Tampa Bay households carry the nation’s steepest debt load—about a 2.3 : 1 debt-to-income ratio—as highlighted in the 2024 University of South Florida State of the Region report.

According to a randomized Consumer Financial Protection Bureau (CFPB) evaluation, coaching participants boosted savings by nearly $1,200, slashed debt by more than $10,000, and lifted credit scores an average 21 points.

With pressure that high, many residents are swapping traditional investment chatter for hands-on money coaching. Below, we spotlight nine Tampa Bay coaching firms—each “best” for a specific need—so you can choose the partner who moves your money story forward.

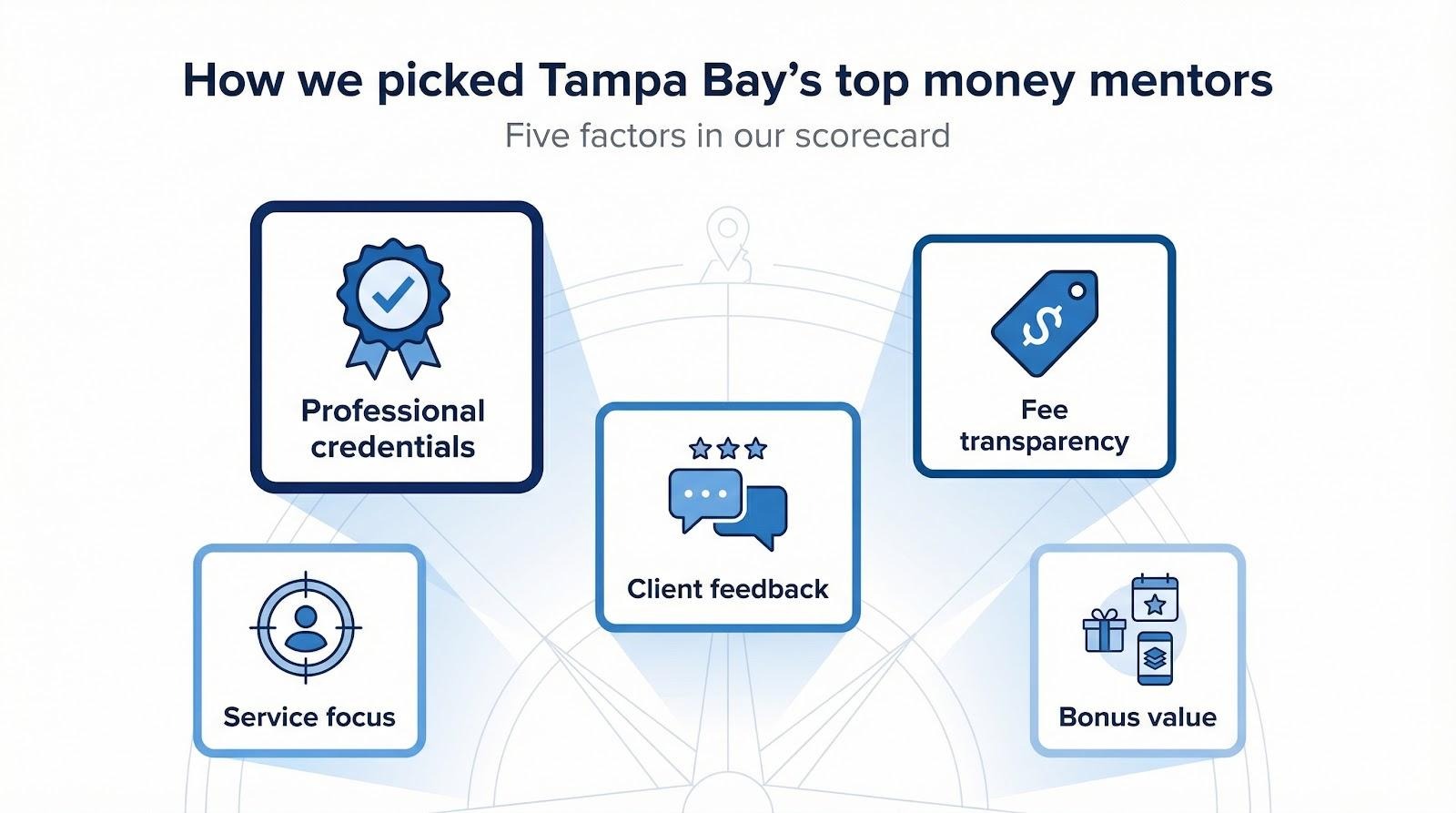

How we picked the nine stand-outs

We began with fifteen Tampa-area money mentors, from solo Ramsey coaches to full-service registered investment advisers.

