Otto Money, an AI-powered wealth guidance platform, has raised $1.3 million in a pre-seed funding round led by Pravega Ventures, marking its first institutional capital as it looks to bring data-driven, institution-grade investment guidance to India’s rapidly expanding base of retail investors.

The round also included participation from prominent angel investors such as Rishi Kohli, CIO at Jio BlackRock AMC; Amit Gupta, founder of InMobi and Yulu; Amit Agarwal, founder of NoBroker; and Mohit Aron, founder of Nutanix and Cohesity. Existing backers also doubled down, signaling continued conviction in the company’s long-term thesis.

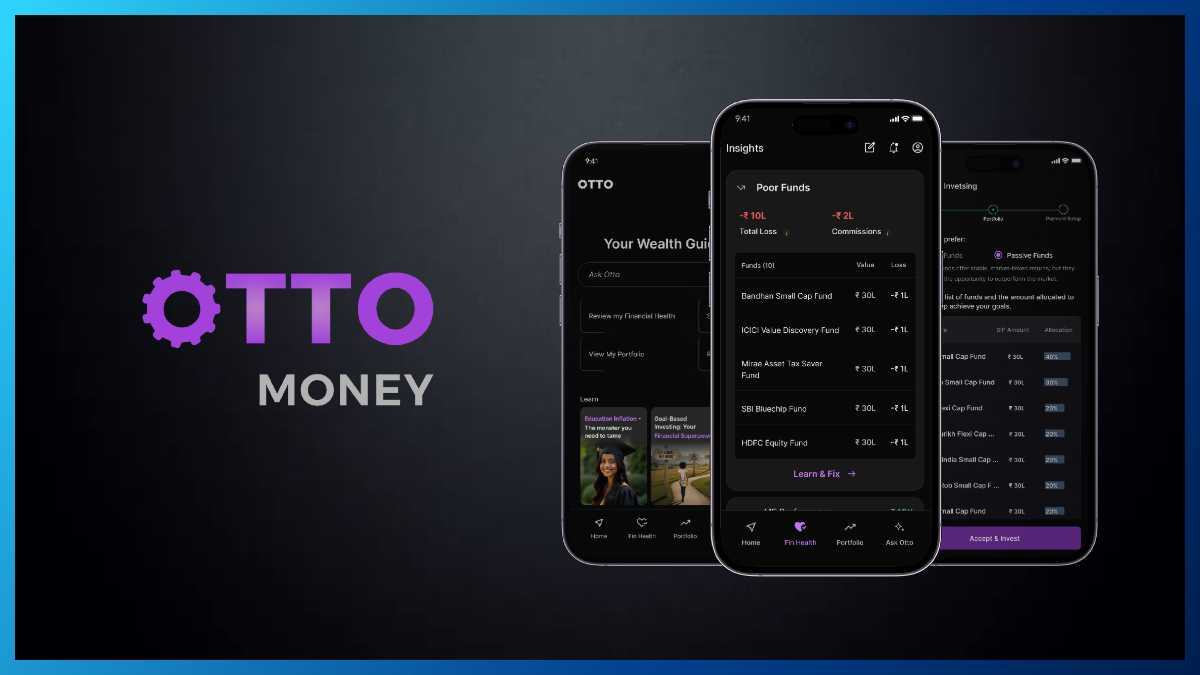

Building an “AI decision layer” for retail investors

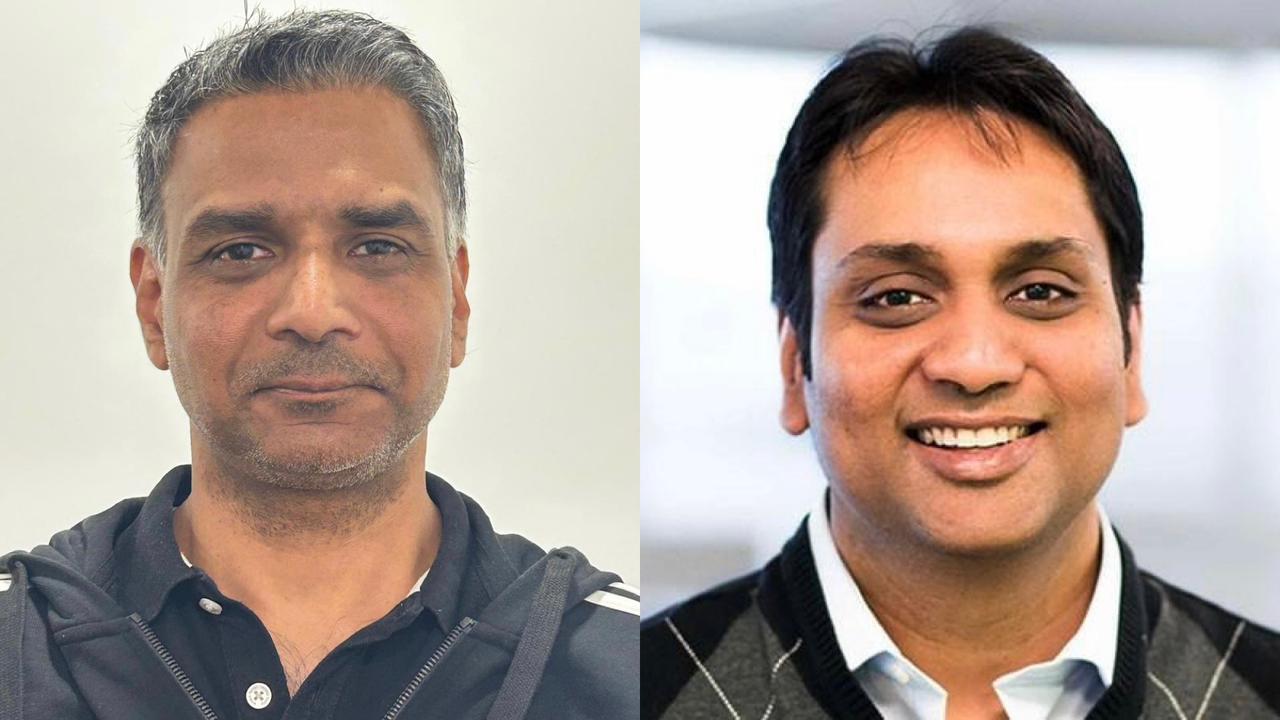

Founded in 2025 by IIT alumni Apurv Gupta and Ankur Lahoti, Otto Money positions itself not as a product distributor but as an intelligence layer for investment decisions.

The platform uses institution-grade investment models and artificial intelligence to deliver holistic, multi-asset guidance that:

- Explains trade-offs between asset classes

- Highlights portfolio-level risks

- Aligns decisions with long-term financial goals

- Avoids pushing specific financial products

At a time when India’s retail participation in equities and mutual funds continues to rise, the company argues that access to products has scaled faster than access to clarity.

“Indian investors today have more choices than ever, but clarity hasn’t scaled at the same pace,” said co-founder Apurv Gupta. “We’re building AI that helps investors manage risk consciously and stay aligned with long-term aspirations instead of reacting to short-term noise.”

Founders with enterprise data DNA

Otto’s founding team brings deep experience in large-scale data infrastructure and AI systems.

Apurv Gupta previously served as CTO at Cohesity, where he led engineering for enterprise-grade data security platforms used globally. Ankur Lahoti spent more than two decades at Google as Director of Engineering, focusing on reliability, performance, and privacy at internet scale.

That background shapes Otto’s positioning: a security-first, data-intensive approach to consumer wealth guidance, rather than a traditional fintech distribution play.

Otto Money – Capital allocation and roadmap

The newly raised capital will be deployed over the next 12–18 months across:

- Strengthening AI and personalization models

- Expanding goal-based investment guidance

- Hiring across engineering, product, and data science

