Nasdaq-listed Ebix Inc., a software and ecommerce solutions provider to the insurance industry, has filed for bankruptcy protection in the United States Bankruptcy Court, Northern District of Texas, after defaulting on a $617 Mn loan.

The court filing was done on Sunday (December 17). As per a Bloomberg report, several subsidiaries of Ebix have also filed for bankruptcy and each subsidiary and advisors will “conduct a fulsome marketing and sale process” for the assets of the company.

The Texas court will reportedly hear the case on December 19.

Ebix has been struggling to repay the $617 Mn loan for months now. Last month, the company failed to meet another deadline and was given time till December 17 to raise the money for the repayment.

In September, its creditors had declared the company in default after earlier repayment delays and were pushing Raina’s firm to sell off its assets, a Bloomberg report said.

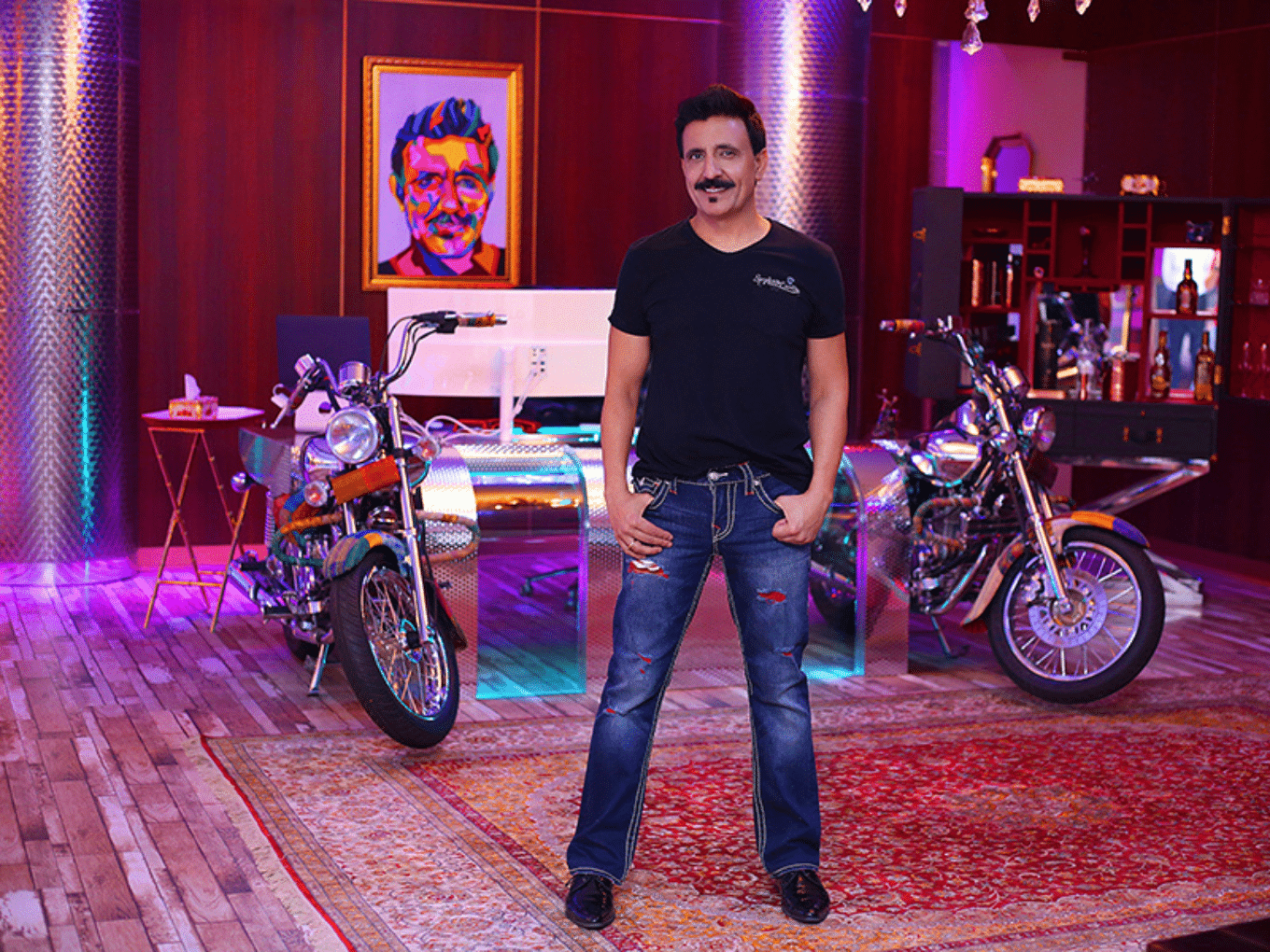

The India-American entrepreneur Robin Raina-led company was aggressively looking to tap the public market to raise funds. Its India entity EbixCash filed its draft red herring prospectus (DRHP) with the market regulator SEBI in early 2022 for an INR 6,000 Cr IPO.

In April this year, the IPO also received SEBI’s nod and there were reports doing rounds about EbixCash launching its public offering sometime in mid-2023. However, the company also hadn’t disclosed a case hearing in Singapore in the IPO filing, which was expected to cost the company INR 100 Cr-INR 200 Cr.

Some of the major shareholders in Ebix Inc. include Blackrock, Vanguard Group, State Street Corp, and Invesco. Meanwhile, the company president and CEO Raina himself is the largest shareholder.

In Q3 2023, Ebix’s GAAP operating income declined 32.4% year-over-year to $20.5 Mn, which the company attributed primarily to certain one-time increased expenses related to credit agreement and EbixCash IPO marketing costs.

“These are difficult times for the Company. In spite of that, the company’s operating results after excluding the one-time items are consistent with our expectations,” Raina had said in a statement.

In India, EbixCash is profitable. Its net profit increased to INR 751.3 Cr in FY23 from INR 482 Cr last year.

Amid the legal fiasco, shares of Ebix Inc. have nosedived over 80% since the end of July this year. On Monday, the stock was also dropped from S&P Software & Services Select Industry Index.

The post title=”Robin Raina’s Ebix Inc. Files For Bankruptcy In Northern Texas” href=”https://inc42.com/buzz/robin-rainas-ebix-inc-files-for-bankruptcy-in-northern-texas/”>Robin Raina’s Ebix Inc. Files For Bankruptcy In Northern Texas appeared first on Inc42 Media.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)