SUMMARY

The Indian edtech startups could only secure a mere $283 Mn in 2023 compared to $2.4 Bn in 2022. The number of deals declined 45.91% YoY to 139 from 257 in 2022

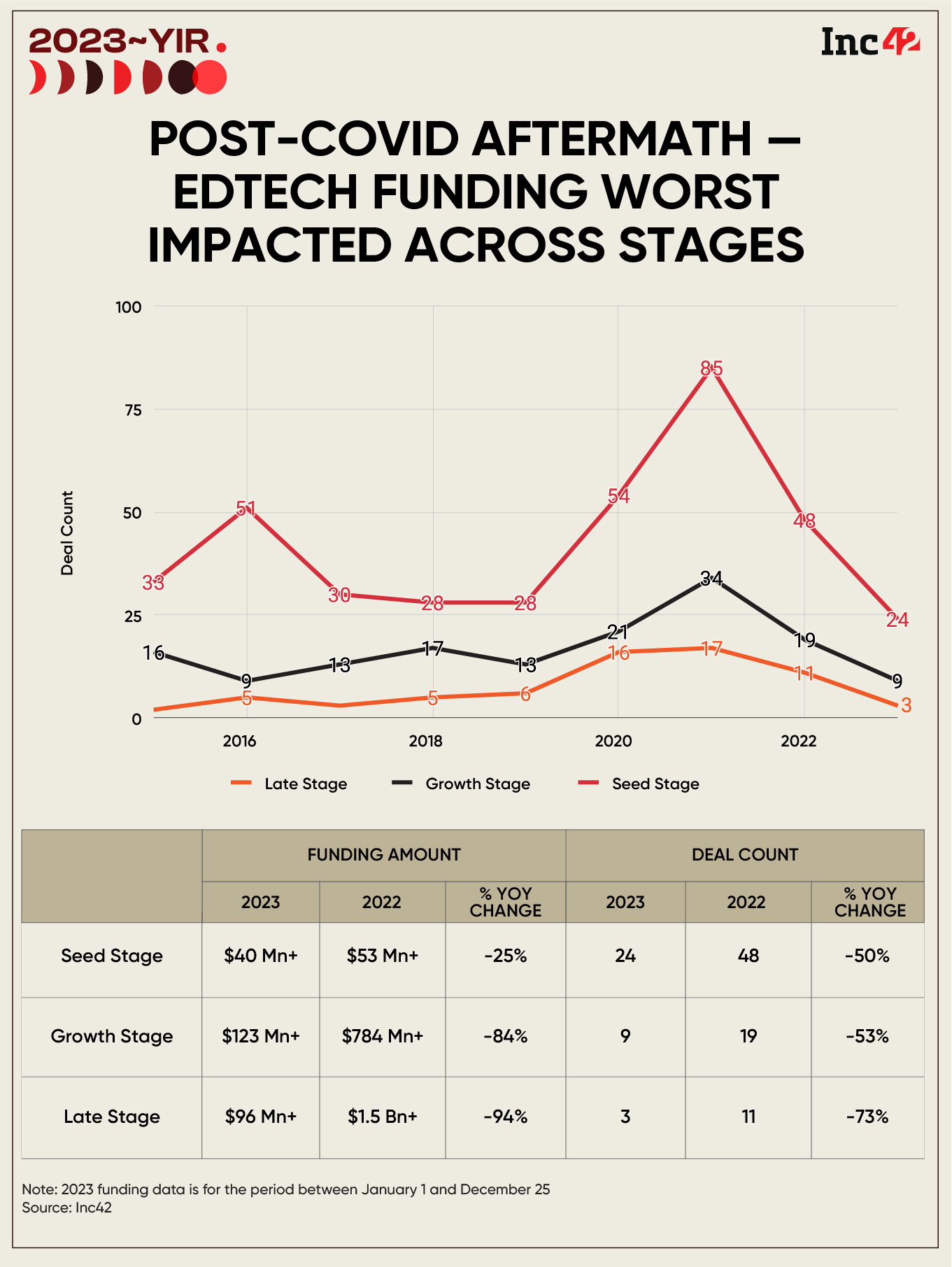

Of all stages, late stage edtech startups witnessed the sharpest YoY funding decline of 93.6% to $96 Mn, while total deals fell 73% to 3 from 11 in 2022

