The year was 2015 and Reliance Jio was emerging as a potential game changer. Reliance had tried to become a telecom player in the first 2G wave, even though this proved to be only a limited success. In 2015, Reliance Jio revisited its device-plus-network strategy from 2004, this time for 4G. And this time around, it worked wonders.

The Indian tech ecosystem, as we know it today, would arguably not be possible without Jio’s cheap mobile internet and affordable 4G devices.

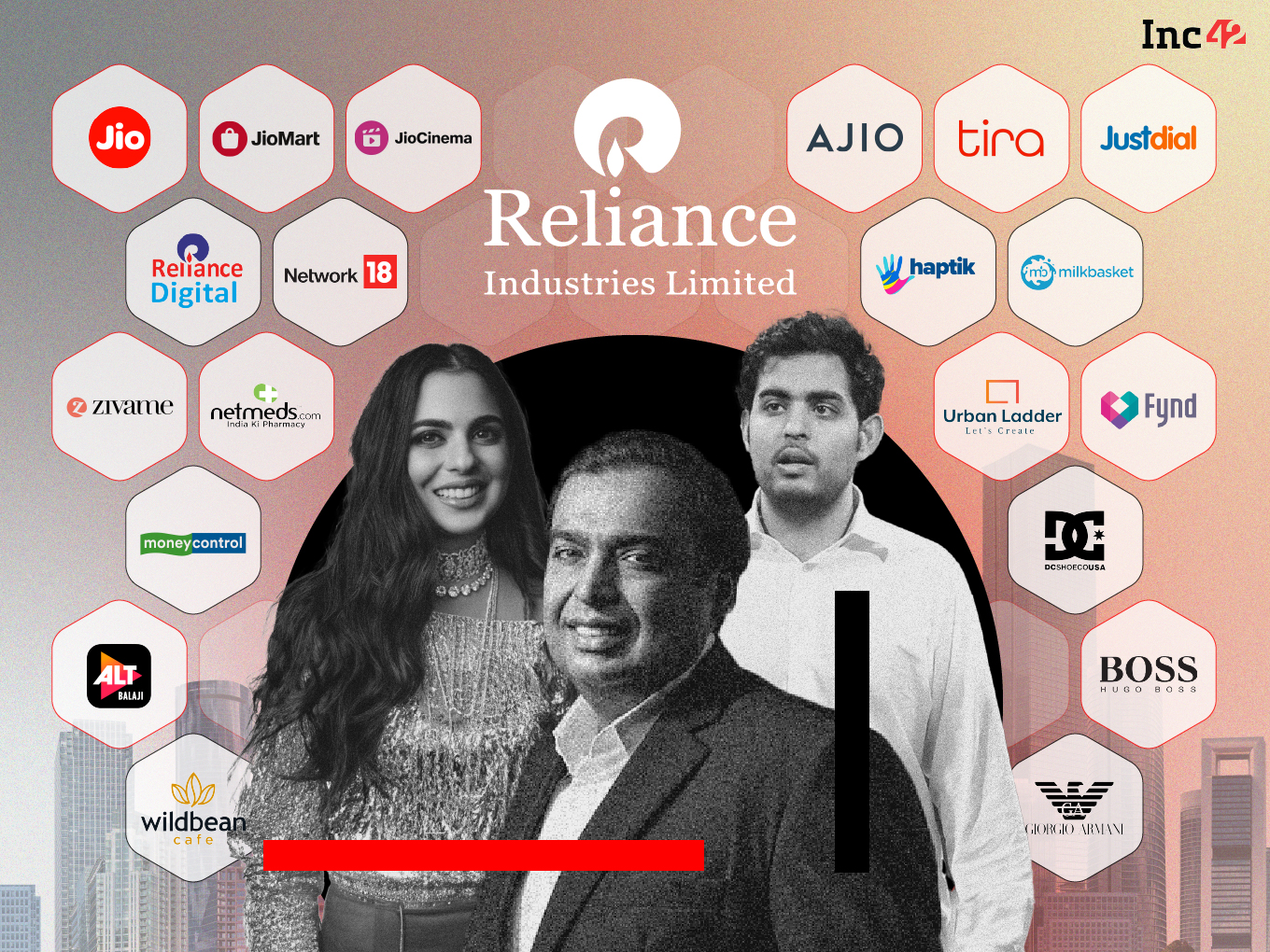

Buoyed by this success, Reliance Jio has evolved beyond a mere telecom operator today and Reliance itself is changing from a petrochemical giant to a tech behemoth in so many ways. Alongside Reliance Jio, there’s Reliance Retail with its many massive marketplaces and an array of brands and Jio Financial Services, which is set to disrupt banks and the fintech ecosystem.

