Alibaba Group has introduced Qwen 3.5, the latest iteration of its large language model family, as China’s technology giants intensify efforts to secure domestic leadership in generative artificial intelligence.

The release comes amid an accelerating cadence of model launches from Chinese firms, reflecting mounting competitive pressure both within China and globally. With export controls limiting access to advanced AI chips and rising geopolitical scrutiny over AI capabilities, domestic innovation cycles are tightening.

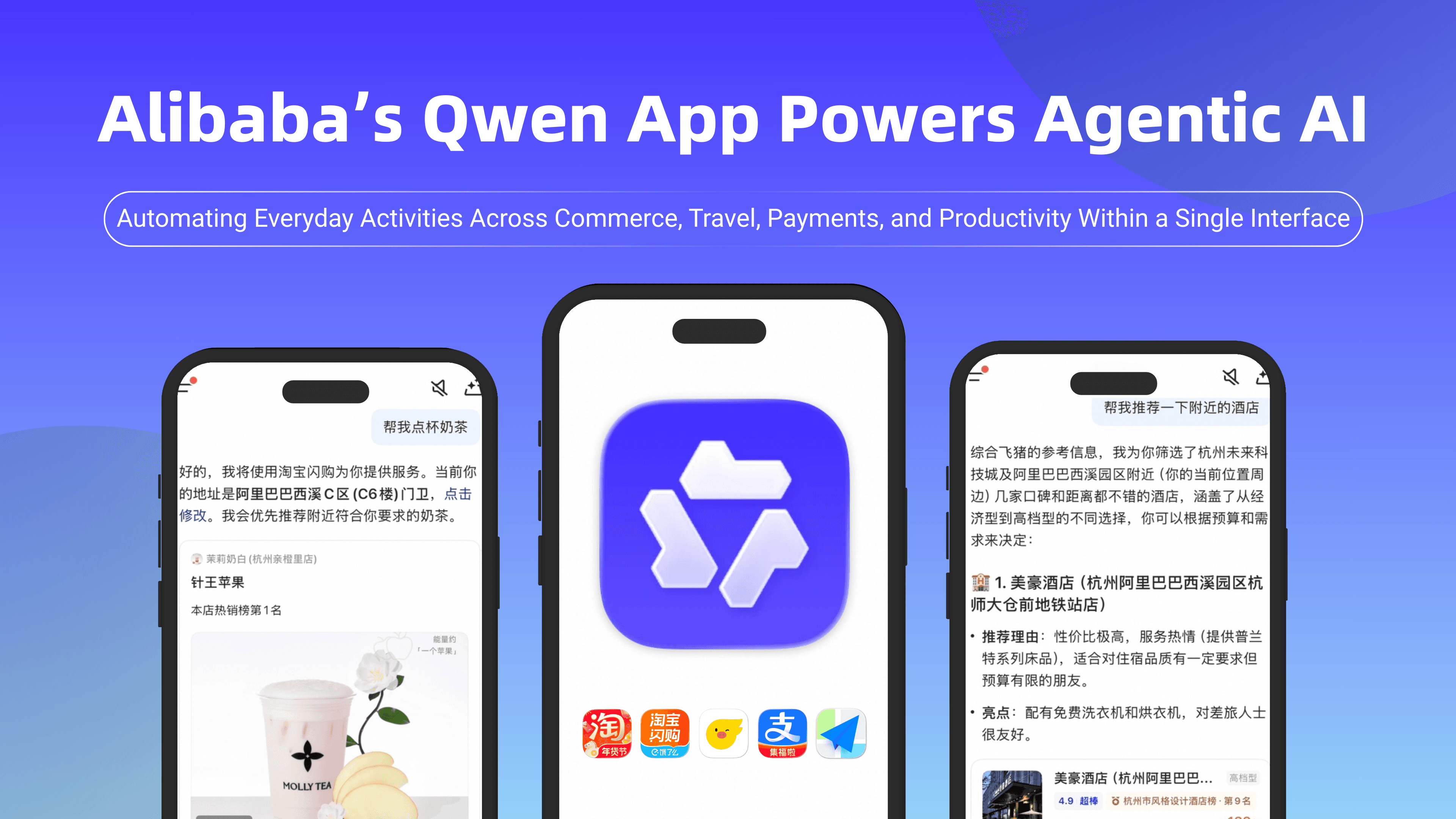

Alibaba’s Qwen series, originally launched as part of its broader cloud AI strategy, has evolved into a central pillar of the company’s enterprise and developer ecosystem. Qwen 3.5 is positioned as an upgrade focused on improved reasoning, coding capabilities, and enterprise-grade deployment.

China’s model arms race

Over the past year, Chinese AI companies have adopted a faster release rhythm, mirroring the iteration cycles seen in the U.S. market. Instead of waiting for multi-year leaps, firms are rolling out incremental upgrades designed to:

- Improve inference efficiency

- Lower deployment costs

- Enhance multilingual performance

- Expand enterprise integration

The competition is not solely about benchmark performance. For Chinese firms, scalability under domestic chip constraints and compliance with local regulatory requirements are equally strategic.

China’s regulatory framework for generative AI requires content moderation safeguards and algorithmic filings, shaping how companies architect their models from the outset. This has led to a distinct ecosystem that balances innovation speed with policy compliance.

Enterprise-first positioning

Alibaba’s advantage lies in its cloud infrastructure footprint. By embedding Qwen 3.5 within its cloud services stack, the company aims to accelerate enterprise adoption across e-commerce, logistics, manufacturing, and financial services.

Unlike consumer-facing chatbots that rely heavily on public usage metrics, Alibaba’s AI strategy emphasizes enterprise productivity use cases, including:

- Intelligent customer service automation

- Supply chain analytics

- Developer copilots

- Data summarization and decision support

For China’s broader digital economy, such integrations may prove more economically material than standalone AI assistants.

Global implications

China’s model race increasingly operates under two constraints: limited access to leading-edge semiconductors and reduced collaboration with Western research ecosystems.

Yet domestic competition remains fierce. Rapid iteration cycles suggest that Chinese firms are prioritizing model optimization and deployment efficiency over sheer parameter scale.

For global AI markets, this dynamic could result in parallel innovation tracks — one driven by U.S. hyperscalers with access to cutting-edge chips, and another shaped by Chinese firms optimizing under hardware constraints.

Alibaba’s Qwen 3.5 signals that the competitive tempo is unlikely to slow.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)