Each firm was graded on five factors that clients care about: professional credentials, service focus, fee transparency, client feedback, and bonus value such as community classes or budgeting apps.

Credentials carried the most weight. A CFP® or AFC® signals formal training plus an enforceable code of ethics.

Pricing clarity came next. Fee-only or flat-fee planners outscored commission models, echoing a broader move toward conflict-free advice that Financial Compass Hub calls “a transparent model like never before.”

We also combed recent Google, BBB, and Wealthtender reviews, hunting for consistent trust signals rather than isolated praise.

Last, we rewarded a clear niche—veterans, entrepreneurs, or women in transition—because specialists usually solve problems faster than generalists.

The nine services that topped our scorecard make up the list below.

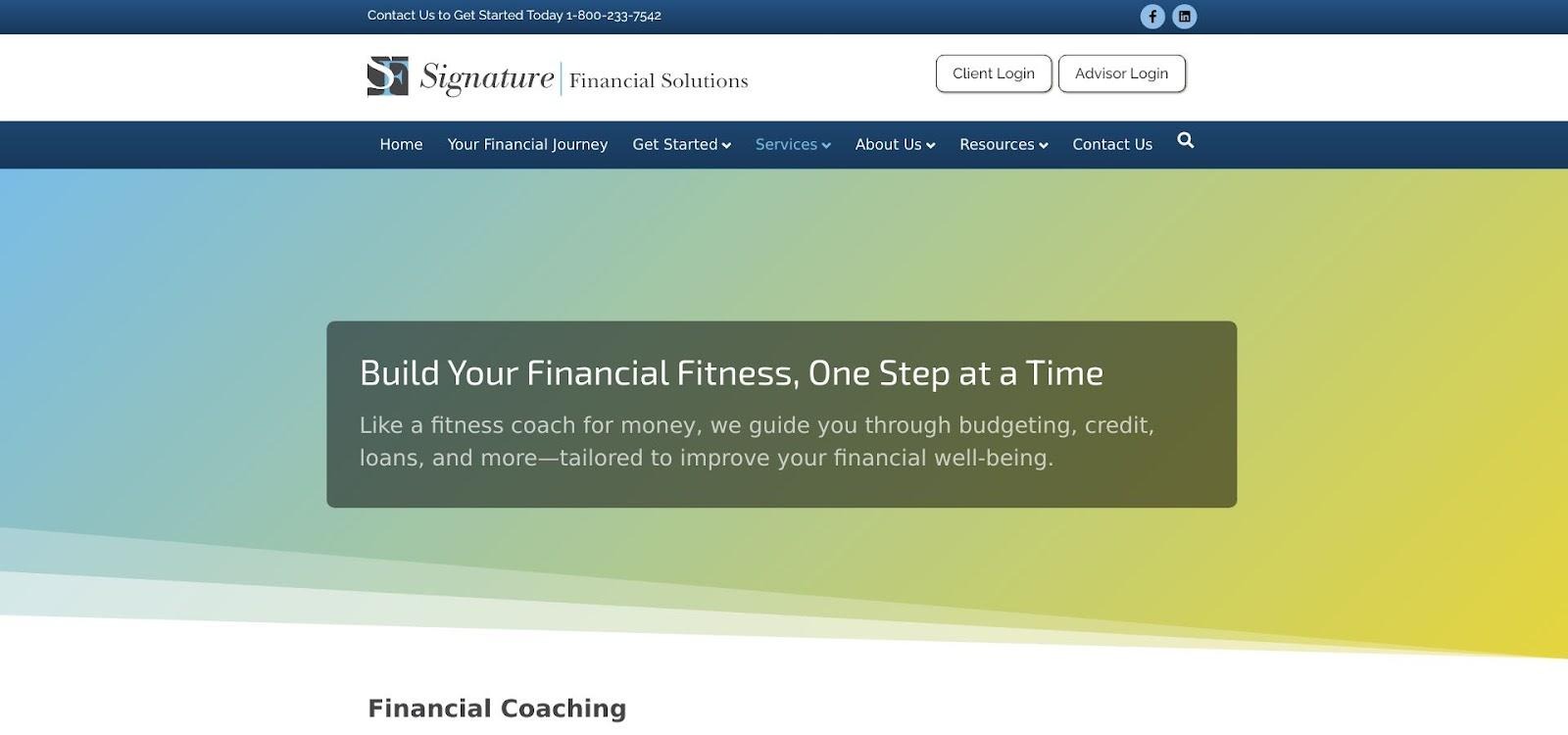

1. Signature Financial Solutions: best overall holistic coaching

Signature Financial Solutions Tampa financial coaching program screenshot

Picture a gym trainer for your wallet. That “wallet workout” vibe is exactly what Signature Financial Solutions delivers through its financial coaching program, branded as a way to “build your financial fitness” whether you step into the Westshore office or log in from anywhere in Tampa Bay.

The team starts with the basics: a clear look at spending, saving, and credit. Monthly coaching sessions then keep you accountable while you pay down debt and build cash reserves. Because the firm’s advisers also hold planning licenses, you can add investment or insurance guidance later without finding a second expert.

You schedule a free consultation first, so you see the cost before you commit. If you want one trusted partner for both daily money habits and long-term strategy, this all-in-one program belongs at the top of your list.

2. Opinicus Wealth: best for entrepreneurs and business owners

Running a company can blur the line between personal and business cash flow. Opinicus Wealth understands the overlap. Founded in 2006, the firm pairs investment management with fractional-CFO guidance so your P&L and your retirement plan stay in sync.