With eyes on the hardware manufacturing ecosystem (especially affordable smartphones and mobile devices), the Mukesh Ambani-led company has created a unique stack — from infrastructure and a mobile network to consumer and enterprise services across ecommerce, retail, financial services, entertainment, and most large sectors.

While the ‘Reliance Jio Stack’ is not just about Jio, the moniker fits because everything is centred around Jio and the internet that is powering the machine.

At the same time, however, one cannot ignore the elephant in the room. Today, Jio, Reliance Retail and JFS have become key competitors for major startups and tech companies in India. From enablers to rivals, the role of Reliance has changed just as it has transformed itself. And all of this has happened in less than a decade.

With Mukesh Ambani stepping aside from key companies such as Jio and Reliance Retail to pass on the baton to the next generation, there’s a lot at stake even for Reliance. Akash Ambani and Isha Ambani will lead the company into the next phase, as it looks to cross the 10 Lakh Cr mark for revenue in FY24.

Through conversations with key players in the industry as well as those who have seen the early days of Jio, we were able to piece together a picture of the grander vision of Reliance and Jio, and what it means for startups in the long run.

Reliance Jio did not respond to our questions about the organisational structure and how the various companies work together.

The Starting Point: Reliance Jio & 4G

It’s no surprise that it all began with 4G. Even though the timing of Reliance’s 4G launch was fortunate, it did not have the 3G baggage of Airtel, Vodafone, Idea and others. It forced players to not just consolidate but focus on retaining subscribers rather than network expansion.

With its deep pockets, Reliance Jio forced many of these players to become 4G first and start again. For India’s internet companies though, Jio’s entry brought a whole generation of users online.

“Anyone who has seen India’s internet ecosystem mature knows that Mukesh Ambani tried this before with CDMA in 2000, but this time around it was a different market altogether. The mobile industry had evolved; consumer internet was changing and businesses were going digital for the first time; it was the right time for 4G,” recalled Elevation Capital partner Mayank Khanduja.

Khanduja, who began taking investment decisions in 2015 as a principal at venture capital firm Elevation Capital (then SAIF Partners), saw first-hand the emergence of the early stage ecosystem, startups that are today unicorns or value creators in the Indian market.

Between 2016 and 2019, Reliance Jio 4G spread like wildfire, and pretty much cast the competition aside. Reliance Jio added 90 Mn subscribers in 2019 to sit at a total of 370 Mn subscribers in just a matter of three years. Today, it commands a huge lead in the market with 439 Mn subscribers as per its FY2023 disclosures.

And somewhere along the way — between 2018 and 2020 — it began pressing home this market share.

The company’s net profit jumped to INR 5,297 Cr in Q2 FY24. Jio Platforms, the umbrella entity created around Jio, had a quarterly revenue of INR 26,875 Cr (roughly $3.3 Bn).

Targeted Acquisitions: Building The Reliance Jio Stack

“One of the things about Reliance is that it saw waves early on and acquired companies to fill those gaps. When these acquisitions happen, they seem small, but they can snowball,” according to an entrepreneur and investor, whose startup was acquired by Reliance (RIL) in 2019.

In 2019, Reliance Industries signed eight acquisition deals, including the likes of retail tech startup Fynd, marketing SaaS platform Haptik, and digitalisation enabler Nowfloats among others.

The acquisitions in 2019 and since form the backbone of Reliance’s growing prowess in the SaaS space.

The entrepreneur quoted above believes there’s no entity like Reliance anywhere in the world. “Amazon has ecommerce and AWS [besides OTT], Microsoft and Google have a huge array of services; Meta has social media power and Apple rules hardware, but Reliance has the capability to enter each of these spaces. And let’s face it, most of them, in India, they have to work with Reliance,” the entrepreneur added.

The acquisitions laid the foundation for what was to come. While RIL was using its years of profits to buy these companies, eventually they moved to a new umbrella entity encompassing all the digital services and products.

The Age Of Jio Platforms

“Jio gave Reliance the pipeline through which it can feed all these services in the future,” added another Mumbai-based investor, who was a key figure at Jio for nearly six years when Reliance acquired these various startups and raised the funding from marquee names.

After acquiring these companies, the next big challenge was integrating them into one central vision. And this is where Jio Platforms came into the picture.

“The launch of Jio Platforms is not only a corporate structure, but it also was the first step in the transition of leadership from Mukesh Ambani to Akash Ambani. We then saw a similar thing with Reliance Retail and Isha [Ambani], so these new companies are not just an evolution of Reliance but a passing of the baton in many ways,” added the Mumbai-based investor, who did not wish to be named as they are close to the Reliance group.

