Apple and Goldman Sachs are set to drop the interest rate offered by Apple Card Savings Account later this week, according to a new report. Currently, the account offers a 4.5% annual percentage yield, but this is set to change to 4.4% on April 3.

The change was first spotted by MacRumors, based on “data on Apple’s backend.” Apple and Goldman Sachs haven’t confirmed the change publicly yet. Once the rate change officially goes into effect on Wednesday, Apple will likely send out a push notification to Apple Card Savings Account users informing them of the adjustment.

Apple Card Savings Account started with a 4.15% annual percentage yield for the first eight months of availability. The rate increased to 4.25% in December, then to 4.35% in early January, followed by a boost to 4.5% in late January.

Even with a decrease to 4.4%, Apple Card Savings Account’s annual percentage yield is still relatively competitive. For example, the Marcus savings account offered by Goldman Sachs offers a 4.5% APY.

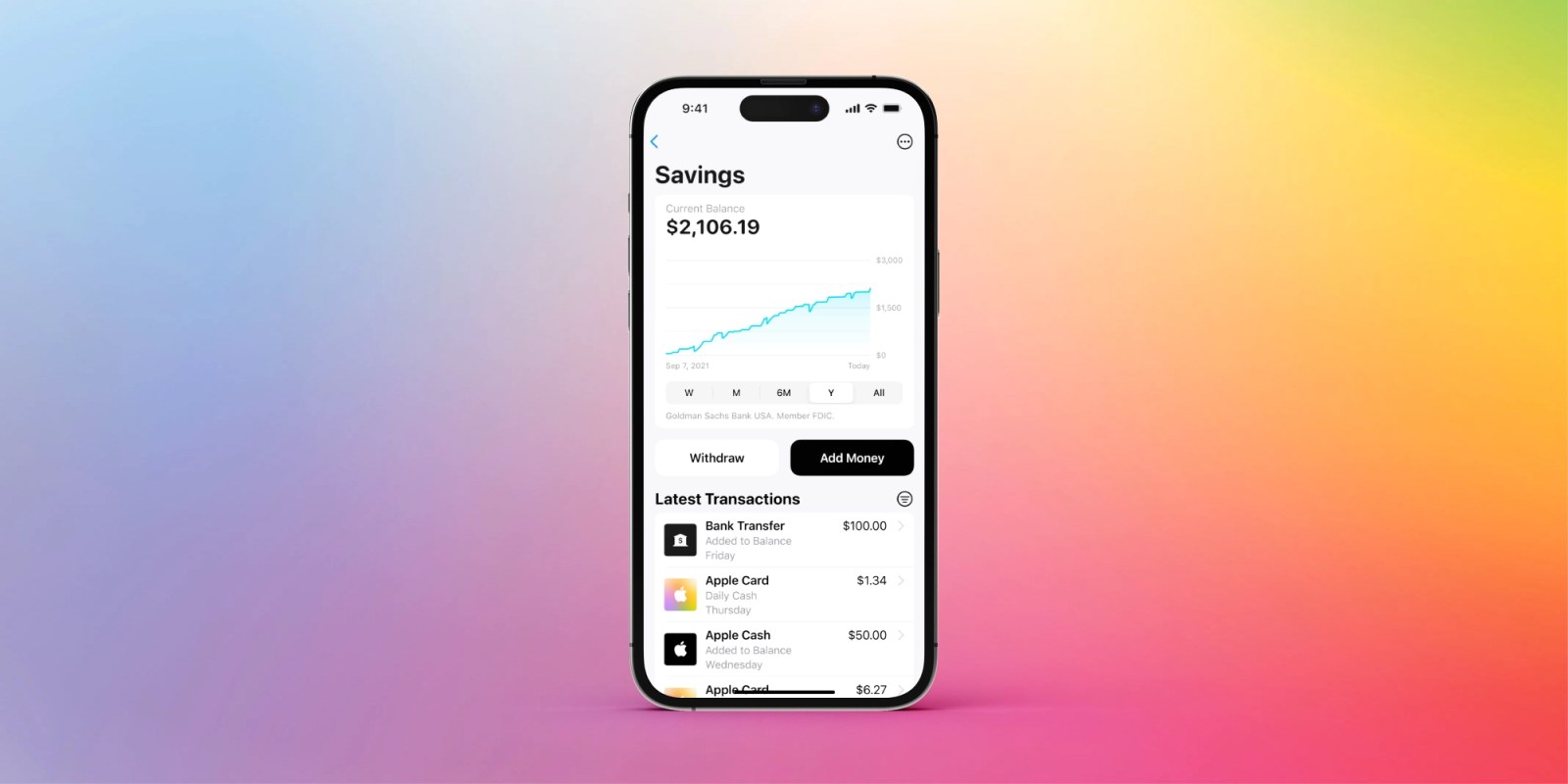

Apple Card Savings Account is available exclusively to Apple Card users. As you earn Daily Cash rewards with your Apple Card, you can choose to have that money automatically deposited into the high-yield savings account in the Wallet app.

In addition to depositing Daily Cash directly into the savings account, Apple Card users can also deposit additional money using a linked bank account or their Apple Cash balance. Interest is compounded daily and paid at the end of the month.

Learn more about Apple Card Savings Account in our in-depth guide right here.

Follow Chance: Threads, Twitter, Instagram, and Mastodon.

FTC: We use income earning auto affiliate links. More.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)