SUMMARY

Das said that it was critical to strengthen monitoring systems and leverage technology to detect potential frauds before they take place

The RBI Governor also noted that deployment of AI without appropriate safeguards could lead to customer data being compromised

The RBI Governor noted that deployment of AI without appropriate safeguards could lead to customer data being compromised

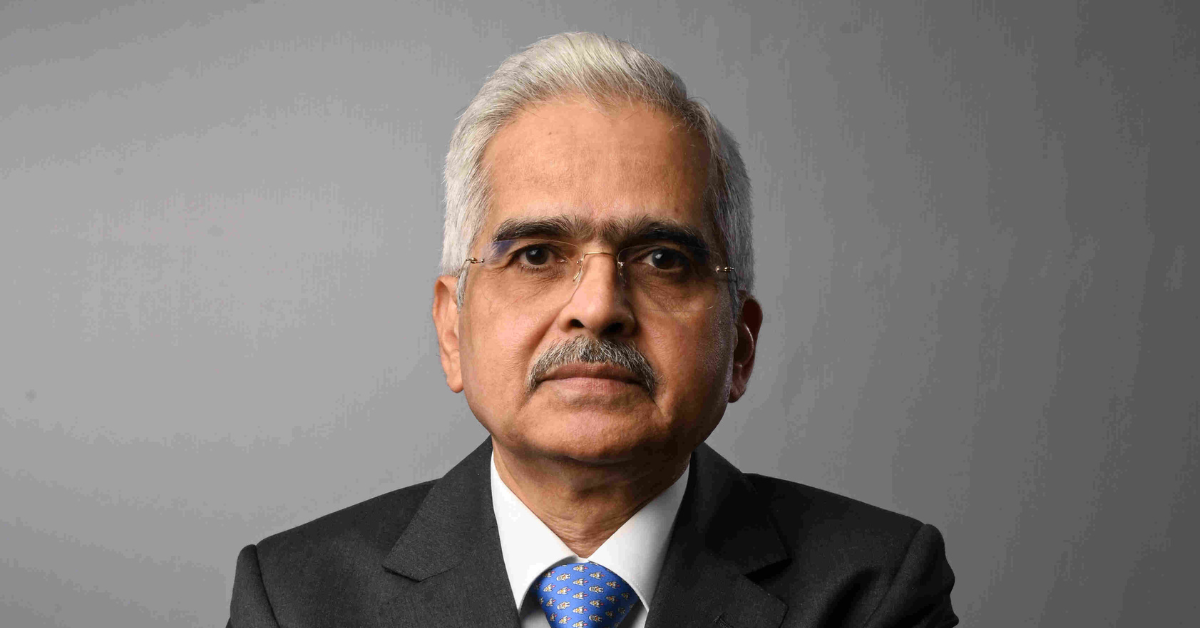

Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday (March 15) cautioned financial institutions against the pitfalls of artificial intelligence (AI), saying that the emerging technology could lead to manifold rise in cybersecurity challenges.

Speaking at the annual conference of the RBI ombudsman, Das called on the financial institutions to make “substantial efforts” towards protecting customer information. He also underlined that it was critical to strengthen monitoring systems and leverage technology to detect potential frauds before they take place.

“With the advent of AI, cybersecurity challenges can rise manifold. They can expose consumers to identity theft, fraud, and unauthorised access to personal information… Financial Institutions must dedicate substantial efforts to protect customer information and ensure that vulnerabilities exposing customers to risk are promptly identified and addressed,” Das said.

The RBI Governor also noted that deployment of AI without appropriate safeguards could lead to customer data being compromised. He added that lax safeguards could create issues such as privacy invasion and “subtle manipulations (of end customers) based on consumer profiling to nudge him into certain services that may not be the right fit”.

However, Das also lauded the emerging technology for its use in the area of customer servicing, chatbots, prevention of frauds and data protection.

“Technology, combined with behavioural analysis, can go a long way in analysing exceptions to consumer behaviour like transactions during odd hours, transactions against usual patterns, unauthorised beneficiary additions, etc. Analysing such factors can help in understanding and preventing frauds,” the RBI Governor added.

Calling regulated entities as repositories of data on financial transactions and customer interactions, the Governor said that this information could be leveraged to enhance customer service. He also called on the entities to “harness” the power of data analytics to proactively anticipate customer needs, address issues promptly, and streamline processes.

The development comes at a time when the central government has ramped up focus on AI, both on the deployment as well as the regulatory front. Earlier this month, the Union Cabinet cleared the IndiaAI Mission with an allocation of INR 10,372 Cr over the course of next five years.

Prior to this, IIT-Madras’ research lab AI4Bharat unveiled IndicVoices, a comprehensive, open-source speech dataset spanning 22 Indian languages and 7,348 hours of audio. The National Payments Corporation of India (NPCI) also signed a multi-year agreement with IISc, Bengaluru to conduct joint research in the area of AI.

On the regulatory front, the ministry of electronics and information technology (MeitY) recently issued an advisory mandating digital platforms, excluding startups, to seek prior approval before deploying AI models.

It also directed platforms to label under-trial AI models and ensure that no unlawful content is hosted on their sites.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)