Aditya Birla Group-backed GIVA crossed the INR 100 Cr mark in terms of operating revenue in the financial year ended March 31, 2023. The startup’s operating revenue surged 97% to INR 165 Cr in FY23 from INR 84 Cr in the previous fiscal year.

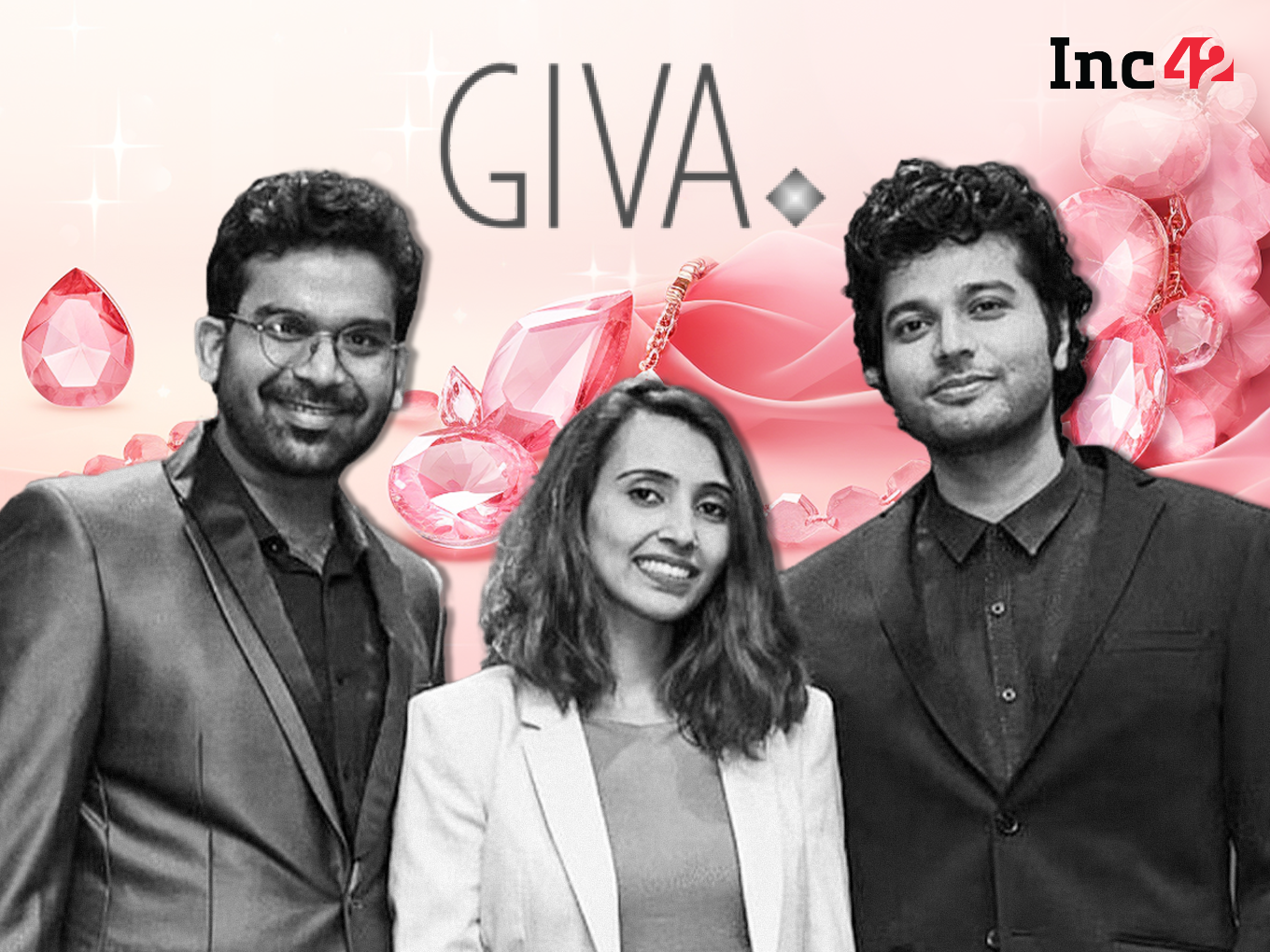

Founded in 2019 by Ishendra Agarwal, Nikita Prasad and Sachin Shett, GIVA deals in authentic 925 fine silver jewellery, 14 carat and 18 carat gold jewellery, and lab-grown diamond jewellery. The omnichannel brand also operates retail stores across the country.

Including other income, the startup’s total revenue stood at INR 167 Cr in FY23, an increase of 98% from INR 84.5 Cr in the previous year.

Despite this, the startup’s net loss rose 138% to INR 45.2 Cr during the year under review from INR 19 Cr in FY22.

Where Did GIVA Spent?

The startup’s overall expenditure more than doubled to INR 212.3 Cr in FY23 from INR 104 Cr in the previous year.

Marketing Costs The Biggest Expense: GIVA spent INR 77 Cr on selling and marketing expenses, a 64% increase from INR 47 Cr it spent in the previous year. This expense included advertising, brand promotion, and brand photoshoot expenses – everything that a brand needs to raise brand awareness.

Procurement Cost Surges: The startup’s procurement cost zoomed 114% to INR 74.3 Cr in FY23 from INR 34.7 Cr in FY22. The increase in procurement cost also indicates higher demand for the brand’s jewellery.

Employee Benefit Expenses Quadruple: GIVA’s employee benefit expenses rose a whopping 306% to INR 21 Cr in FY23 from INR 5.2 Cr in the previous fiscal year. This rise could be attributed to the startup opening more retail stores during the year, which led to an increase in its employee count.

EBITDA margin deteriorated to -25.3% in FY23 from -22.2% in FY22.

GIVA has raised over $45 Mn in multiple funding rounds till date and counts marquee names like Premji Invest and A91 Partners among its investors.

Earlier this year, it bagged $35 Mn in its Series B funding round led by Premji Invest.

In the new-age fast fashion jewellery space, GIVA competes directly against Ratan Tata-backed BlueStone, Tata-owned CaratLane, and Lightbox funded Melorra.

Earlier this year, Titan acquired GIVA’s competitor CaratLane at a valuation of over $2 Bn. Meanwhile, BlueStone reported an operating revenue of INR 770 Cr in FY23, with a loss of INR 59 Cr.

The post Premji Invest-Backed GIVA Sold Jewellery Worth INR 165 Cr In FY23 appeared first on Inc42 Media.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)