Set up in late 2019, Jio Platforms was launched to encompass Reliance-owned digital businesses including Reliance Jio which offered the 4G telecom service, and key B2B and B2C apps and products such as JioMeet or JioCloud.

In 2020, Jio Platforms raised nearly $16 Bn from Google, Facebook, General Atlantic, KKR, ADIA, Mubadala, Qualcomm, Intel Capital among others. This fundraising spree not only gave Jio a capital boost, but also got it ready for a future IPO. But most importantly it signalled a new dawn for Jio and other Reliance companies.

Because, soon after, Reliance Retail began its fundraising spree and became a piece of the Reliance Jio Stack as well.

A majority of Jio’s investors lined up to back what is India’s largest retail operator now. Reliance Retail had raised close to $6 Bn in the year from strategic and financial investors, and went on its own spree of acquisitions.

From A Retail Giant…

It would be folly to think that Reliance has only emerged as a retail force in the last few years. In fact, the seeds were sown more than two decades ago with the launch of Reliance Fresh, Reliance Digital and other retail chains.

Reliance Retail also signed exclusivity deals with a host of renowned brands and labels to bring them to India. Reliance also has a grip on the FMCG segment with a number of private labels that leverage not just its own store network but also non-native retail channels.

The below graphic does not include brands such as Marks & Spencer, for which Reliance Retail had a JV which has now been dissolved.

Interestingly, a number of international brands that may be more popular on other marketplaces are also owned by Reliance Retail in some way or the other.

“The retail scale is mind-boggling. Most people would not know that Reliance has a piece in bringing such brands to India. This allows the company to really get a huge share of the wallet and when it comes to retail, it’s hard to look around and not see a Reliance brand,” according to Ankur Bisen, a senior partner at Technopak.

..To Building An Ecommerce Empire

The ecommerce opportunity presented after Jio’s internet revolution meant that Reliance also had to double down on marketplaces and online-first brands.

Reliance began its ecommerce journey with AJIO in 2016, followed by JioMart in 2020 and added Tira in 2023. It also entered new areas through acquisitions such as epharmacy Netmeds, Urban Ladder, Just Dial, Milkbasket, lingerie maker Clovia and Alia Bhatt’s D2C brand Ed-a-mamma between 2020 and 2023.

For many years, AJIO was the lone horse battling the likes of Myntra, Nykaa, Flipkart and Amazon. Besides this, Reliance put up its brands on marketplaces to get the right revenue mix.

The addition of JioMart and Tira as channels will prove critical for Reliance in the long run because native revenue is any day more profitable than non-native channels.

Analysts believe that having an array of exclusive brands will be advantageous for fashion through AJIO or beauty and personal care through Tira in the long run, since Reliance can create a walled garden effect.

On the horizontal marketplace side, JioMart is expected to face stern competition not just from Tata-owned BigBasket, Amazon or Flipkart, but also quick commerce players that have emerged as real disruptors in the metros.

Talking about the Reliance Jio Stack, Bisen added that when Jio entered telco, it disrupted lives for existing players.

Reliance’s track record in establishing and nurturing new platforms is evident from its experience with AJIO, which it supported for many years. Additionally, its ability to attract the best talent and provide exposure to new platforms gives it a competitive edge. Those watching Reliance expect a similar strategy to be adopted for Tira, which is the latest platform to emerge from Reliance Retail.

The Tira offline store is expected to have technology-enabled features such as virtual try-on rooms, skin analyser, personalisation engines and smart assistance. This is said to be its key differentiation in retail.

“For Tira, a big chunk of revenue will initially go towards marketing and customer acquisition, at least for the first couple of years, as it is a new brand. More than marketing, Reliance will look at discounting more prominently. Reliance will try to give higher discounts compared to other players,” according to Karan Taurani of Elara Advisors.

Reliance’s Media Dominance Growing

It’s hard to believe that JioCinema, a service that did not exist till late 2022, is the biggest OTT platform in India today. With Disney+ Hotstar expected to be acquired by JioCinema, it would also very soon be the biggest streaming platform for live sports in India.

In the past one year, JioCinema has snatched the digital streaming rights for the IPL and other marquee properties from Disney+ Hotstar. JioCinema is today billing itself as the home of Indian cricket, which naturally brings in millions of subscribers.

Analysts now expect JioCinema to turn on the monetisation pipeline. It has already launched a subscription tier and is likely to put IPL 2024 behind a paywall of some kind. In just under eight months after its launch, JioCinema has 221 Mn monthly active users as of June 2023, according to reports.

Of course, beyond OTT and streaming, Reliance has the might and reach of Network18 with its various TV channels and digital publications, as well as production houses for motion pictures, and Mumbai Indians, which has won the IPL five times. These form a key part of the distribution side of the Reliance Jio Stack as well.