Its advisers act as fiduciaries. They review tax angles, entity structure, and succession options, then wrap everything into one living plan. Bring last year’s financials to the first, free meeting and you will leave with clear next steps, not a sales pitch.

If your net worth sits in inventory, receivables, or a pending exit, Opinicus converts that complexity into a personal roadmap you can follow with confidence.

3. BayView Financial Planning: best for women and military families

Military life brings sudden moves, deployments, and—at times—unexpected loss. Stacy Miller, CFP®, founded BayView Financial Planning to guide clients through those shifts with calm, qualified advice.

Stacy holds an MBA and is a military spouse, so she speaks TRICARE, TSP, and survivor benefits fluently. Her fee-only model means you pay for counsel, not products, which removes the second-guessing many widows and first-time DIY investors feel around commission-based advisers.

BayView lists a transparent flat-fee schedule on its website, starting near $2,500 for a full plan, so costs are clear before any paperwork begins.

Clients praise Stacy’s plain-language explanations and Zoom-friendly approach. If you want a supportive professional who can translate jargon and chart a long-term game plan you can follow with confidence, BayView is a solid choice.

4. MD Money Mentor: best for doctors and high earners

High income often comes with hefty student loans. MD Money Mentor meets you at that crossroads.

This coaching-only practice serves physicians, attorneys, and other professionals earning six figures who never covered personal finance in school. One-hour sessions tackle debt payoff timelines, reduce lifestyle creep, and map how to move leftover cash into low-cost index funds.

The coach sells no insurance or managed portfolios, which keeps advice conflict-free. Pricing starts near $750 for a three-month program or about $250 per month for ongoing support, and you receive a plain-language action checklist you can follow at any brokerage.

If your white-coat salary seems to vanish each month, MD Money Mentor supplies both the shovel and the plan to reclaim it.

5. Frisby Financial Coaching: best for veterans and debt freedom

Frisby Financial Coaching veteran-focused debt freedom website screenshot

Debt can feel like a permanent deployment. Coach Nicole Frisby, a U.S. Air Force veteran, shows you how to plan the retreat.

