Gyde, an AI-native brokerage platform based in Austin, Texas, has emerged from stealth with a $60 million capital raise led by Lightspeed Venture Partners alongside participation from Optum Ventures, Crystal Venture Partners, Virtue, MVP Ventures and other institutional backers.

The company’s launch — and its significant first funding round — arrives at a moment when venture capital continues to flow into fintech and InsurTech startups that promise to automate legacy segments of financial advice and agency work. In 2025 alone, fintech firms have attracted a staggering volume of investment across dozens of deals, underscoring investor appetite for innovation in financial services.

Bridging Legacy Brokerage and Modern AI Tools

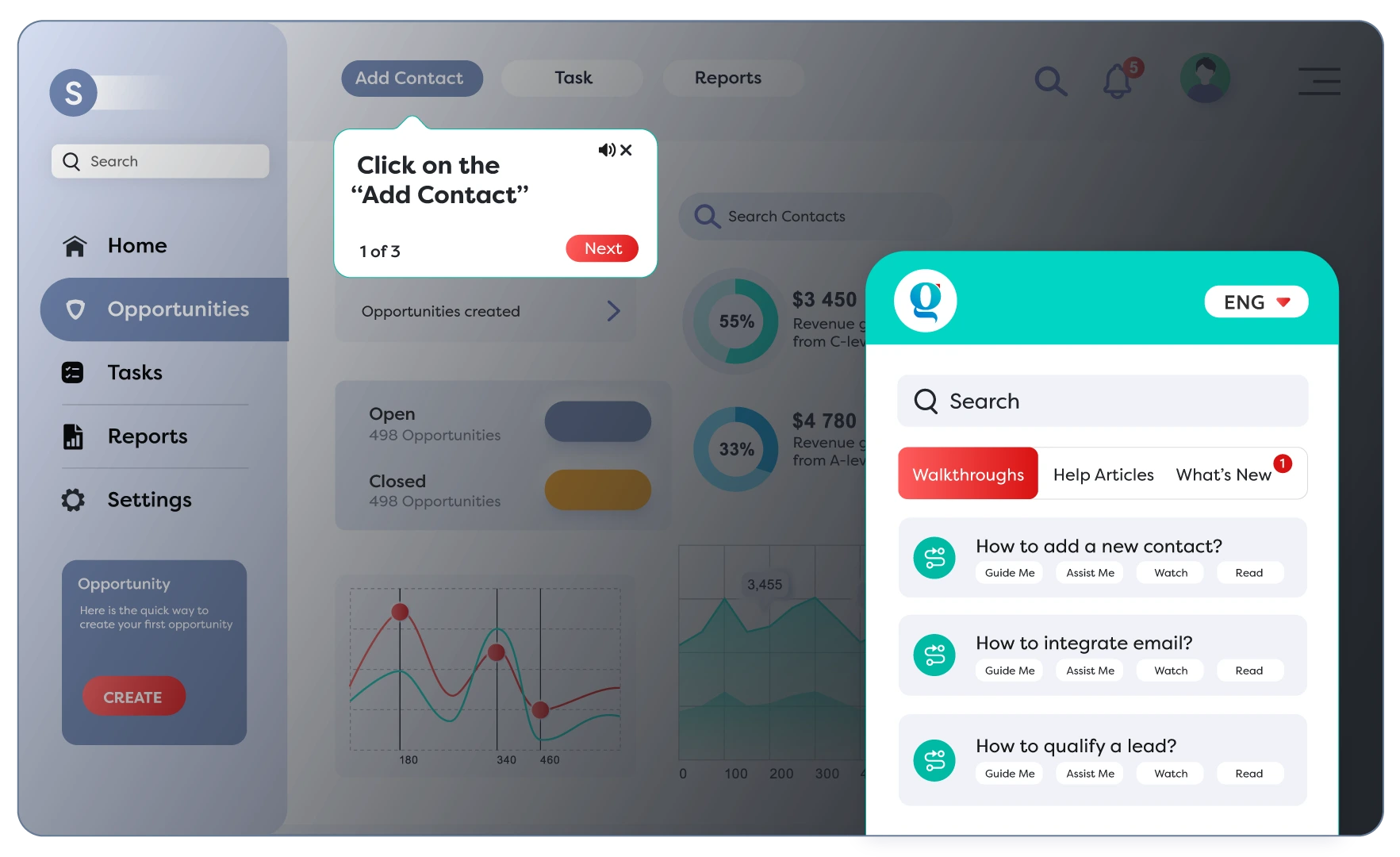

Gyde’s platform combines an intelligent broker operating system, GydeOS, with an AI assistant called Gia. Together, these technologies are designed to automate routine tasks, streamline customer interactions and enhance decision support for human brokers — a hybrid model that seeks to preserve advisor relationships while boosting efficiency.

According to related public reports from Lightspeed’s own communications, the AI stack aims to reduce administrative overhead for agencies and create a more consistent, high-touch advisory experience at scale.

The startup’s initial go-to-market focus is on health insurance agencies, particularly those active in Medicare Advantage, employee benefits, and individual markets, with plans to announce its first partner cohort in the coming months.

Why It Matters in Fintech and Insurtech

The brokerage market — especially for insurance — is notoriously fragmented, with tens of thousands of independent agencies and uneven technology adoption. Investment into a platform like Gyde reflects a broader industry push to modernize workflows and customer experiences through AI and data automation.

For brokers, automation platforms promise to reduce low-value, repetitive work and free up time for more complex client engagements. For insurers and their distribution partners, improved efficiency can translate into deeper client relationships and higher lifetime profitability.

From an investor perspective, the sizable round — led by a Tier-1 venture firm — signals confidence that brokerage infrastructure remains ripe for digital transformation. Lightspeed’s involvement, along with strategic participation from health-adjacent capital like Optum Ventures, underscores the intersection of fintech, insurtech and health services as a fertile ground for new technology platforms.

Startup Context and Competitive Landscape

Gyde’s funding entry comes amid a dynamic VC environment where AI-driven fintech startups continue to attract major checks. Across the industry, firms combining domain expertise with generative AI and automation are competing for share in segments such as lending, insurance, and wealth management.

As incumbents — from legacy broker software providers to consultancies — increasingly explore AI augmentation, new entrants like Gyde may reshape brokerage economics by lowering barriers to technology adoption and standardizing previously manual processes.

Looking Ahead

In the next 6–12 months, Gyde plans to expand partnerships with agencies and refine its AI tooling to scale across different lines of financial advice beyond insurance. The company’s progress could serve as an early indicator for how generative and decision support AI can be embedded into traditional advisory ecosystems.

For founders and investors, Gyde’s launch highlights a persistent trend: AI is not just a front-end feature for customer apps, but a foundational layer for industry infrastructure startups with the potential to redraw competitive lines in established markets.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)