- Brand-building and partnerships in Tier 1 cities

The company is currently in early market deployment and reports active engagement among digitally native investors.

Over the next two to three years, Otto Money aims to broaden its investment scenario coverage and deepen its AI capabilities, while building partnerships across India’s financial ecosystem.

A large, evolving market

India’s wealth and investment management market represents a multi-billion-dollar opportunity, fueled by:

- Rising disposable incomes

- Growing equity participation

- Rapid SIP adoption

- Increasing comfort with self-directed investing

However, the market remains fragmented. Many retail investors rely on product-led advice, social media signals, or fragmented dashboards that lack a unified multi-asset view.

Otto Money seeks to address persistent challenges such as:

- Information asymmetry

- Conflicted product distribution models

- Poor visibility into portfolio-level risk

- Decision fatigue during market volatility

By functioning as a decision-support layer rather than a transactional platform, the company aims to differentiate itself in a crowded fintech landscape.

Investor perspective

“At Pravega, we back founders who pair deep technical depth with clarity of problem,” said Rohit Jain, Partner at Pravega Ventures. “Otto isn’t just another fintech app. It’s a proprietary intelligence layer designed to reshape the relationship between people and their money.”

The firm’s backing suggests investor appetite for AI-native financial infrastructure plays, particularly those focused on long-term wealth creation rather than short-term trading engagement.

The broader AI-fintech intersection

Otto Money’s raise reflects a wider trend: AI is increasingly being embedded into financial advisory, risk modeling, and portfolio construction. While robo-advisory platforms have existed for years, newer AI systems promise deeper personalization and scenario-based reasoning.

The key test for Otto will be whether it can translate institutional-grade modeling into simple, trustworthy consumer experiences — and maintain regulatory compliance in a sector where fiduciary responsibility and transparency are paramount.

As India’s retail investor base continues to grow, platforms that can combine trust, technology, and long-term alignment may find durable market space.

Otto Money is betting that AI — applied with discipline and engineering rigor — can become the missing decision layer in India’s evolving wealth ecosystem.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)