Her program starts with a free fifteen-minute Zoom call, then moves into a three-month package built around zero-based budgets and targeted payoff dates. Pricing begins near $900 for the full series or $125 per hour for single check-ins.

Clients celebrate each milestone, from the first credit-card closure to the moment they shout “debt-free.” Service members appreciate that Nicole speaks military pay scales, PCS costs, and TSP quirks without translation. Civilian clients gain the same disciplined, mission-first mindset.

If you need a coach who blends accountability with genuine support, Frisby Financial Coaching can help you reach a debt-free date you can circle on the calendar.

6. Southshore Financial Planning: best for flat-fee fiduciary advice

Percentage fees feel manageable when you have five figures invested, but at $600,000 an annual one-percent charge equals $6,000. Chris Shoup, CFP®, fixes that pain with a simple alternative: advice priced like any other professional service.

You pay a clear flat rate—typically about $1,800 for a full plan—or an hourly retainer around $225 for quick check-ins. No trailing commissions and no product quotas, just guidance tied to your goals. Many do-it-yourself investors like the model because they can place trades on their own and still keep a professional on call for tricky issues such as Roth conversion timing or Medicare surcharges.

Clients highlight quick email replies and plain-language explanations. If you value cost clarity as much as returns, Southshore Financial Planning turns the fee conversation from fuzzy to crystal clear.

