SUMMARY

India now accounts for ~ 46% of the global real-time payments, which is more than the transactions of the next four countries combined

In December 2023, ONDC surpassed the two lakh+ transactions per day mark, accounting for over 5.5 Mn transactions during the month

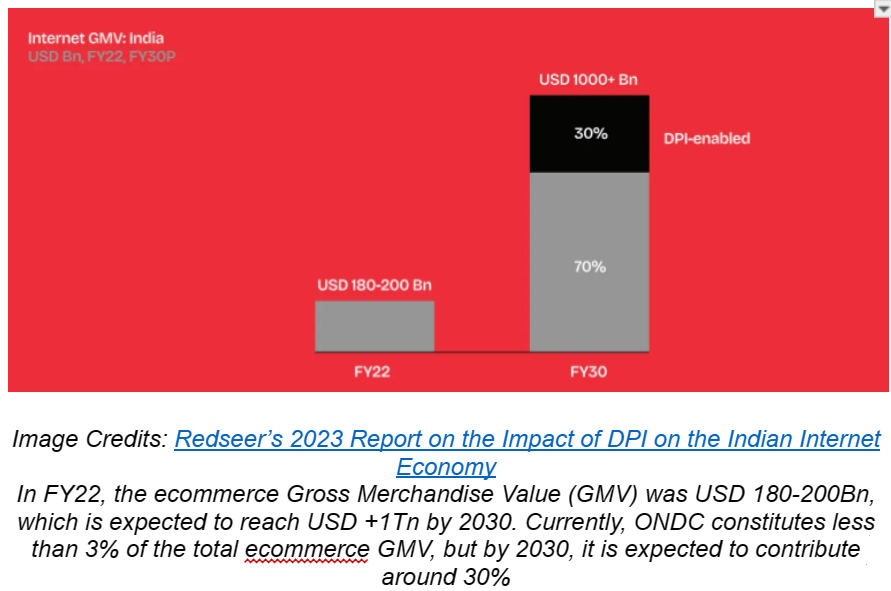

By 2030, ONDC is projected to grow to a whopping 30% of the ecommerce GMV, estimated to be $1 Tn by then

The payment landscape in India has transformed remarkably over the past decade with the development of the country’s Digital Payment Infrastructure (DPI). In a bid to bolster financial inclusion, the Government of India strategically introduced an array of DPI initiatives, such as the Unified Payments Interface (UPI), Aadhaar, Data Empowerment and Protection Architecture (DEPA), and Digilocker.

Of these, with a CAGR of 168%, UPI is one of the Indian economy’s biggest success stories. Before the introduction of UPI in 2016, the share of digital transactions in India was only 11.3%. By the end of 2022, it had reached 80.4%. India now accounts for ~ 46% of the global real-time payments, which is more than the transactions of the next four countries combined.

The most recent advancement in the DPI space is the Open Network for Digital Commerce (ONDC). A major reason behind the launch of ONDC was to avoid the monopoly of large ecommerce companies over the Indian ecommerce market and offer a level playing field for small sellers.

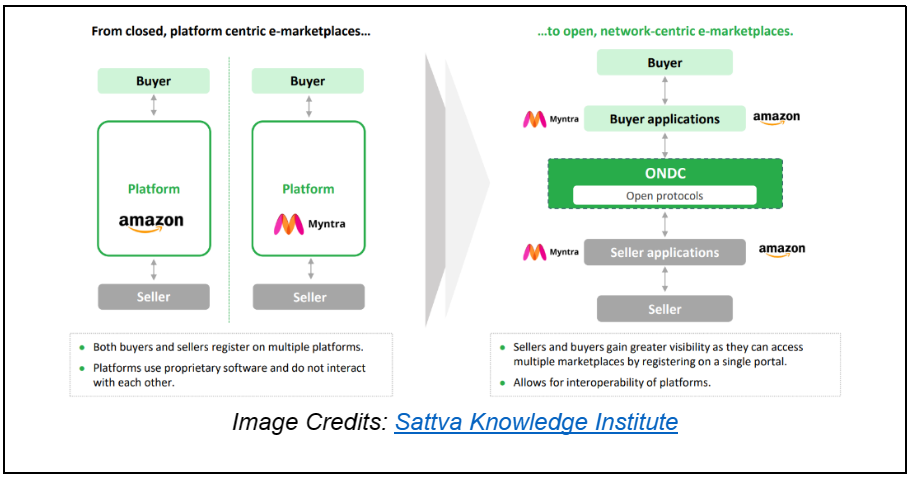

Launched in April 2022, this government-backed DPI initiative is based on open protocol, enabling digital commerce across segments. ONDC’s functional structure is not a platform-centric model but rather a network where buyers and sellers across different platforms can connect with each other to enable ecommerce transactions.

ONDC Vs Traditional Platform-Centric Models

For sellers, the most significant advantage is that ONDC eliminates the need to register and operate on different platforms separately to conduct transactions. It establishes interoperability and standardisation across network participants, allowing sellers and customers to transact regardless of the platform they use.

Moreover, ONDC promotes hyperlocal commerce transactions by prioritising sellers near the consumer’s location. This way, ONDC promotes small sellers, reduces logistics costs, enables quicker delivery, and makes the entire process more efficient and viable.