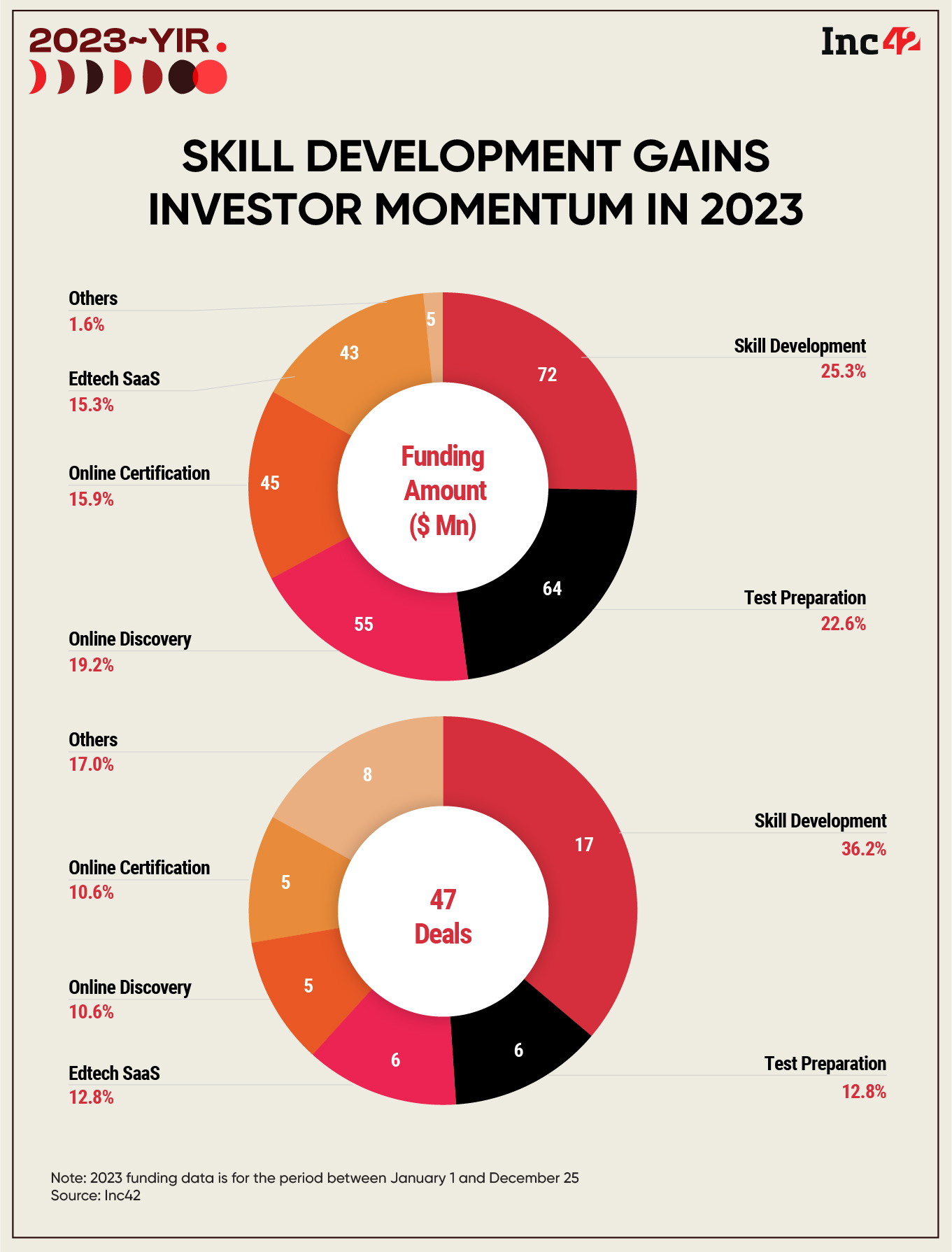

Within the edtech space, skill development has remained the winner through and through in successfully keeping the investor interest intact.

Once hailed for its rapid growth and transformative impact on education, the Indian edtech sector is going through some of the most uncertain times right now.

This uncertainty is majorly due to the diminishing interest of investors in this space, which is largely the result of the reopening of schools and colleges after the Covid-19 pandemic. Not to mention, weak governance guardrails, hefty cash burns, and mounting losses by many, too, impacted investors’ sentiment for this once-flourishing space.

According to Inc42’s Indian Tech Startup Funding Report 2023, the Indian edtech startups could only secure a mere $283 Mn in 2023 compared to $2.4 Bn in 2022, registering a massive 88% year-on-year (YoY) decline. Also, the number of deals declined 45.91% YoY to 139 from 257 in 2022.

Imperative to mention that the Indian edtech space has laid off the most number of individuals in the last two years. As many as 24 Indian edtech startups sacked more than 14,616 employees during these years.