They help drive Reliance’s empire of products and services, as was evident during the IPL 2023, when Reliance products such as Tira and AJIO featured heavily during ad breaks.

JioCinema has the potential to become a very cost-effective sales funnel for Reliance platforms in the long run. Reliance can leverage the scale to succeed at formats such as live commerce, which have so far failed to take off due to the lack of vertical integration.

“The Reliance Jio Stack, or whatever you want to call it, is all about unlocking this vertical integration across all segments, unlike ever done before,” says the Mumbai-based investor quoted above.

The Final Frontier: Financial Services

While we expected Reliance to do something about fintech in the long run, the launch of Jio Financial Services this year was still something of a surprise. From payments to insurance to investment tech, JFS is set to disrupt several key fintech segments and pose a significant threat to existing players — both startups as well as legacy BFSI companies.

At launch, JFS is the world’s highest capitalised financial services platform and this safety net is a key to success for Jio’s fintech ambitions.

“The cost of fintech is still very high in India, whether you look at payments or insurance broking or any other service which relies on commissions. Having capital means JFS can be bullish on expansion. It can acquire some customers very easily due to Reliance Jio and Reliance Retail,” according to the founder of a Delhi-based B2B and B2C lending tech startup.

What works out for JFS is the fact that Reliance Jio boasts of over 439 Mn subscribers, while Reliance Retail has close to 250 Mn registered customers and 3 Mn merchants. These will be the anchors for scaling up Jio Financial Services over the next few quarters as it looks to push personal loans and consumer durable loans.

All this makes ominous reading for India’s fintech startups, which have so far banked on Reliance Jio’s internet services as a growth ladder. But now, startups not only have to solve the revenue puzzle that has plagued fintech for long, but also compete with a giant such as JFS, backed by Reliance’s technological prowess, retail network and significant reach across sectors.

As is evident from Reliance’s journey in the past eight years, the company looks to dominate the verticals it enters with a mix of capital-led growth and inorganic acquisitions.

Will we see a similar burst of acquisitions for JFS? It’s very much on the cards given the wider problems in the fintech space. Startups are struggling with revenue growth and JFS could use its deep pockets to acquire some of these ailing startups.

Even established players such as Paytm, Zerodha, Groww, PhonePe, Policybazaar, Lendingkart and others are very likely to see JFS as a challenge in payments, investment broking, insurance and other areas.

Startups have faced regulatory headwinds, a funding winter and Reliance’s mega entry means another massive player to compete with. A potential consolidation wave of fintech startups cannot be ruled out, which brings us to the final point about this “Reliance Jio Stack”.

Reliance Jio’s Big Tech Avatar

By all indications, Reliance is not about to halt its juggernaut any time soon.

Jio Financial Services is only the latest piece of the empire, which may soon include automotives and electric vehicles besides hardware manufacturing. Reliance is essentially aiming to become an everything-tech company.

And for many startups that have so far leaned on Reliance for growth, this is a scary proposition. There are fears about a monopoly in certain segments such as streaming as well as retail, but more ominously, entrepreneurs and other ecosystem stakeholders are worried about potentially having to cede ground to Reliance in other areas as well.

“No one can dispute that Reliance has taken Indian tech to a new place, but at the same time, there needs to be a check on where this is going. We have seen cases in CCI about monopolistic practices of foreign giants like Google or Meta, and the same argument can be extended to Reliance in many areas,” says the Delhi NCR-based entrepreneur and investor quoted first in this story.

Others pointed out that the Future Retail battle with Amazon shows that as Reliance tries to stretch further it will attract more such opposition. The potential Disney+ Hotstar deal will be an acid test for these concerns. Will there be some opposition to the fact that Reliance would pretty much be in a dominant position in the digital media space?

On the JFS front, many fintech founders have raised concerns in the past few weeks. “JFS will earn the fruits of our years of working with regulators and banks to form this foundation we have today,” the Delhi-based lending startup founder added.

Their primary contention is that Reliance gets an unfair advantage of having seen regulations evolve and mature, which are headwinds that fintech founders have fought back. Similar concerns were raised about Reliance Retail using its financial muscle in the Future Retail saga.

There’s little doubt eight years ago, Reliance Jio changed India forever and gave new wings to Indian tech. Today, in late 2023, the clear signs of the Reliance Jio Stack threaten to do it once again. How will it change Indian tech next?

The post title=”The ‘Jio Stack’: The Making Of Reliance’s Digital Empire” href=”https://inc42.com/features/reliance-jio-stack-making-of-digital-empire/”>The ‘Jio Stack’: The Making Of Reliance’s Digital Empire appeared first on Inc42 Media.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)