As for the buyer, ONDC enables consumers to choose products & services from all the ONDC-enabled platforms, offering more choices and enhanced convenience. With such a combination of benefits, ONDC is expected to grow exponentially over the coming years.

Is ONDC The Next UPI? Let’s Explore!

The Gaps In Ecommerce

Ecommerce forms only ~6% of the overall commerce market in India, which is comparatively low. In the United States, the share of ecommerce is 24%, and in China, it’s 35%.

Despite our larger population, ecommerce has not been able to capture more market share. I suppose this can be attributed to two prominent reasons: low participation from the rural population and the insufficient presence of MSME sellers.

The rural-urban gap in India’s ecommerce landscape is quite evident. 65% of the internet users that shop online are from the top eight Indian cities, but less than 5% of the internet users from the rural segment shop online.

Add to this the insufficient online presence of B2C and B2B sellers. Of the ten crore MSMEs in India, around 65% to 70% have internet connectivity. However, only 5% to 6% sell on digital platforms, and even fewer get meaningful business through the online medium. In India, the B2B seller’s participation in ecommerce is only 1% to 1.5%, which is staggeringly low compared to the global average of 20%.

On The Bright side…

As per the International Monetary Fund (IMF), India’s per capita GDP, which was around $2600 in 2023, is expected to surpass $4000 by 2030. If economic trends are to be observed, generally, when a country’s per capita GDP crosses $4000, a sharp increase in online spending per consumer and discretionary spending is also witnessed.

The promising growth in India’s GDP will likely unlock the potential of ecommerce, increasing its penetration and expansion in the years ahead. Moreover, the number of ecommerce users in India is expected to grow at a CAGR of 23%, touching a 50 crore count by 2030, including users from not only Tier-I cities but also Tier-2 cities and beyond.

Presently, seven out of every ten online shoppers live in Tier 2 cities and beyond. Also, one-third of online shoppers are a part of Gen Z, giving us reason to believe that the Indian youth or Gen Z will also contribute immensely to this ecommerce growth.

Current State Of ONDC

While this projected growth creates hope for ONDC to become DPI’s next big thing, the current status quo of ONDC is not gloomy either. In December 2023, ONDC surpassed the two lakh+ transactions per day mark, accounting for over 5.5 Mn transactions during the month.

Currently, mobility drives the highest number of transactions at 3.5 Mn, followed by F&B at 12% and Fashion at 11%. The digital commerce network is operational in over 500 cities and towns across India and is expected to achieve over 50 Mn transactions in the financial year 2024.

ONDC: Future Projections

While today, ONDC barely contributes 3% of the total ecommerce GMV, by 2030, it is projected to grow to a whopping 30% of the ecommerce GMV, estimated to be $1 Tn by then.

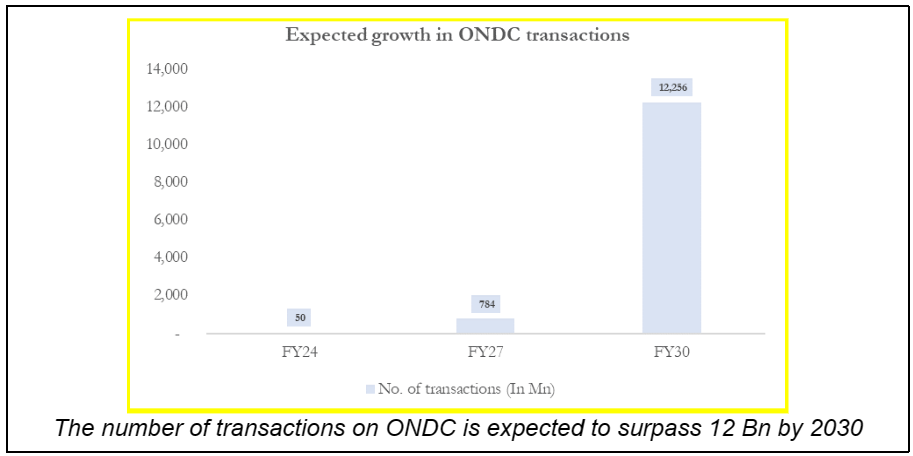

The volume of UPI transactions grew at a CAGR of 150% between FY18 to FY23. Assuming the same CAGR for ONDC transactions, the number of transactions on ONDC can exceed 12 Bn by 2030.

However, we need to be mindful that as the network grows, challenges such as managing the data privacy of all stakeholders, ensuring great customer experiences, and driving accountability will also emerge. As of today, ONDC is a work in progress, and while currently there are no specific guidelines, there are plans to establish a mechanism of “Scores and Badges” to get customer feedback and rate vendor performances that is aimed to strengthen the confidence of both buyers and sellers in the ecosystem.

In Conclusion

While the journey has just begun, the developments in ONDC give us hope that it can potentially transform the ecommerce market in India, similar to how UPI altered the digital payments market. I am optimistic that the transformation that ONDC will bring will fortify India’s position in the digital commerce space, creating a fair ecosystem for all market players and further strengthening financial inclusion across the country.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)