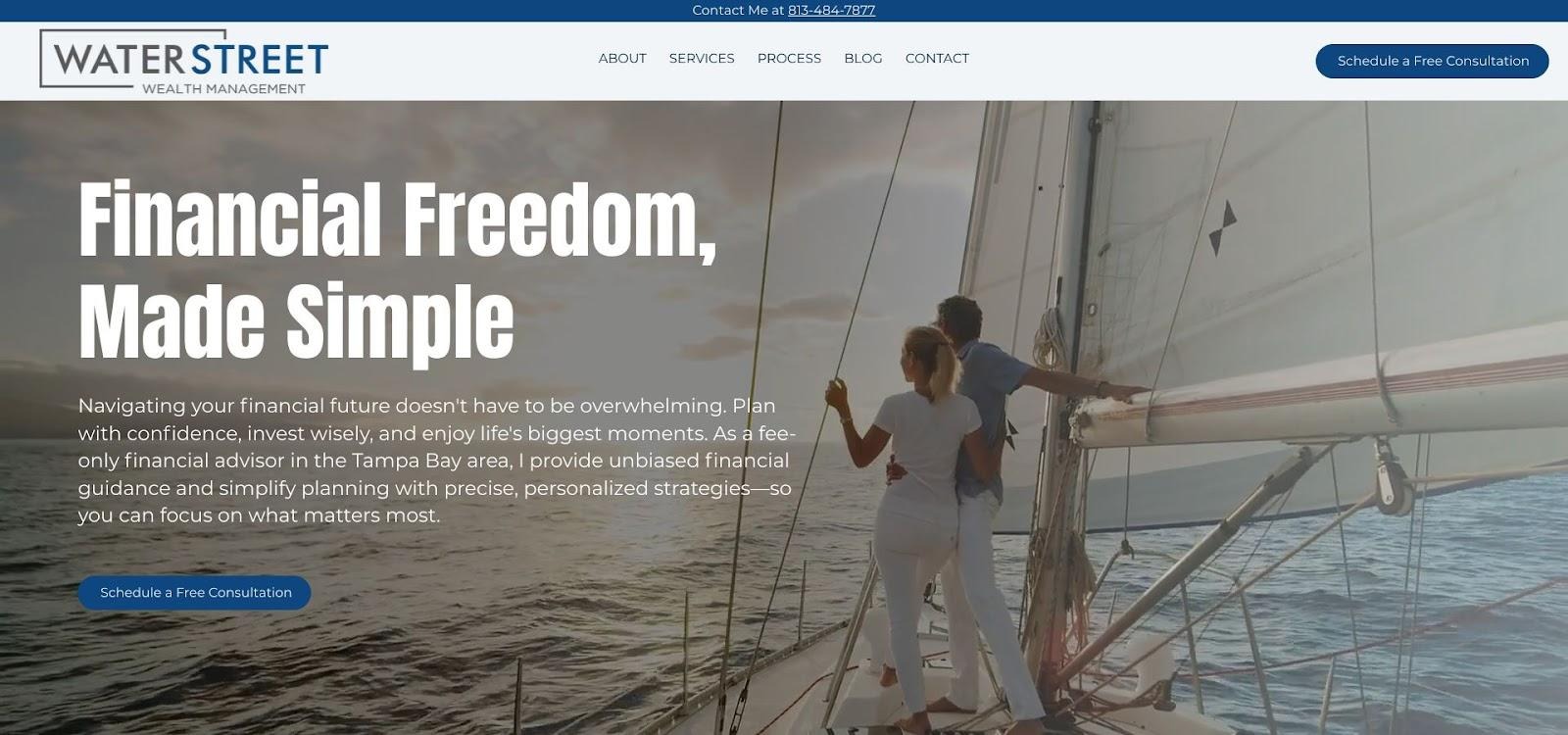

7. Water Street Wealth Management: best for retirement peace of mind

Water Street Wealth Management Tampa retirement planning website screenshot

When the countdown to your final paycheck begins, clarity matters more than market chatter. Water Street Wealth Management focuses on that transition.

Founder Jeff Schlotterbeck, CFP®, has more than sixty public five-star reviews, a level of client praise that is uncommon among local firms. His team diagrams Social Security timing, Roth conversion windows, and tax-smart withdrawal sequences, then manages portfolios built with low-cost ETFs.

The firm charges an assets-under-management fee that starts near 0.95 percent on the first $500,000 and declines on higher tiers. Clients say the ongoing education and quarterly plan reviews justify every basis point.

If you find yourself asking, “Will my savings last as long as I do?” Water Street supplies a written, numbers-driven answer and revisits the plan each quarter to keep it on track.

8. Tampa Bay Counseling & Financial Coaching: best for money habits and mindset

Tampa Bay Counseling and Financial Coaching money mindset website screenshot

Budget spreadsheets collapse when emotions override logic. Phil Lewis blends financial coaching with counseling techniques so behavior change lasts.

Each 50-minute session feels part therapy, part money workshop. You create a zero-based budget, chart a debt snowball, and unpack the stress or relationship friction that can derail progress. Because Phil is a Ramsey Master Financial Coach working inside a counseling practice, he can invite a licensed therapist if deeper issues surface.

Fees resemble standard counseling, starting near $140 per session or about $380 for a three-session bundle. If anxiety, arguments, or shame block your progress, this blended approach fixes both the numbers and the mindset.

9. Westshore Financial Group: best for all-in-one planning with insurance depth

Some balance sheets call for more than budgets and index funds. If your goals involve a family business, sizable income, and people who rely on you, insurance becomes a pillar, not an afterthought. Westshore Financial Group has specialized in that pillar since 1948.

As a Guardian affiliate, the firm staffs advisers with CFP and CLU designations who weave investment strategy with life and disability coverage under one roof. Business owners also gain expertise in buy–sell funding and succession planning.

Compensation mixes flat planning fees that start near $2,000 with product commissions on insurance policies. Ask your adviser to outline exactly how each piece is priced; transparency is part of the engagement process.

When you want deep knowledge in both growth and protection—and prefer a firm that has weathered every market cycle since World War II—Westshore Financial Group is a reliable option.

