Chinese chipmaker Montage Technology is preparing a Hong Kong IPO seeking up to $900 million, spotlighting investor appetite for semiconductor firms.

China’s semiconductor strategy increasingly runs through capital markets.

Montage Technology is preparing to debut in Hong Kong with an initial public offering that could raise as much as $900 million, according to people familiar with the plans. The listing comes as China seeks to strengthen its domestic chip ecosystem amid ongoing geopolitical and supply chain pressures.

For investors, the deal is a test of confidence as much as a fundraising event.

Why Montage matters

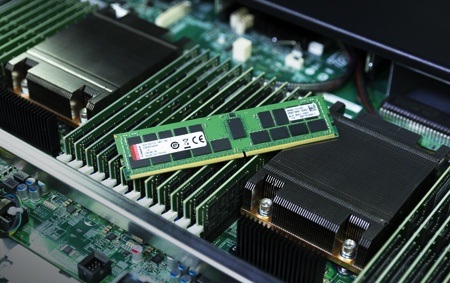

Montage focuses on high-performance memory interface chips used in servers and data centers—components that sit behind the AI boom even if they rarely make headlines.

These chips play a critical role in managing data flow between processors and memory, making them increasingly important as workloads grow more demanding.

That positioning places Montage within the strategic core of China’s push to localize key semiconductor technologies.

Hong Kong as a financing gateway

Choosing Hong Kong reflects both opportunity and constraint. Mainland listings face regulatory complexity, while overseas markets carry geopolitical risk.

Hong Kong offers access to international capital while remaining politically aligned with Beijing’s broader technology goals. For Chinese chip firms, it has become a preferred venue for large-scale fundraising.

Still, investor scrutiny has intensified, particularly around profitability, customer concentration, and exposure to export controls.

Market timing is delicate

Global semiconductor stocks have been volatile, shaped by AI optimism on one hand and cyclical concerns on the other.

Montage’s IPO will need to convince investors that demand for its products is durable, not merely tied to a single wave of infrastructure spending.

Pricing will matter. A successful debut could open the door for other Chinese chipmakers considering public markets. A weak one could reinforce caution.

More than one company’s outcome

Montage’s listing is part of a larger story: how China finances technological self-reliance.

Public markets are being asked to underwrite long-term industrial strategy, not just short-term earnings growth.

Whether investors are willing to do so—at scale—will shape the next phase of China’s semiconductor ambitions.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)