SUMMARY

The DoT is acting as a mediator to introduce startups to venture capitalists (VCs)

Reportedly, around 25 startups in the field of quantum communications, 5G-enabled AI drones, satellite-brd navigation systems, cyber security, IoT etc, pitched their ideas in front of 13 VCs in a recent meeting

Besides VC support, the government is felicitating a telecom technology development fund (TTDF) under Universal Services Obligation Fund (USOF)

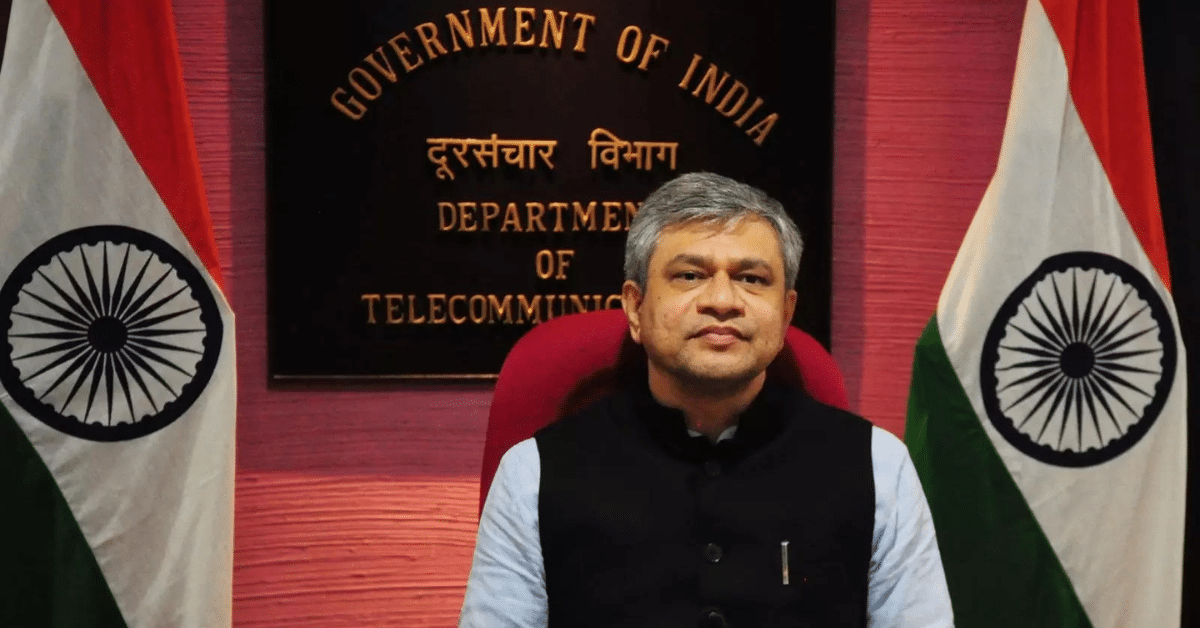

In an effort to foster India’s tech businesses, the telecom department has launched a Shark Tank-style funding initiative for startups focussed on advanced technologies.

As per ET’s report, the department of telecommunications (DoT) is acting as a mediator to introduce startups with venture capitalists (VCs).

“We want to provide exposure and funding opportunities to the MSMEs and startups to scale up. If the idea is good, the VCs will provide the requisite support,” the report said, citing an official close to the matter.

Reportedly, around 25 startups in the field of quantum communications, 5G-enabled AI drones, satellite-brd navigation systems, cyber security and IoT pitched their ideas in front of 13 VCs in a recent meeting. Besides India, the VC also hailed from the UK and Uganda.

“Talks for funding are at an advanced stage for some startups and a decision will be taken soon,” the report added.

The participatory firms in the meeting include QPIAI India, which counts quantum communication as its core work area, Menthosa Solutions, which works on 5G-enabled AI drones, Webyfy IoT, which is involved in R&D in the Internet of things (IoT) space, etc.

VCs in the likes of Lets Comply, World Five VC Advisors, SIDBI Venture Capital, Invest India, Amity Innovation Incubator, IAN Group, among others also participated in the meeting.

The government aims to be self-sufficient in the field of communications for it is vital to the country’s electronics infrastructure. Besides VC support, the government is felicitating a telecom technology development fund (TTDF) under Universal Services Obligation Fund (USOF).

According to Inc42’s annual survey, Investor sentiment in the startup ecosystem is increasingly favouring seed-stage investments, a shift from the earlier focus on growth and early stages. Moreover, with over 38% of investors failing to deploy even 50% of the allocated startup investment targets for FY24, the government’s intervention becomes even more vital.

India is home to the third largest startup ecosystem in the world. Still, there’s little doubt that the global tech ecosystem is driven by US tech giants and large corporations that drive most top-level innovation.

In the case of AI, for instance, the likes of Microsoft, Google, OpenAI, Nvidia, Adobe and others have taken the early lead. Similarly, private sector involvement in aerospace and drone tech development in the US is potentially a few years ahead of India.

In recent times, India has also been looking to secure global collaborations. Be it India-US next-gen interoperable telecom network for the 6G era or collaborative research in quantum computing. Both countries also signed a deal to spur research on quantum, AI, and advanced wireless technologies.

However, past records reveal that there’s usually a lag between announcement and execution due to cross-border red tape. But the fact that India’s tech economy is in a maturity phase has also come as a blessing in disguise.

From a macroeconomic perspective, India’s tech economy is said to have avoided the worst of the slowdown of the past year.

VCs believe that the momentum is with the country when you look at the global macroeconomic factors and how severely China and the US have been impacted. India is relatively better off in that sense.

In this context, the emergence of indigenous technology startups becomes pivotal, while also fostering innovation and economic growth.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)