Palantir’s current market valuation implies sustained high growth in revenue and profits over the next several years. Analysts say the company must significantly accelerate commercial adoption to meet those expectations as government growth moderates.

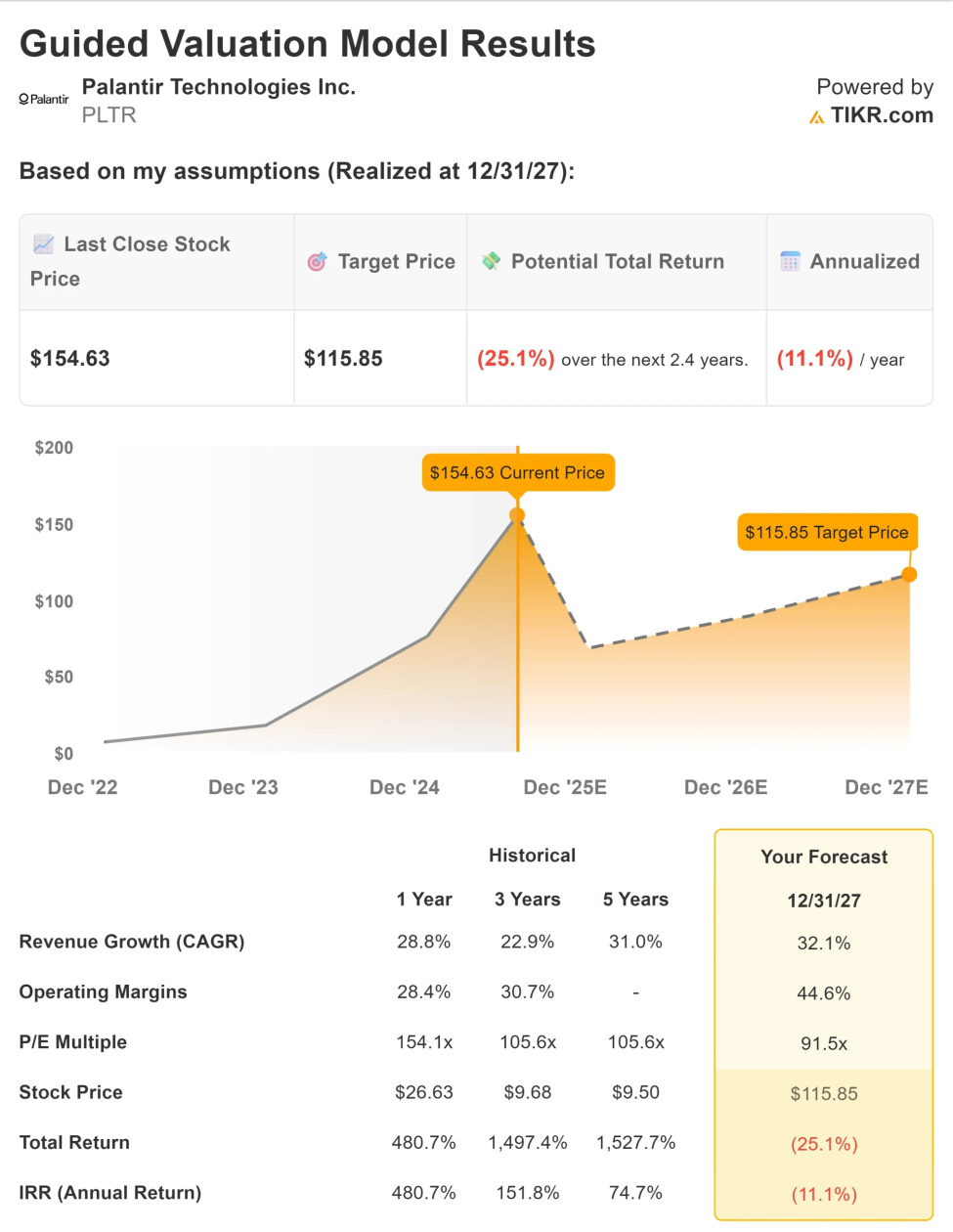

Palantir’s stock has surged over the past year, propelled by enthusiasm around artificial intelligence and the company’s expanding commercial business. But that rally has also raised a harder question for investors: how much growth does Palantir actually need to deliver to justify where its shares are trading today?

The answer matters because Palantir is no longer a speculative startup. It is a profitable, publicly traded software company with increasing scrutiny on margins, customer concentration, and long-term scalability. As expectations rise, so does the cost of missing them.

At the center of the debate is whether Palantir can evolve from a niche government contractor into a broad-based enterprise AI platform.

A valuation built on acceleration, not stability

Palantir Technologies currently trades at a valuation that implies years of strong double-digit revenue growth, according to analysts cited in recent market commentary. That is a demanding benchmark for any software company, particularly one whose early success was driven by large, lumpy government contracts.

Historically, its revenue growth has slowed as its government business matured. While those contracts remain sticky and lucrative, they are less likely to deliver the kind of acceleration investors now expect.

That has shifted attention to Palantir’s commercial segment, which includes private-sector customers using its Foundry and AI platforms for operations, analytics, and decision-making.

Commercial growth is the key variable

In recent quarters, the company has reported faster growth in its U.S. commercial business, helped by demand for AI-driven tools and new product offerings. Management has positioned this segment as the company’s primary engine for future expansion.

The challenge is scale. To support its current valuation, Palantir would need to sustain elevated growth rates across a much larger revenue base, not just from a handful of high-profile enterprise wins.

For investors, that means watching not only headline revenue growth, but also customer count, deal size distribution, and expansion within existing accounts.

Profitability raises the bar further

Unlike many high-growth software firms, Palantir is already profitable under generally accepted accounting principles. That strengthens its credibility but also tightens expectations.

Once a company crosses into consistent profitability, markets tend to focus less on vision and more on execution. Margins, operating leverage, and cash flow discipline become central to the story.

Palantir’s valuation assumes it can expand profits alongside revenue, even as it continues to invest heavily in sales, marketing, and product development to compete with larger enterprise software rivals.

Competitive pressure in the AI software market

Palantir is not operating in a vacuum. Enterprise AI and data analytics have become crowded markets, with established players and cloud providers integrating similar capabilities into broader platforms.

That competition could pressure pricing and slow adoption, particularly among cost-sensitive customers. To meet growth expectations, Palantir must convince enterprises that its software delivers differentiated value that justifies long-term commitments.

For startups in the AI tooling space, Palantir’s trajectory offers a case study in how difficult it is to transition from bespoke, high-touch deployments to repeatable, scalable software sales.

What investors will be watching next

Looking ahead, Palantir’s growth requirements are less about a single quarter and more about consistency. Sustained commercial expansion, improving margins, and reduced reliance on government contracts would all support the company’s valuation narrative.

Failure to deliver on those fronts would not necessarily signal trouble for the business itself, but it could force a reset in market expectations.

For now, Palantir sits at a crossroads familiar to many maturing tech companies: strong technology, rising ambition, and a valuation that leaves little room for disappointment.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)