Adding insult to injury, many edtech startups, including Lido, Udayy, Supen Learn, and DUX Education, were forced to shut down on the back of the looming industry-wide crisis of a fund crunch.

The investor sentiment took a further blow when the reports hit the market that the Indian edtech decacorn, BYJU’S, was ailing. This also heavily impacted investor sentiment towards late stage edtech startups.

Late Stage Edtech Startups Suffered The Most

In 2023, late stage edtech funding was the most hit and only three deals happened during the year of the extended funding winter. While growth stage edtech deals stood at nine, 24 deals were secured by seed stage startups.

However, in terms of funding amount, growth stage startups topped the chart by securing $123 Mn, followed by late stage ($96 Mn) and then seed stage ($40 Mn).

Of all stages, late stage edtech startups witnessed the sharpest YoY decline of 93.6% while total deals fell 73% from 11 in 2022.

In addition, the median ticket size for late stage edtech startups fell 36% YoY to $36.5 Mn in 2023 from $57 Mn in 2022. While no change has been noticed across seed stage startups, the median ticket size for growth stage startups fell 81% to a mere $3.5 Mn in 2023 from $18.5 Mn in 2022.

Skill Development Saves The Day

One cannot deny the fact that Indian edtech startups were able to make a noticeable flutter before everything returned to business as usual following the pandemic.

However, within the edtech space, skill development has remained the winner through and through in successfully keeping the investor interest intact. One of the key reasons for the growth of this sector is the inclination of users towards professional courses and their interest in constant upskilling.

As Akshay Munjal, CEO of Hero Vired explained, IT is a massive and important sector for everybody in terms of upskilling. Many companies are investing heavily in data analysis, big data, and other elements such as AI deployment.

“Also, cybersecurity, which has been there for over 20 years, is getting a huge impetus from the incorporation of AR and VR gamification of data and other processes. These sectors have a lot of potential for training and upskilling, thus leading to an increased investor interest in the segment,” Munjal added.

The investor interest is reflected in the state of funding as well. The startups in this sub-sector raised $72 Mn, which is 25.4% of the total edtech funding raised in 2023. This is much higher in percentage growth, as skill development startups raised only 6.3% of the total $2.4 Bn raised in 2022.

In 2023, the highest funding deal in the skill development segment was raised by Nxtwave ($33 Mn), followed by Beyond Odds ($11 Mn) and Unstop ($5 Mn).

Another sub-sector that led the charts was test preparation, raising $64 Mn in 2023. Although, this sector saw a YoY decline of 53% from $137 Mn+ in 2022. More than 95% of the funding was raised by only one startup, Xylem Learning.

Surprisingly, online discovery startups emerged as the new favourites of among edtech investors.

The segment, which encompasses the likes of Leverage Edu, Leap Scholar, and CollegeDekho among others, raised $55 Mn, or 19.2% of the total funding raised by edtechs, in 2023. Leverage Edu alone secured more than $40 Mn in two rounds.

Meanwhile, online certification and edtech SaaS, which raised $45 Mn and $43 Mn, respectively, in 2023, were the other two sub-sectors to gain investor interest.

Further, K12, which was once an apple of investors’ eyes saw a major setback in 2023, with the reopening of schools and other institutions in the post-pandemic period. The K12 startups raised only $450K+, witnessing a whopping 99% YoY decline from $1.03 Bn+ raised in 2022.

When, Where And How Will The Roller Coaster Ride Stop?

High market saturation and a decline in demand for hybrid and remote learning are the two key causes of the downfall of Indian edtech startups. A multitude of ‘me-too’ platforms threw a challenge to the startups in terms of user acquisition and retention, impacting their profitability and sustainability.

However, the Indian government is working to check the regulatory issues in the ecosystem. Here are a few instances where the Indian government has called out the edtech startups in the last few years:

- Issued an advisory, thereby asking parents to exercise necessary due diligence about the company in question before signing up for their services as part of the Consumer Protection (Ecommerce) Rules, 2020.

- Edtech startups must have grievance officers who would address consumer complaints against the company.

- Edtech startups are banned from making any claims to guarantee jobs or special positions after using its services.

Irrespective of the sectors, navigating the complex blend of several challenges requires strategic adaptation, innovative solutions, and a commitment to addressing the multifaceted issues. Citing the current scenario of the edtech ecosystem, resilience and agility are the keys to regaining momentum and contributing efficiently to the education ecosystem in India.

[Edited by Shishir Parasher]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)