighted both the resilience of Netflix’s business model and the risks of paying too much for even the best companies.

As media stocks continue to adjust to shifting market conditions, Netflix’s ability to justify its premium will depend on execution, discipline, and sustained growth in an increasingly competitive landscape.

Key Highlights

Investors remain divided on near-term opportunity

Netflix shares pulled back amid a Warner Bros.-led media selloff

Valuation remains elevated despite the decline

Strong fundamentals support the premium, but limit upside

Advertising and international growth are key variables

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)