Compare the nine coaches at a glance

| Service | Best for | Credentials | Fee model | Base location |

| Signature Financial Solutions | Holistic coaching and planning | Licensed advisers, CFP® | Monthly retainer | Tampa (Westshore) |

| Opinicus Wealth | Entrepreneurs | Fiduciary advisers | AUM or flat plan | South Tampa |

| BayView Financial Planning | Women and military families | CFP®, MBA | Fee-only | Tampa (Westshore) |

| MD Money Mentor | Doctors and high earners | Coach/educator | Flat or monthly | New Tampa |

| Frisby Financial Coaching | Veterans and debt payoff | Ramsey Coach | Package or hourly | Virtual (Tampa) |

| Southshore Financial Planning | Flat-fee fiduciary advice | CFP® | Flat or hourly | Riverview |

| Water Street Wealth Management | Retirement simplicity | CFP® | About one percent of AUM | Westchase |

| Tampa Bay Counseling & Financial Coaching | Money habits and mindset | Ramsey Master Coach | Per session | St. Petersburg |

| Westshore Financial Group | Comprehensive planning plus insurance | CFP®, CLU | Fee and commission mix | Tampa (Cypress St.) |

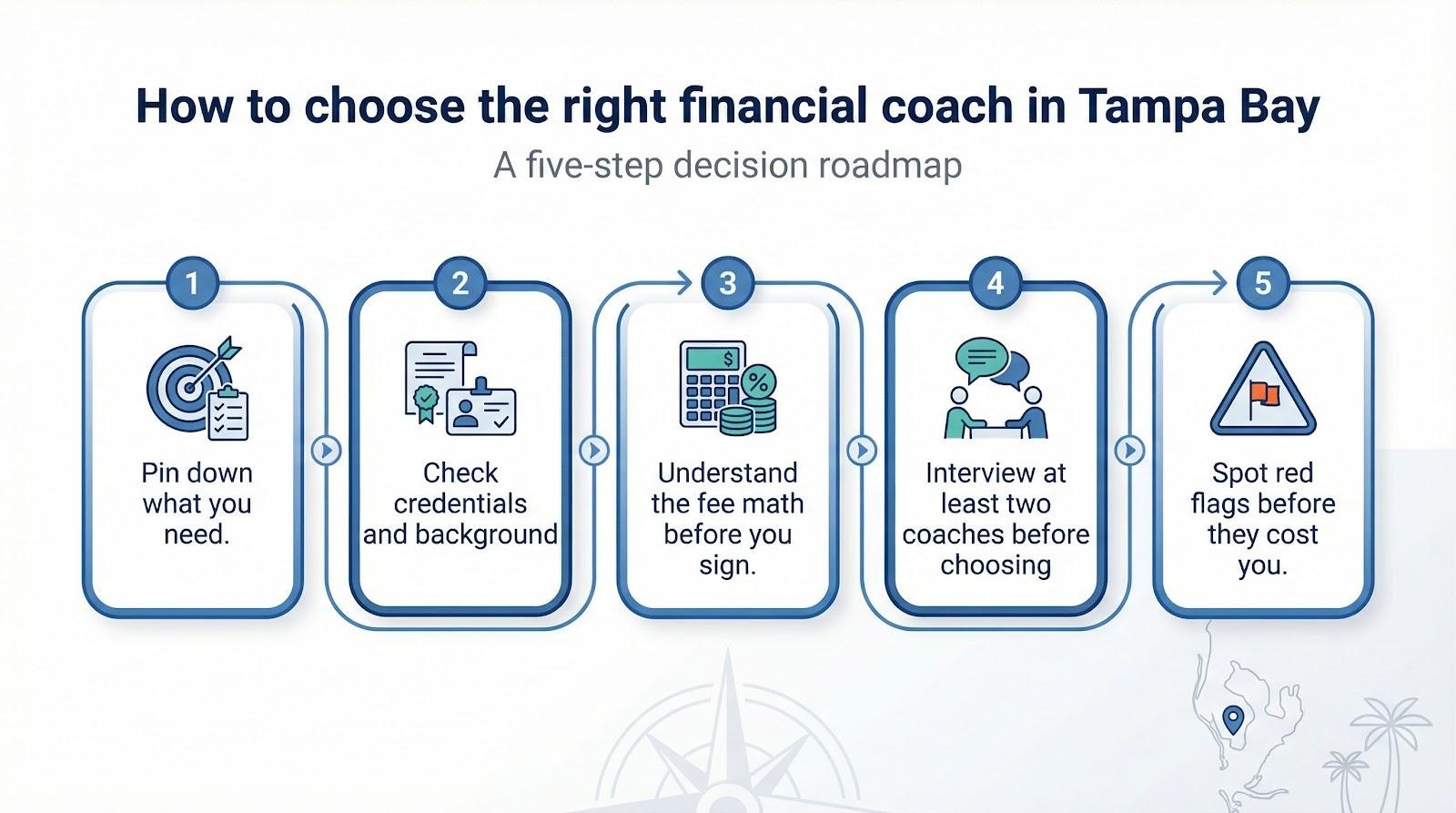

How to choose the right coach in Tampa Bay

1. Pin down what you need.

Start with a one-sentence gut check: “I want help with ____.”

If the blank is “budgeting,” “credit rehab,” or “paying off credit cards,” you likely need a pure financial coach.

If it is “optimizing investments” or “creating a retirement income ladder,” you need a licensed adviser—or a hybrid firm that offers both services.

Write your goal in plain words, then add two facts such as current income and top money stressor. This micro-brief keeps the search efficient and makes the first meeting productive.

Think of it like health care. You would not visit an orthopedic surgeon for seasonal allergies; in the same way, do not hire an assets-under-management adviser when the real hurdle is a leaky checking account.

2. Check credentials and background.

Florida does not regulate the term “financial coach,” so anyone with a Canva logo can hang a shingle. Credentials protect you.

For investment advice, look for CFP® or CFA after the name; these designations require coursework, exams, a code of ethics, and ongoing education.

If debt or budgeting is your focus, an AFC® (Accredited Financial Counselor) or Ramsey Master Coach certificate shows training in money habits rather than markets.

One more filter: fiduciary status. A fee-only fiduciary must put your interests first, a standard consumers now demand “like never before,” according to Financial Compass Hub.

