Urban Company reported higher partner earnings in 9M FY26, with average net monthly income reaching ₹28,322 and top performers earning up to 60% more than entry-level IT salaries.

Urban Company has reported a steady rise in earnings for service professionals on its platform, underscoring the growing income potential of gig-based, skill-led work in India’s urban services economy.

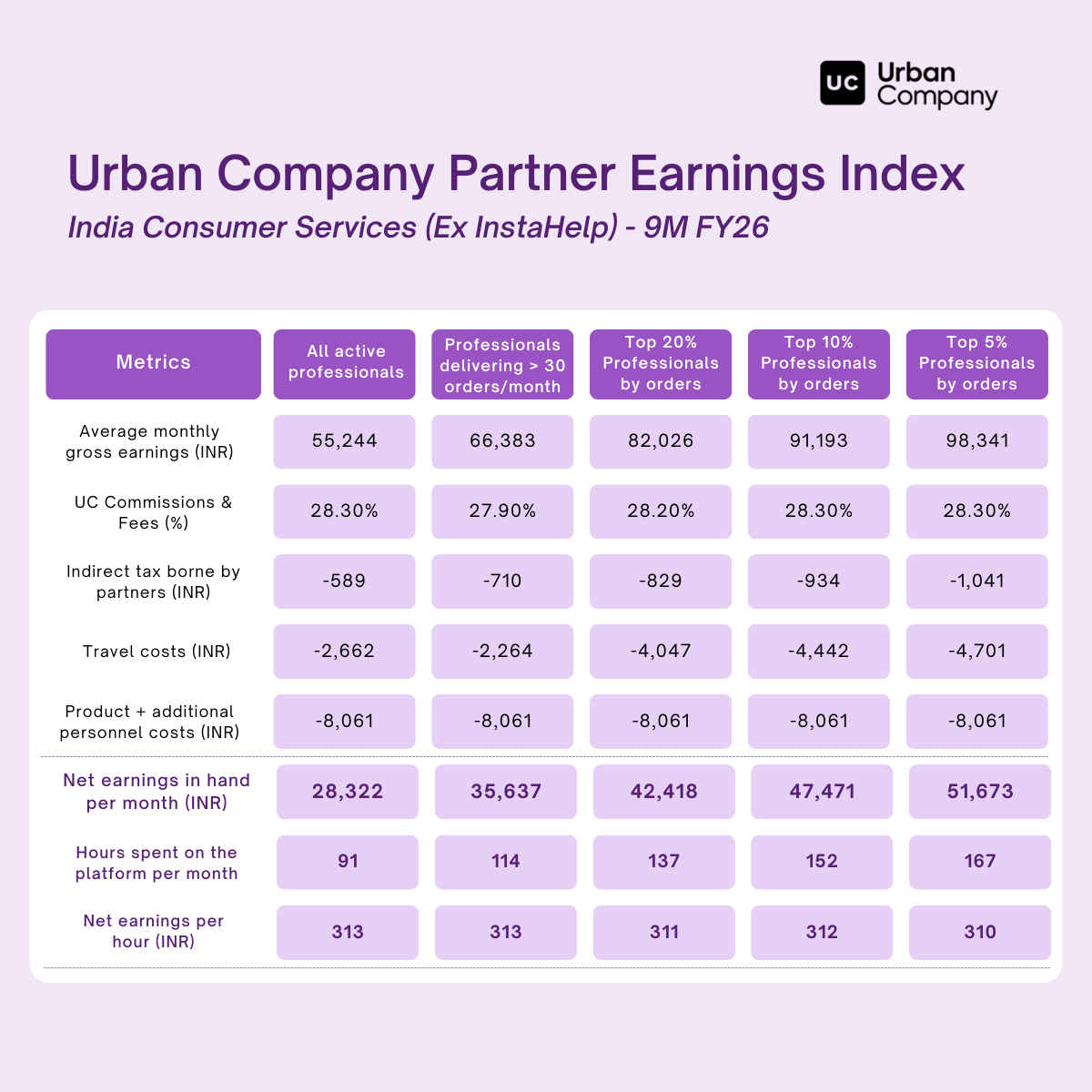

According to the company’s latest partner earnings data for the nine months ended FY26, average monthly net in-hand earnings for all active service partners stood at ₹28,322, up from ₹26,489 in the corresponding period last year. The growth reflects sustained demand across service categories, as well as improvements in platform efficiency and utilisation.

Strong earnings across partner cohorts

Urban Company’s data points to consistent earning opportunities across different cohorts of service professionals, with meaningful upside for those who increase engagement and performance on the platform.

At the upper end of the earnings spectrum:

- The top 20% of service professionals earned an average of ₹42,418 per month, net in hand

- The top 10% earned ₹47,471 per month, net in hand

- The top 5% earned ₹51,673 per month, net in hand

On average, partners spent 91 hours per month active on the platform, translating into net earnings of approximately ₹313 per hour — a level meaningfully above statutory minimum wage benchmarks across several urban markets.

Comparable — and often higher — than IT fresher salaries

Urban Company highlighted that service professionals on the platform now earn at par, and in many cases significantly more, than entry-level salaried professionals in India’s IT and ITeS sectors.

With average net monthly earnings of ₹28,322, partner income is broadly comparable to typical IT fresher salaries, which are estimated at around ₹4 lakh per annum based on publicly available industry data.

The earnings gap widens substantially with tenure and performance:

- The top 20% of Urban Company service professionals earn approximately 30% more than an average entry-level IT professional

- The top 10% earn about 45% more

- The top 5% earn nearly 60% more

This sustained differential highlights the platform’s merit-based income structure, where higher engagement and service quality directly translate into materially higher earnings.

Focus on partner ecosystem health

Commenting on the earnings data, Abhiraj Singh Bhal, Chief Executive Officer of Urban Company Limited, said:

“Sustained earnings growth is a very important indicator of a healthy partner ecosystem. Our focus remains on nurturing that ecosystem by strengthening demand, improving efficiency, and investing in the long-term career progression of service partners on our platform.”

The company has increasingly positioned itself not just as a marketplace, but as a long-term livelihood platform for skilled service professionals.

Investments beyond income

In addition to earnings, Urban Company continues to invest in partner enablement across safety, insurance, financial security, training, and technology.

All active service professionals on the platform are covered under group life and accidental insurance, including:

- Life insurance cover of up to ₹10 lakh

- Disability cover of up to ₹6 lakh

- Accidental hospitalisation and OPD treatment coverage

Recently, Urban Company partnered with HDFC Pension to facilitate access to the National Pension System (NPS) for service professionals, supporting long-term retirement planning.

Training and career progression

The company also invests heavily in training and upskilling, supported by 300+ full-time trainers and training centres across India. Through its partnership with the National Skill Development Corporation, service professionals receive structured training and Skill India–certified digital credentials.

High-performing partners also have opportunities to transition into full-time trainer roles within Urban Company, creating clearer pathways for career advancement beyond frontline service delivery.

A changing view of platform work

Urban Company’s latest data comes amid a broader reassessment of gig and platform-based work in India. While flexibility has long been a key draw, income stability, benefits, and progression pathways are increasingly central to how such platforms are evaluated.

With partner earnings now rivaling — and in many cases exceeding — traditional entry-level white-collar roles, the data suggests that skilled service platforms are emerging as a credible alternative career track for a growing segment of India’s workforce.

As demand for home and personal services continues to expand in urban India, platforms that can combine consistent earnings with long-term security may play a defining role in the future of work.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)