Ask each pro, “Are you a fiduciary at all times, and how do you earn money from me?” A concise answer signals both expertise and integrity.

3. Understand the fee math before you sign.

Money pros earn income in four main ways: hourly, flat project, monthly retainer, or a slice of assets under management. Each can be fair—or painful—depending on your situation.

Hourly and flat fees feel higher at first, but once paid, your portfolio growth is yours alone. Retainers spread the cost, great for cash-flow planners who need steady accountability. Assets-under-management fees look gentle early on, yet balloon as your nest egg grows; at half a million dollars, one percent equals five thousand dollars per year.

Ask every adviser to write the projected cost in dollars, not percentages. Then compare that figure with the benefit you expect—lower interest payments, higher returns, or reclaimed peace of mind. If the value outweighs the bill, proceed; if not, keep shopping.

4. Interview at least two coaches before choosing.

Treat the first meeting like hiring for a key role—because you are.

Bring a short list of targeted questions:

- “What experience do you have with clients in situations like mine?”

- “How will we measure success together?”

- “How and how often will we communicate?”

Watch for clear, concise answers delivered without jargon. Notice whether the coach listens more than talks. Rapport matters; you will share salary details and money fears, so the conversation must feel safe.

Schedule at least one other intro call, even if the first contender feels perfect. Back-to-back comparisons sharpen your instincts and highlight what you value most—expertise, empathy, or accountability style.

5. Spot red flags before they cost you.

A great coach welcomes questions. A sketchy one dodges them.

Walk away if the first meeting relies on urgency—“This annuity bonus ends Friday.” Genuine professionals give you space to think.

Be cautious of guarantees. Markets, interest rates, and human behavior remain unpredictable. Any promise of a “twelve percent annual return” or “debt wiped out in ninety days with no sacrifice” signals hype, not expertise.

Finally, verify licensing for anyone who handles investments. A quick search on FINRA’s BrokerCheck or the SEC adviser database reveals disciplinary history in minutes. No listing, no deal.

Heed these cues and you will avoid the seminar-to-sales-pitch pipeline that still traps many Tampa retirees.

Conclusion

Choosing a financial coach is a personal decision. Use the criteria above to compare options and select the Tampa Bay professional who best fits your goals, budget, and comfort level.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)